Pound Moves Down Following U.K. Mini-budget Statement

23 Septiembre 2022 - 4:07AM

RTTF2

The pound depreciated against its major counterparts in the

European session on Friday, as the new government unveiled tax cuts

and huge increases in borrowing in its mini budget that spooked the

markets.

The Chancellor announced that the top rate of income tax will

drop to 40 percent from 45 percent.

The basic rate of income tax will be slashed to 19 percent next

year, from 20 percent at present.

The UK's Debt Management Office raised its debt issuance plans

for the current financial year by £72.4 billion to £234.1

billion.

European shares fell, as investors fear that the Federal

Reserve's steep interest rate hikes could trigger a recession.

The Distributive Trades Survey from the Confederation of British

Industry showed that UK retail sales declined sharply in September

on the cost of living crisis.

The retail sales balance fell more-than-expected to -20 percent

in September from +37 percent in August. The score was seen at +10

percent. A net 13 percent of retailers expect sales volumes to fall

again in October.

The pound touched 1.1020 against the greenback, a level unseen

since 1985. The currency may locate support around the 1.08

level.

The pound dipped to 1.0809 against the franc, its lowest level

since 1974. If the pound extends drop, 0.99 is possibly seen as its

support level.

The pound fell to more than a 4-month low of 157.46 against the

yen and 1-1/2-year low of 0.8850 against the euro, down from its

early highs of 160.46 and 0.8711, respectively. The pound is likely

to face support around 160.46 against the yen and 0.89 against the

euro.

Looking ahead, Federal Reserve Chair Jerome Powell is scheduled

to deliver the opening remarks at the Fed Listens event in

Washington D.C. at 2 pm ET.

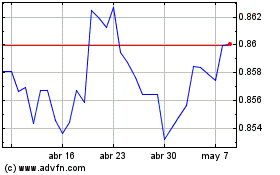

Euro vs Sterling (FX:EURGBP)

Gráfica de Divisa

De Mar 2024 a Abr 2024

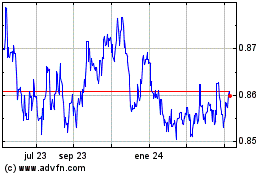

Euro vs Sterling (FX:EURGBP)

Gráfica de Divisa

De Abr 2023 a Abr 2024