Azincourt Closes Private Placement and Receives TSX Venture Exchange Approval to Option With Fission Uranium

19 Junio 2013 - 8:00AM

Marketwired Canada

Azincourt Resources Inc. (TSX VENTURE:AAZ) (the "Company" or "Azincourt")

announces that further to its news releases dated April 30, 2013 and May 15,

2013, the Company has now received TSX Venture Exchange ("Exchange") approval

to:

-- its option agreement with Fission Uranium Corp. ("FCU") dated April 29,

2013 whereby Azincourt can earn up to a 50% interest in FCU's Patterson

Lake North project ("PLN");

-- the technical report dated May 5, 2013 prepared by Allan Armitage,

Ph.D., P.Geol. of GeoVector Management Inc. for the PLN project (which

has been filed on SEDAR);

-- a part-and-parcel private placement (more fully described below) whereby

the Company raised $1,500,000 to be used to complete its first year work

expenditures on the PLN project; and

-- a finder's fee agreement dated April 29, 2013 whereby the Company has

agreed to pay Pure Capital Holdings Inc. a fee in stages as it acquires

incremental interests in the PLN project over time. In year one, the fee

will be $136,250 payable following the Azincourt spending $2,000,000 to

acquire the first 10% interest in the PLN project, payable by the

issuance of 908,333 common shares of the Company, at a deemed price of

$0.15 per share;

The PLN project is comprised of 10 contiguous claims totalling 27,408 hectares

in the southwest portion of the Athabasca Basin, Saskatchewan. The Athabasca

Basin is a premiere geologic district notable for hosting the world's richest

uranium deposits, with a well established and politically stable, uranium

exploration and mining sector. Recent discoveries of high-grade uranium in the

southwestern region of the Athabasca Basin are considered by Azincourt to

indicate the prospective merit of this under-explored area.

The Company has the right to acquire incremental interests in the PLN by making

annual payments to FCU and incurring minimum work expenditures on the PLN

project. To acquire the first 10% interest, the Company must pay FCU $500,000

($100,000 paid to date and the balance to be paid on closing) and incur

$1,500,000 of work on the PLN project.

PLN lies adjacent to the north of Fission's Patterson Lake South (PLS) joint

venture property (Fission 50%, Alpha Minerals 50%), where recent drill results

located 5.7km to the south, have identified high grade uranium in bedrock in 3

separate pods and have included a drill hole intersection of 6m at 35.0% U3O8 in

49.5M at 6.26% U3O8 (PLS 13-053) (see Fission Energy Corp. news release dated

April 24, 2013).

PLN lies within a large basin scale NE trending gravity low structural corridor

that also incorporates the adjacent PLS property. The former Cluff Lake mine

(greater than 60M lbs U3O8 produced) and the UEX-Areva Shea Creek deposits (42

km and 27 km to the north respectively) lie along the western margin of this

structural feature. The recently discovered high-grade uranium mineralization

found at PLS located 5.7km to the south, also lies within this structural

corridor. Coincidentally, PLN also lies within a complex magnetic corridor

showing magnetic highs and lows and breaks in regional major features. Several

EM anomalies are evident within PLN, including what may be interpreted to be the

southern extension of the Saskatoon Lake EM conductor, which itself is

associated with the Shea Creek deposit to the north.

To date Fission has spent approx. $4.7M on exploration on PLN ranging from

airborne to ground geophysics to a first-pass drilling of a few select targets.

Portions of PLN are currently drill-ready and other areas require further ground

geophysical surveys and interpretation to bring them up to drill ready stage.

The $1.5 million budgeted work program for year 1 will consist of approx. 2500m

of diamond drilling in addition to select areas of airborne EM geophysical

survey coverage. It is anticipated that radon and helium surveys designed to

assist in the detection of subsurface uranium occurrences will be conducted in

certain areas to assist in developing high priority drill targets.

PRIVATE PLACEMENT

The Company announces that it has closed its private placement and issued an

aggregate of 10,000,000 common shares (the "Shares") at $0.15 per share for

gross proceeds of $1,500,000. The Shares are subject to a four-month hold period

expiring October 19, 2013. The proceeds of the private placement will be used by

the Company to fund its first year work expenditures on its PLN project.

The Company has agreed to pay finders fees in cash aggregating $83,650 in

connection with the private placement.

GRANT OF STOCK OPTIONS

The Company confirms its previously announced grant of 1,750,000 incentive stock

options to directors and officers of the Company. Each option is exercisable to

purchase one common share of the Company at a price of $0.18 for a period of

five years from the date of grant, in accordance with the Company's stock option

plan.

BOARD AND OFFICER CHANGES

Further to the Company's news release of May 15, 2013: (i) each of Darren Devine

and Latika Prasad have resigned as directors of the Company; (ii) each of Ian

Stalker, Terrence (Ted) K. O'Connor and Dev Randhawa have been appointed as

directors of the Company; (iii) Ian Stalker will not be acting as President but

will remain Chairman; (iv) Ted O'Connor has assumed the positions of CEO and

President; and (v) Latika Prasad has resigned as CFO and Vivien Chuang has been

appointed as CFO in her place.

NAME CHANGE

The Company has made application to the TSX Venture Exchange to change its name

to Azincourt Uranium Inc. to more clearly reflect its new business and

commitment to developing the PLN project. The Company's ticker symbol remains

TSXV:AAZ.

QUALIFIED PERSON

Paul Reynolds P.Geo., a director of Azincourt, is the qualified person who has

reviewed the geological data summarized in this news release on behalf of

Azincourt.

ON BEHALF OF THE BOARD OF AZINCOURT RESOURCES INC.

Ted O'Connor, CEO and President

This press release includes "forward-looking statements", including forecasts,

estimates, expectations and objectives for future operations that are subject to

a number of assumptions, risks and uncertainties, many of which are beyond the

control of Azincourt. Statements regarding the exercise of the option are

subject to all of the risks and uncertainties normally incident with the raising

of capital and completing corporate transactions including, but are not limited

to, financing risks, property title issues and regulatory approvals. There is no

assurance the Company will be able to acquire any interest in the PLN. Investors

are cautioned that any such statements are not guarantees of future performance

and that actual results or developments may differ materially from those

projected in the forward-looking statements. Such forward-looking information

represents management's best judgment based on information currently available.

No forward-looking statement can be guaranteed and actual future results may

vary materially.

FOR FURTHER INFORMATION PLEASE CONTACT:

Azincourt Resources Inc.

(604) 638-8067

(604) 648-8105 (FAX)

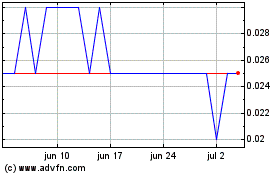

Azincourt Energy (TSXV:AAZ)

Gráfica de Acción Histórica

De Ago 2024 a Sep 2024

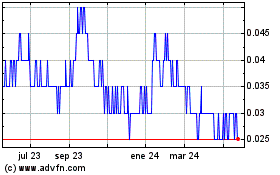

Azincourt Energy (TSXV:AAZ)

Gráfica de Acción Histórica

De Sep 2023 a Sep 2024