Pound Declines After BoE Announces Intervention In Bond Market

28 Septiembre 2022 - 5:39AM

RTTF2

The pound fell against its major rivals in the European session

on Wednesday, after the Bank of England announced that it would

intervene to support the bond market to prevent a material risk to

financial stability.

The BOE noted that it is watching developments in financial

markets very closely in light of the significant repricing of UK

and global financial assets.

The central bank said that it would carry out temporary

purchases of long-dated UK government bonds from September 28 in

order to restore orderly market conditions.

The purchases of long-dated bonds would be strictly time

limited. Auctions will take place from today until October 14.

The BoE added that the purchases would be unwound in a smooth

and orderly fashion when risks to market functioning are found to

have subsided.

In light of current market conditions, the central bank has

postponed the beginning of gilt sale operations aimed to commence

next week. The first gilt sale operations will take place on

October 31 and proceed thereafter.

U.K. bond yields fell after the announcement, with the yield on

the 30-year note falling to 3.925 percent.

The pound declined to a 2-day low of 1.0538 against the

greenback, from a 2-day high of 1.0838 seen at 6 am ET. Next key

support for the pound is seen around the 1.03 level.

The pound dropped to a 2-day low of 1.0419 against the franc,

after rising to a 2-day high of 1.0730 at 6 am ET. The pound is

seen finding support around the 0.9 mark.

The pound touched a 2-day low of 152.55 against the yen,

following a 2-day high of 156.64 it logged at 6 am ET. The pound is

likely to challenge support around the 149.00 region, if it drops

again.

The pound weakened to a 2-day low of 0.9066 against the euro,

down from a 2-day high of 0.8854 set at 6 am ET. Should the pound

falls further, it is likely to face support around the 0.92

region.

Survey results from the market research group GfK showed that

Germany's consumer sentiment is set to fall again to a fresh record

low in October as high inflation amid rising energy prices hit

income expectations, and in turn, consumer spending.

The consumer confidence index plunged to -42.5 in October from

revised -36.8 in the previous month.

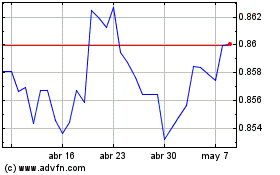

Euro vs Sterling (FX:EURGBP)

Gráfica de Divisa

De Mar 2024 a Abr 2024

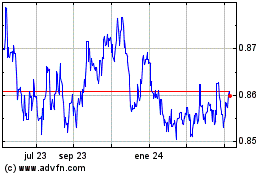

Euro vs Sterling (FX:EURGBP)

Gráfica de Divisa

De Abr 2023 a Abr 2024