Pound Climbs As European Shares Rise

01 Agosto 2022 - 2:40AM

RTTF2

The pound advanced against its major counterparts in the

European session on Monday, as European shares advanced following

strong corporate results and investors awaited a rate hike from the

Bank of England later this week.

HSBC Holdings reported that its second-quarter earnings climbed

from last year and raised its profitability target.

The BoE will deliver its interest rate decision on Thursday,

with investors expecting a half-point rate hike and move rate to

1.75 percent.

Investors shrugged off a data showing a slowdown in U.K.

manufacturing activity in the month of July.

Data from S&P Global and the Chartered Institute of

Procurement & Supply showed that U.K. manufacturing PMI fell to

a 25-month low of 52.1 in July, from 52.8 in June. The expected

score was 52.2.

The pound firmed to 1.2262 against the dollar, its highest level

since June 28. The pound is likely to face resistance around the

1.24 region, if it gains again.

The pound recovered to 162.09 against the yen, after falling to

161.04 at 9:15 pm ET, which was its weakest level since July 6.

Should the pound rises further, 163.5 is possibly seen as its next

resistance level.

The pound edged up to 1.1631 against the franc and 0.8367

against the euro, from its early lows of 1.1568 and 0.8399,

respectively. The pound is seen finding resistance around 1.19

against the franc and 0.82 against the euro.

Looking ahead, U.S. ISM manufacturing PMI for July and

construction spending for June are set for release in the New York

session.

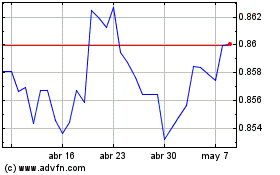

Euro vs Sterling (FX:EURGBP)

Gráfica de Divisa

De Mar 2024 a Abr 2024

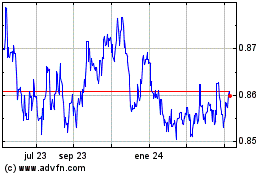

Euro vs Sterling (FX:EURGBP)

Gráfica de Divisa

De Abr 2023 a Abr 2024