Euro Advances; U.S. Dollar Falls As European Stocks Climb

23 Febrero 2022 - 2:05AM

RTTF2

The euro climbed against its major counterparts in the European

session on Wednesday, while the U.S. dollar weakened, as sanctions

imposed on Russia by the U.S. and its allies were softer, helping

lift sentiment.

Markets breathed a sigh of relief after the U.S. held back from

introducing aggressive sanctions against Russia.

Russian President Vladimir Putin said that he is willing to have

diplomatic talks over the Ukraine conflict, but the country's

interests are "non-negotiable."

Putin's comments came after the imposition of sanctions on

Russia following the recognition of two Ukrainian separatist

regions as sovereign states.

U.N. chief Antonio Guterres dismissed Russia's assertion that

troops sent to eastern Ukraine will uphold peace.

Final data from Eurostat showed that Eurozone inflation rose to

a record high in January, as initially estimated, driven by surging

energy prices.

Inflation rose to a record 5.1 percent in January from 5.0

percent in December. The rate matched the flash estimate published

on February 2.

The euro advanced to 130.71 against the yen and 1.1359 against

the greenback, off its early lows of 130.14 and 1.1316,

respectively. The euro may find resistance around 132.00 against

the yen and 1.16 against the greenback.

The euro edged up to 1.0460 against the franc and 0.8354 against

the pound, following its prior lows of 1.0420 and 0.8325,

respectively. The euro is likely to face resistance around 1.06

against the franc and 0.86 against the pound.

In contrast, the euro weakened to nearly 5-week lows of 1.5610

against the aussie and 1.6684 against the kiwi, after gaining to

1.5698 and 1.6828, respectively in early trades. The next possible

support for the currency is seen around 1.53 against the aussie and

1.64 against the kiwi.

The euro reversed from a previous high of 1.4469 against the

loonie, dropping to 1.4410. On the downside, 1.42 is likely seen as

the next support for the euro.

Pulling away from its early highs of 1.2770 against the loonie,

0.7216 against the aussie and 0.6729 against the kiwi, the

greenback depreciated to a 5-day low of 1.2703 and nearly 5-week

lows of 0.7267 and 0.6799, respectively. The greenback is seen

finding support around 1.26 against the loonie, 0.75 against the

aussie and 0.70 against the kiwi.

The greenback touched a 2-day low of 1.3620 against the pound,

down from a high of 1.3574 seen at 5:00 pm ET. Should the greenback

falls further, 1.38 is likely seen as its next possible support

level.

After climbing to 0.9219 at 4 am ET, the greenback dropped to

0.9183 against the franc. The greenback may test support around the

0.90 region.

The greenback retreated to 115.02 against the yen, from a high

of 115.17 hit at 4 am ET. If the greenback slides further, 112.00

is likely seen as its next support level.

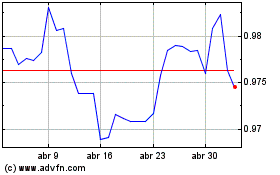

Euro vs CHF (FX:EURCHF)

Gráfica de Divisa

De Mar 2024 a Abr 2024

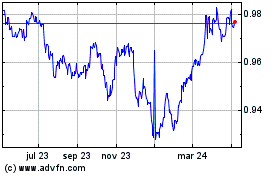

Euro vs CHF (FX:EURCHF)

Gráfica de Divisa

De Abr 2023 a Abr 2024