Crédit Agricole CIB Advises and Finances Innovative $980 Million Multi-Technology Chilean Energy Platform

04 Octubre 2021 - 8:00AM

Business Wire

Crédit Agricole CIB advised and financed a $980 million project

finance deal for Chilean energy platform GM Holdings S.A.

(Generadora Metropolitana), a 1.23 GW multi-technology energy

platform providing 8% of the Chilean electricity market. The

financing was the largest non-recourse transaction in Chile this

year.

Generadora Metropolitana is the fifth largest generator by

capacity in Chile and is jointly owned by EDF, the world’s leading

energy producer as measured by net installed capacity and

electricity generation, and AME, an independent Latin America power

company. The jointly owned company currently supplies electricity

on a 24-hour basis to regulated users of 23 Distribution Companies

in an amount up to 4,000GWh per annum, which equates to 8% of the

Chilean regulated electricity market.

Proceeds of the financing will go toward refinancing the

Company's existing debt, funding the construction of Generadora

Metropolitana’s flagship 480MWp photovoltaic plant (the largest in

Chile) and to convert the 132MW Los Vientos diesel-fired plant to

natural gas. The resulting electricity generation mix fits within

Chile's efforts to transition toward more renewables while

simultaneously replacing its coal generation with other baseload

technologies such as natural gas.

The financing was innovatively structured under a project

finance structure with strong credit metrics, combining a

monetization of the cash flows from Generadora Metropolitana’s

existing assets and contracts with a construction financing.

The issue received robust interest among banks and institutional

investors and was oversubscribed.

Crédit Agricole CIB acted as Financial Advisor, Note Rating

Advisor, sole Global Note Coordinator, Hedge Advisor &

Coordinator as well as Coordinated Lead Arranger and Hedge

Provider.

This is the third transaction that Crédit Agricole CIB advised

and closed this year in Chile. Previous closings included the 204MW

Cabo Leones II wind farm, owned by Spanish power producers Grupo

Ibereólica and Global Power Generation, and the 101 San Pedro PV

plant, owned 100% by Global Power Generation. This transaction

solidifies Crédit Agricole CIB’s leadership position in this

market.

About Crédit Agricole Corporate and Investment Bank (Crédit

Agricole CIB)

Crédit Agricole CIB is the corporate and investment banking arm

of Credit Agricole Group, the 12th largest banking group worldwide

in terms of tier 1 capital (The Banker, July 2021). Nearly 8,600

employees across Europe, the Americas, Asia-Pacific, the Middle

East and Africa support the Bank's clients, meeting their financial

needs throughout the world. Crédit Agricole CIB offers its large

corporate and institutional clients a range of products and

services in capital markets activities, investment banking,

structured finance, commercial banking and international trade. The

Bank is a pioneer in the area of climate finance, and is currently

a market leader in this segment with a complete offer for all its

clients.

For many years Crédit Agricole CIB has been committed to

sustainable development. The Bank was the first French bank to sign

the Equator Principles in 2003. It has also been a pioneer in Green

Bond markets with the arrangement of public transactions from 2012

for a wide array of issuers (supranational banks, corporates, local

authorities, banks) and was one of the co-drafters of Green Bond

Principles and the Social Bond Guidance. Relying on the expertise

of a dedicated sustainable banking team and on the strong support

of all bankers, Crédit Agricole CIB is one of the most active banks

in the Green bonds market.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211004005250/en/

Crédit Agricole Corporate and Investment Bank

Jenna Lee Head of Communications for the Americas Email:

jenna.lee@ca-cib.com Tel: +1 212 261 7328

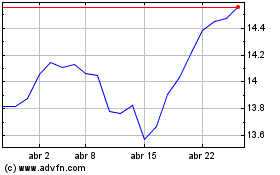

Credit Agricole (EU:ACA)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

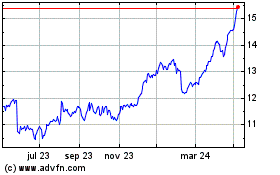

Credit Agricole (EU:ACA)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024