SAP Discloses Investment by Chairman's Charity in Joint Venture

12 Mayo 2021 - 11:05AM

Noticias Dow Jones

By William Boston

BERLIN -- SAP SE, the German software company, said Wednesday

that a charity set up by Hasso Plattner, SAP's chairman and

co-founder, had invested in a financial-services joint venture SAP

had created, but it denied any wrongdoing in not disclosing the

investment earlier.

After German media reported the existence of the Hasso Plattner

Foundation's investment this week, a spokesman for SAP said an

extensive compliance review before the transaction turned up no

conflict of interest and that neither Mr. Plattner nor Rouven

Westphal, the foundation's executive director, had any operational

influence over the joint venture.

SAP and Dediq GmbH, a financial services investment company,

agreed in April to form a joint venture to help boost SAP's efforts

to gain traction in supplying applications for financial services.

SAP agreed to take a 20% stake in the venture and Dediq pledged to

invest EUR500 million, equivalent to about $603 million.

"It was clear to SAP that the Hasso Plattner Foundation is a

passive investor behind Dediq, but neither Hasso Plattner nor

Rouven Westphal are," SAP said.

News of the foundation's investment in the venture was earlier

reported on Tuesday by German business daily Handelsblatt.

SAP said it chose Dediq after an extensive search for a

potential partner to boost its financial-services business.

When SAP and Dediq agreed to set up the joint venture, Dediq

created a vehicle for its planned EUR500 million investment in the

venture. A spokesman for Mr. Plattner and his Hasso Plattner

Foundation said the foundation agreed to invest in the Dediq

financing vehicle, providing a "significant amount" of the EUR500

million, but declined to name a specific number.

The spokesman said Rouven Westphal, the foundation's executive

director and manager of the Hasso Plattner Family Office, conducted

the negotiations. Mr. Plattner was kept outside the process, the

spokesman said.

"Hasso Plattner was not involved in any way," his spokesman

said, adding that the foundation was a silent investor and had no

role in the venture's management or supervision.

Investors said the revelation raised questions about the

governance of SAP. Mr. Plattner is one of SAP's original founders

and longtime chief executive.

Ingo Speich, head of sustainability and corporate governance at

fund manager Deka, raised concern that SAP didn't disclose Mr.

Plattner's involvement with Dediq through his charity and said it

exposed a conflict of interest.

"This will always be a gray area in this transaction because Mr.

Plattner has deeper insight into SAP than any other shareholder,"

Mr. Speich said.

Speaking at the company's annual general meeting on Wednesday,

Mr. Plattner said he would seek a two-year extension of his term.

His latest term as chairman was approved in 2019 and is due to

expire next year.

The foundation on its website describes Mr. Plattner as a

strategic adviser "in all matters of business." It also says Mr.

Plattner's wife and daughters help to approve new projects and

influence strategy.

SAP said Wednesday the venture would be called SAP Fioneer and

that it would start operating in the second half of the year

subject to antitrust approval.

Dediq declined to comment, saying it doesn't discuss its

co-investors or their investments.

Write to William Boston at william.boston@wsj.com

(END) Dow Jones Newswires

May 12, 2021 11:50 ET (15:50 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

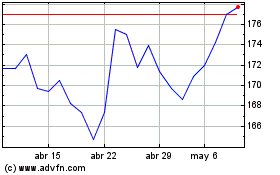

Sap (TG:SAP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

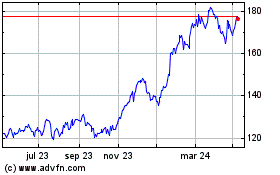

Sap (TG:SAP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024