U.S. Dollar Spikes Up As Treasury Yields Climb On Powell's Hawkish Comments

22 Abril 2022 - 6:09AM

RTTF2

The U.S. dollar was higher against its major counterparts in the

European session on Friday, buoyed by a spike in treasury yields

following comments from Federal Reserve Chair Jerome Powell

supporting aggressive rate hikes to tackle soaring inflation.

The benchmark yield on the 10-year note touched 2.92 percent.

Yields move inversely to bond prices.

Speaking at an IMF panel discussion, Powell signaled that two or

more half-point hikes would be appropriate at upcoming meetings to

tame inflation.

Investors are pricing in a half-point move in May and a 75 basis

point hike in June.

The prospect of bigger rate hikes spooked global markets, while

the rally in the dollar weighed on commodities.

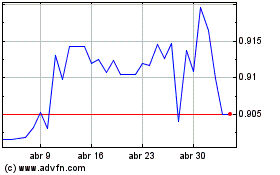

The greenback appreciated to 0.9570 against the franc, ts

strongest level in nearly two years. If the greenback rises

further, it may challenge resistance around the 0.97 level.

The greenback jumped to its highest level since November 2020

against the pound, at 1.2856. The greenback may target resistance

around the 1.25 level.

The greenback rebounded to 128.59 against the yen, from a low of

127.74 seen at 2 am ET. The greenback is likely to find resistance

around the 130.00 level.

The greenback touched more than a 5-week high of 0.7266 against

the aussie and near a 2-month high of 0.6644 against the kiwi, up

from its prior lows of 0.7377 and 0.6737, respectively. The

greenback is seen finding resistance around 0.72 against the aussie

and 0.64 against the kiwi.

The greenback was up against the loonie, at a fresh 5-week high

of 1.2696. Next likely resistance for the currency is seen around

the 1.29 level.

The greenback resumed its early rally against the euro, hitting

a 2-day high of 1.0784. On the upside, 1.06 is likely seen as the

next resistance level for the currency.

US Dollar vs CHF (FX:USDCHF)

Gráfica de Divisa

De Mar 2024 a Abr 2024

US Dollar vs CHF (FX:USDCHF)

Gráfica de Divisa

De Abr 2023 a Abr 2024