Australian, NZ Dollars Decline On Fed, Ukraine Concerns

24 Enero 2022 - 9:24PM

RTTF2

The Australian and NZ dollars weakened against their major

counterparts in the Asian session on Tuesday, as Asian stocks

dropped on growing concerns over the possibility of the Federal

Reserve tightening monetary policy aggressively as well as the

threat of a Russian invasion into Ukraine.

The Fed meeting will begin later today, although no policy

change is expected.

Investors await the Fed statement for more clues about the

timing and pace of rate hikes for this year.

U.S.-Russia tensions escalated amid a continued buildup of

Russian troops near the border of Ukraine.

The U.S. placed 85,000 troops on high alert in order to support

NATO forces in Eastern Europe if needed.

The aussie initially got a support from stronger-than-expected

inflation data out of Australia, but it eased during the course of

the trading session.

Data from the Australian Bureau of Statistics showed that

consumer prices in Australia were up 3.5 percent on year in the

fourth quarter of 2021. .

That exceeded expectations for an increase of 3.2 percent and

was up from 3.0 percent in the third quarter.

The aussie dropped to 0.7129 against the greenback and 1.5865

against the euro, off its prior highs of 0.7175 and 1.5771,

respectively. The aussie is poised to find support around 0.70

against the greenback and 1.60 against the euro.

The aussie retreated to 81.05 against the yen and 0.9020 against

the loonie, following its early high of 81.78 and a 5-day high of

0.9055, respectively. The aussie may locate support around 78.00

against the yen and 0.88 against the loonie.

Pulling away from its previous highs of 0.6709 against the

greenback and 76.49 against the yen, the kiwi declined to 0.6669

and 75.83, respectively. On the downside, 0.65 and 74.00 are

possibly seen as its next support levels against the greenback and

the yen, respectively.

The kiwi was down at 1.6961 against the euro and 1.0699 against

the aussie, reversing from its prior highs of 1.6869 and 1.0645,

respectively. Next key support for the currency is likely seen

around 1.70 against the euro and 1.09 against the aussie.

Looking ahead, German Ifo business sentiment index for January

is due in the European session.

U.S. consumer confidence index for January, FHFA's house price

index and S&P/Case-Shiller home price index for November will

be out in the New York session.

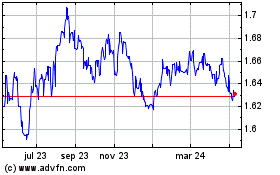

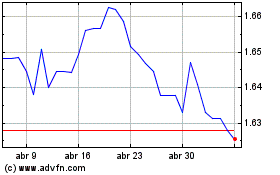

Euro vs AUD (FX:EURAUD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

Euro vs AUD (FX:EURAUD)

Gráfica de Divisa

De Abr 2023 a Abr 2024