Swiss Franc Climbs As Weak Eurozone Data Dampens Sentiment

05 Diciembre 2022 - 2:19AM

RTTF2

The Swiss franc firmed against its major counterparts in the

European session on Monday amid safe-haven status, as Eurozone

business activity contracted for a fifth successive month in

November, intensifying fears of a recession in the currency

bloc.

Final data from S&P Global showed that the composite output

index came in at 47.8, in line with expectations.

The services PMI dropped to a 21-month low of 48.5 from 48.6 a

month ago. The index was forecast to fall to 48.6.

Investors focus on U.S. factory orders data and ISM

non-manufacturing PMI due later today for more direction.

Better-than-expected non-farm payrolls data released last week

triggered uncertainty about the outlook for interest rates.

The Swiss currency was up against the yen, at a 4-day high of

144.98. If the franc rises further, 146.00 is likely seen as its

next resistance level.

The franc edged up to 1.1451 against the pound and 0.9851

against the euro, after falling to a 5-week low of 1.1539 and near

a 4-week low of 0.9893, respectively in prior deals. The franc is

likely to face resistance around 1.12 against the pound and 0.96

against the euro.

The franc rose to 0.9331 against the greenback, off its prior

low of 0.9382. On the upside, 0.92 is possibly seen as its next

resistance level.

Looking ahead, U.S. factory orders for October and ISM

non-manufacturing PMI for November, as well as Canada building

permits for October will be released in the New York session.

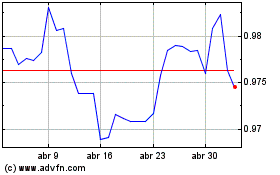

Euro vs CHF (FX:EURCHF)

Gráfica de Divisa

De Mar 2024 a Abr 2024

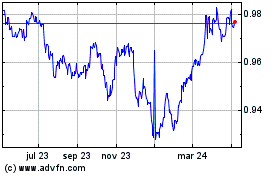

Euro vs CHF (FX:EURCHF)

Gráfica de Divisa

De Abr 2023 a Abr 2024