Euro Climbs After Hawkish ECB Remarks

29 Septiembre 2022 - 2:27AM

RTTF2

The euro advanced against its major counterparts in the European

session on Thursday, as German bond yields rose and several

policymakers of the European Central Bank supported another large

interest rate hike next month.

Lithuanian central bank chief Gediminas Simkus said that he

prefers a rate hike of 75 basis points in October to combat

inflation.

"My choice would be 75," Simkus said. "I understand a couple of

options may be on the table but 50 is the minimum."

German bond yields rose, with the yield on the 10-year Bund

touching 2.246 percent.

Investors await German flash consumer inflation data for

September, due at 8.00 am ET. Consumer price inflation is seen at

9.4 percent versus 7.9 percent in August.

The euro recovered to 0.9706 against the greenback and 0.9519

against the franc, from its prior lows of 0.9636 and 0.9469,

respectively. The euro is seen finding resistance around 1.07

against the greenback and 1.05 against the franc.

The euro climbed to 1.5001 against the aussie and 1.7080 against

the kiwi, off its early lows of 1.4909 and 1.6972, respectively.

The euro is likely to challenge resistance around 1.53 against the

aussie and 1.74 against the kiwi.

The euro firmed to 1-week highs of 140.59 against the yen and

1.3293 against the loonie, after falling to 139.40 and 1.3215,

respectively in previous deals. The next possible resistance for

the euro is seen around 142.00 against the yen and 1.35 against the

loonie.

The euro rebounded modestly against the pound, with the pair

trading at 0.8973. Should the currency rallies again, 0.92 is

possibly seen as its next resistance level.

Looking ahead, at 8:00 am ET, German flash consumer inflation

for September will be published.

Canada GDP data for July, U.S. GDP data for the second quarter

and weekly jobless claims for the week ended September 24 are due

in the New York session.

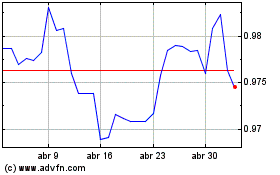

Euro vs CHF (FX:EURCHF)

Gráfica de Divisa

De Mar 2024 a Abr 2024

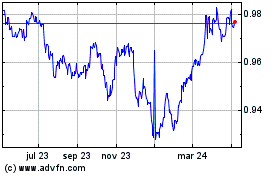

Euro vs CHF (FX:EURCHF)

Gráfica de Divisa

De Abr 2023 a Abr 2024