Euro Weakens After ECB Decision

27 Octubre 2022 - 5:19AM

RTTF2

The euro fell against its key counterparts in the European

session on Thursday, after the European Central Bank decided to

raise its key interest rates by 75 basis points, as expected.

The Governing Council, led by Lagarde, raised the main

refinancing rate to 2 percent, the deposit facility rate to 1.5

percent and the marginal lending rate to 2.25 percent. The move was

in line with economists' expectations.

The bank said that interest rates would be raised further to

ensure the timely return of inflation to its 2% medium-term

inflation target.

"With this third major policy rate increase in a row, the

Governing Council has made substantial progress in withdrawing

monetary policy accommodation," the bank said in a statement.

Policymakers also decided to change the terms and conditions of

the third series of targeted longer-term refinancing operations, or

TLTRO III.

The ECB said that it would adjust the interest rates applicable

to TLTRO III from November 23 and offer banks additional voluntary

early repayment dates.

Survey results from the market research group GfK showed that

German consumer confidence is set to improve in November.

The forward-looking consumer sentiment index rose to -41.9 in

November, in line with expectations, from revised -42.8 in

October.

The currency showed mixed performance against its major

counterparts in the Asian session. While it rose against the

greenback, it held steady against the franc and the pound. Against

the yen, it dropped.

The euro dropped to a 3-day low of 145.86 against the yen and a

10-day low of 0.8624 against the pound, from yesterday's closing

values of 147.49 and 0.8666, respectively. The euro is seen finding

support around against the yen and against the pound.

The euro declined to 3-day lows of 1.5420 against the aussie and

1.7116 against the kiwi, from Wednesday's closing values of 1.5513

and 1.7273, respectively. The euro may challenge support around

1.49 against the aussie and 1.66 against the kiwi.

The euro eased to 0.9972 against the greenback, from a

1-1/2-month high of 1.0094 hit at 7:45 pm ET. The pair had closed

Wednesday's deals at 1.0080. On the downside, 0.95 is possibly seen

as its next support level.

The euro weakened to a 2-day low of 0.9882 against the franc,

from a 3-1/2-month high of 0.9955 seen at 8 am ET. At Wednesday's

close, the pair was valued at 0.9934. The euro may find downside

target around the 0.94 level.

The euro was down against the loonie, at a 2-day low of 1.3526.

The euro was trading at 1.3655 per loonie at yesterday's close. If

the currency falls further, it is likely to test support around the

1.34 level.

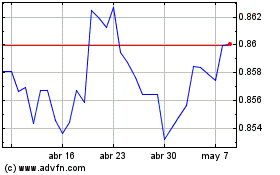

Euro vs Sterling (FX:EURGBP)

Gráfica de Divisa

De Mar 2024 a Abr 2024

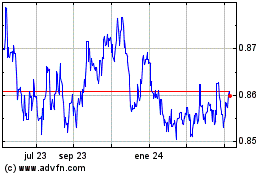

Euro vs Sterling (FX:EURGBP)

Gráfica de Divisa

De Abr 2023 a Abr 2024