Eurozone Manufacturing Activity Shrinks In July

01 Agosto 2022 - 2:37AM

RTTF2

Adding to recession risks, the euro area manufacturing sector

contracted in July as production logged the sharpest fall since the

initial wave of the COVID-19 lockdowns in early 2020, final data

from S&P Global showed on Monday.

The final manufacturing Purchasing Managers' Index fell to a

25-month low of 49.8 in July from 52.1 in June. The flash reading

was 49.6.

A score below 50.0 indicates contraction. The reading signaled

the first deterioration in manufacturing conditions for just over

two years. Manufacturing output declined at the sharpest since the

early stages of the pandemic in May 2020. Another major drag on

output was demand, with new orders falling sharply.

The survey showed that there was a stronger stockpiling at the

start of the third quarter, with both pre- and post-production

inventory levels rising at faster rates.

Purchasing activity was subsequently reduced, marking the first

fall in input buying in just under two years. At the same time,

delivery times lengthened to the least marked extent since October

2020.

Employment increased at the softest pace in almost a

year-and-a-half in July.

Manufacturers turned pessimistic in their assessment towards

growth prospects over the coming year. High inflation, the war in

Ukraine, future energy supplies and recession fears were cited by

firms as reasons for the negative outlook. Eurozone manufacturing

is sinking into an increasingly steep downturn, adding to the

region's recession risk, Chris Williamson, chief business economist

at S&P Global Market Intelligence said.

The energy crisis adds to the risks that not only will weaker

demand and destocking cause manufacturing production to decline at

an increased rate in the coming months, but reduced energy supply

will act as an additional drag on the sector, Williamson added.

Germany, France, Italy and Spain all recorded sub-50.0 readings

in their respective headline manufacturing PMIs in July.

Germany S&P Global/BME final manufacturing PMI registered

49.3 in July, down from 52.0 a month ago but slightly above the

flash 49.2. The sector shrank for the first time since June 2020.

The principal drag on the performance came from a deep fall in new

orders.

At the same time, the French manufacturing sector downturn

worsened in July as both output and new orders declined at their

greatest extents since the initial wave of COVID-19 disruption took

place in the first half of 2020. The final factory PMI dipped to

49.5 from 51.4 in June. The flash reading was 49.6.

Italy's manufacturing activity also fell into the contraction

territory for the first time since June 2020. The PMI slid to 48.5

in July from 50.9 in June. There were renewed decline in production

as well as orders.

The contraction in Spain's factory sector was the first in more

than a year. The index posted 48.7, down from 52.6 in June and hit

its lowest level since May 2020.

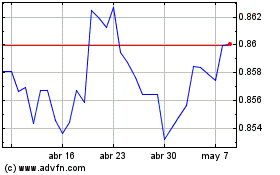

Euro vs Sterling (FX:EURGBP)

Gráfica de Divisa

De Mar 2024 a Abr 2024

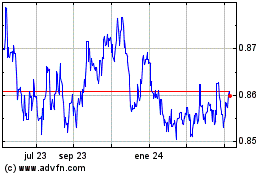

Euro vs Sterling (FX:EURGBP)

Gráfica de Divisa

De Abr 2023 a Abr 2024