Australian Dollar Falls As Australia's New South Wales Reimposes Curbs

06 Enero 2022 - 9:22PM

RTTF2

The Australian dollar declined against its major rivals in the

Asian session on Friday, as the country's New South Wales state

reintroduced several restrictions to contain the outbreak of the

Omicron variant of the coronavirus.

The measures include suspending non-urgent surgeries,

prohibiting singing and dancing in pubs and clubs, mandating

booster shots for high-risk workers and postponing some major

events.

The restrictions, which came in the wake of record daily

infections over the past few days, will last until January 27.

NSW recorded 38,625 cases of COVID-19, while hospitalizations

shot up to 1,738.

Asian shares are mixed ahead of U.S. jobs data that could offer

clues on the potential pace of rate hikes by the Federal

Reserve.

Nonfarm payrolls are expected to rise by 400,000 jobs in

December, with the unemployment rate falling to 4.1 percent from

4.2 percent.

The aussie dropped to 0.7152 against the greenback, 1.5805

against the euro and 82.84 against the yen, off its early highs of

0.7178, 1.5740 and 83.22, respectively. The aussie is poised to

challenge support around 0.70 against the greenback, 1.62 against

the euro and 80.00 against the yen.

The aussie weakened to more than a 3-week low of 0.9096 against

the loonie and a 3-day low of 1.0595 against the kiwi, down from

its early high of 0.9122 and a 2-day high of 1.0633, respectively.

The aussie may locate support around 0.89 against the loonie and

1.045 against the kiwi.

Looking ahead, U.K. construction PMI for December, Eurozone CPI

and economic confidence index for the same month and retail sales

for November are scheduled for release in the European session.

U.S. and Canadian jobs data and Canada Ivey PMI, all for

December, as well as U.S. consumer credit for November will be

released in the New York session.

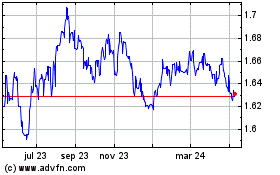

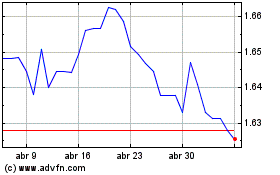

Euro vs AUD (FX:EURAUD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

Euro vs AUD (FX:EURAUD)

Gráfica de Divisa

De Abr 2023 a Abr 2024