Press Release

VALLOUREC SUCCESSFULLY COMPLETES ITS

FINANCIAL RESTRUCTURING AND ADOPTS A NEW GOVERNANCE

STRUCTURE

Boulogne-Billancourt,

July 1, 2021 – Vallourec

announces today the finalization of its financial restructuring,

thanks to the successful completion of the final steps of the

safeguard plan approved by the Nanterre Commercial Court on May 19,

2021.

Edouard Guinotte, Chairman and Chief Executive

Officer, stated:

“We successfully completed the final stages of

our financial restructuring. Thanks to a sound financial structure

and the support of our new reference shareholders, Apollo and

SVPGlobal, we are in a position to fully deploy our strategic

plan.

Our roadmap is clear. It relies on strengthening

the profitability of our core business and activating additional

levers of value creation such as exploiting the full potential of

our iron mine in Brazil and accelerating our commitment to the

energy transition to meet the growing needs of our clients.

I would like to thank our clients and partners

for their lasting trust in Vallourec in this unprecedented context,

as well as our teams, in all regions, for their continued and

exemplary commitment and determination.”

The significant reduction of the Group's debt,

representing approximately EUR 1,800 million, which is more than

half of the principal amount of Vallourec’s debt, as well as the

setting up of new medium-term financing, have been finalized as

part of the final completion of, in particular:

- the settlement and

delivery transactions of:

- the rights issue

for a total gross amount, including issue premium, of EUR

299,724,207.62, through the issuance of 52,954,807 new shares

subscribed in cash by the shareholders of the Company, the proceeds

of which being used to partially repay the claims of the Converted

Creditors under the Company's Bonds and RCFs,

- the share capital

increase for a total gross amount, including issue premium, of EUR

1,330,998,569.43, with removal of the shareholders' preferential

subscription rights in favor of the Converted Creditors, through

the issuance of 164,523,927 new shares subscribed for by the

Converted Creditors by way of set-off against part of their claims

under the Company's Bonds and RCFs,

- the issuance of

30,342,337 Warrants in favor of the Commercial Banks, subscribed by

them by way of set-off against part of their claims under the

Company's RCFs, and

- the issuance of New

Bonds for a total nominal amount of EUR 1,023 million, subscribed

by the Converted Creditors by way of set-off against part of their

claims under the Company’s Bonds and RCFs;

- the repayment of

EUR 262 million to all creditors under the Bonds and RCFs in

proportion to their restructured claims, as well as the payment to

creditors of interest, commitment fees, utilization fees and

default interest under the RCFs and Bonds for the period up to and

including February 1st, 2021;

- the debt write-off

granted by the Commercial Banks in the amount of EUR 169 million;

and

- the setting up by

the Commercial Banks of (i) a revolving credit facility of EUR 462

million, (ii) State-guaranteed loans (prêts garantis par l’Etat) in

the amount of EUR 262 million and (iii) bonding lines of EUR 178

million over a 5-year horizon.

The Bonds are therefore cancelled and delisted

from their respective markets today.

In accordance with the resolutions adopted on

April 20, 2021 by the combined general meeting of shareholders of

the Company, the Company's new form of governance will come into

effect today, upon decision of the Chairman of the Management Board

acknowledging that the Restructuring Effective Date occurred on

June 30, 2021, with:

- the modification of

the Company's governance and management structure to a structure

with a board of directors instead of the structure with a

management board and supervisory board; and

- the termination of

the mandates of the members of the Company’s supervisory board and

management board.

The Company’s new articles of association,

including in particular the removal of double voting rights, will

enter into force as of this date.

The new board of directors of the Company will

meet for the first time today. Following this meeting and subject

to the approval of the relevant decisions, the composition of the

board of directors should be the following:

- Mr. Édouard

Guinotte;

- Mr. Gareth Turner,

whose appointment is proposed by Apollo;

- Mr. Pierre

Vareille, independent member, whose appointment is proposed by

Apollo;

- Mr. William de

Wulf, whose appointment is proposed by SVPGlobal;

- Ms. Corine de

Bilbao, independent member;

- Ms. Maria Silvia

Marques, independent member;

- Ms. Hera Siu,

independent member;

- Ms. Angela Minas,

independent member.

Finally, the representative of the employees

will be appointed at a later date in accordance with the applicable

legal and statutory provisions.

The Board of Directors will resolve on the

combination of the duties of the Chairman of the Board of Directors

(Président du Conseil d’administration) and Chief Executive Officer

(Directeur Général), which should be conferred to Mr. Edouard

Guinotte. Mr. Pierre Vareille should be appointed as Vice-Chairman

(Vice-Président) and Lead Independent Director (Administrateur

Référent) of the Company's Board of Directors and Mr. Olivier

Mallet as Deputy CEO (Directeur Général Délégué) of the Company. In

addition, Mr. Paul Marchand for SVPGlobal and Mr. Conor J.

Sutherland for Apollo should be appointed as non-voting

observers.

The proposed composition of the committees of

the Board of Directors will be the following:

- Audit Committee:

- Ms. Angela Minas,

chairman and independent director;

- Ms. Hera Siu,

independent director;

- Ms. Maria Silvia

Marques, independent director;

- Ms. Corine de

Bilbao, independent director;

- Mr. Gareth Turner;

and

- Mr. William de

Wulf.

- Remuneration,

Nomination and Governance Committee:

- Mr. Pierre

Vareille, chairman and independent director;

- Mr. William de

Wulf;

- Ms. Angela Minas,

independent director; and

- Ms. Maria Silvia

Marques, independent director.

- Strategic and

Financial Committee:

- Mr. Gareth Turner,

chairman;

- Mr. William de

Wulf; and

- Ms. Corine de

Bilbao, independent director.

- Corporate and

Social Responsibility Committee (CSR):

- Ms. Corine de

Bilbao, chairman and independent director;

- Ms. Angela Minas,

independent director;

- Ms. Hera Siu,

independent director; and

- Ms. Maria Silvia

Marques, independent director.

Following the completion of the share capital

increases (before and after exercise of the Warrants) and to the

knowledge of the Company, the shareholding structure of the Company

is the following:

| |

Before exercise of the

Warrants |

After exercise of the

Warrants |

|

Shareholders |

Number of ordinary shares / voting rights |

% of the share capital / voting rights |

Number of ordinary shares / voting rights |

% of the share capital / voting rights |

| Apollo |

53,168,605 |

23.2% |

53,168,605 |

20.5% |

| SVPGlobal |

28,159,346 |

12.3% |

28,159,346 |

10.9% |

| BNP Paribas |

- |

- |

13,147,015 |

5.1% |

| Natixis |

- |

- |

13,113,508 |

5.1% |

| CIC |

- |

- |

4,081,814 |

1.6% |

| Nippon Steel

Corporation |

7,851,128 |

3.4% |

7,851,128 |

3.0% |

| Bpifrance

Participations |

5,200,929 |

2.3% |

5,200,929 |

2.0% |

| Group

Employees |

335,430 |

0.1% |

335,430 |

0.1% |

| Treasury

shares |

14,397 |

0.0% |

14,397 |

0.0% |

| Public |

134,198,593 |

58.6% |

134,198,593 |

51.8% |

| Existing

public |

51,002,617 |

22.3% |

51,002,617 |

19.7% |

| Creditors other

than Apollo and SVPGlobal |

83,195,976 |

36.3% |

83,195,976 |

32.1% |

|

TOTAL |

228,928,428 |

100.0% |

259,270,765 |

100.0% |

For the purposes of this press release:

| |

|

|

“Apollo” |

means certain investment funds managed by affiliates of Apollo

Global Management, Inc. |

| “2022

OCEANE” |

means the EUR250 million 4.125% OCEANE bonds due 2022 (ISIN:

FR0013285046). |

| “2022

Senior Notes” |

means the EUR550 million 6.625% senior notes due 2022 (ISIN:

XS1700480160 / XS1700591313). |

|

“2023 Senior

Notes” |

means the EUR400 million 6.375% senior notes due 2023 (ISIN:

XS1807435026 / XS1807435539). |

|

“2024 Bonds” |

means the EUR500 million 2.250% bonds due 2024 (ISIN:

FR0012188456). |

| “2027

Bonds” |

means the EUR55 million 4.125% bonds due 2027 (ISIN:

FR0011292457). |

|

“Bonds” |

means the 2022 OCEANE, 2022 Senior Notes, 2023 Senior Notes, 2024

Bonds and the 2027 Bonds. |

|

“Commercial Banks” |

means BNP Paribas, Natixis et CIC. |

|

“Converted Creditors” |

means all creditors of Vallourec SA under the RCFs and the Bonds,

other than the Commercial Banks, as of June 21, 2021. |

| “New

Bonds” |

means the senior notes governed by the laws of the State of New

York issued by the Company on June 30, 2021 for an aggregate

principal amount of EUR1,023 million (Regulation S ISIN:

XS2352739184; Rule 114 A ISIN: XS2352739770; IAI ISIN:

XS2352740604). |

|

“RCF” |

means (a) the facility agreement governed by French law and entered

into on February 12, 2014, (b) the facility agreement governed by

French law and entered into on May 2, 2016, (c) the facility

agreement governed by French law and entered into on September 21,

2015 and (d) the facility agreement governed by French law and

entered into on June 25, 2015, in each case, as amended. |

|

“Warrants” |

means the 30,342,337 share subscription warrants issued on June 30,

2021 by the Company, each Warrant conferring the right to subscribe

to one new share at an exercise price of €10.11 per Warrant at any

time during 5 years from their date of issue, the terms and

conditions of which are described in the prospectus approved by the

AMF on March 31, 2021 under number 21-093 (ISIN Code: FR00140030K7;

denomination: VALLOUREC BSA 21). |

|

“SVPGlobal” |

means Strategic Value Partners, LLC, acting in the name and on

behalf of Emerald Health Designated Activity Company, Emerald Moor

Designated Activity Company, Emerald Meadow Designated Activity

Company, Emerald Pasture Designated Activity Company. |

Disclaimer

This press release and the information it

contains do not constitute an offer to sell or subscribe, or a

solicitation of an order to buy or subscribe, Vallourec’s

securities. The dissemination, publication or distribution of this

press release in certain countries may constitute a violation of

applicable laws and regulations. Accordingly, persons who are

physically present in such countries and in which this press

release is disseminated, distributed or published should inform

themselves of and comply with any such local restrictions. This

press release must not be released, published or distributed,

directly or indirectly, in Australia, Canada, Japan or the United

States of America.

This press release is not an advertisement and

does not constitute a prospectus within the meaning of Regulation

2017/1129 of the European Parliament and of the Council of 14 June

2017 on the prospectus to be published when securities are offered

to the public or admitted to trading on a regulated market and

repealing the Prospectus Directive 2003/71/EC.

Forward-Looking Statements

This press release may contain forward-looking

statements. By their nature, forward-looking statements involve

risks and uncertainties as they relate to events and depend on

circumstances that may or may not occur in the future. These risks

include those developed or identified in the public documents filed

by Vallourec with the AMF, including those listed in the “Risk

Factors” section of the Universal Registration Document filed with

the AMF on March 29, 2021 under filing number n° D.21-0226 and the

amendment to the Universal Registration Document filed with the AMF

on June 2, 2021 under filing number n° D.21-0226-A01.

About Vallourec

Vallourec is a world leader in premium tubular

solutions for the energy markets and for demanding industrial

applications such as oil & gas wells in harsh environments, new

generation power plants, challenging architectural projects, and

high-performance mechanical equipment. Vallourec's pioneering

spirit and cutting edge R&D open new technological frontiers.

With close to 17,000 dedicated and passionate employees in more

than 20 countries, Vallourec works hand-in-hand with its customers

to offer more than just tubes: Vallourec delivers innovative, safe,

competitive and smart tubular solutions, to make every project

possible.

Listed on Euronext in Paris (ISIN code:

FR0013506730, Ticker VK), Vallourec is part of the SBF 120 index

and is eligible for Deferred Settlement Service Long Only.

In the United States, Vallourec has established

a sponsored Level 1 American Depositary Receipt (ADR) program (ISIN

code: US92023R4074, Ticker: VLOWY). Parity between ADR and a

Vallourec ordinary share has been set at 5:1.

Calendar

|

July 28th

2021 |

Release of second quarter and first half 2021 results |

For further information, please contact:

| Investor

relations Jérôme FribouletTel: +33 (0)1 49 09 39

77Investor.relations@vallourec.com |

Press

relations Héloïse RothenbühlerTel: +33 (0)1 41 03 77

50 heloise.rothenbuhler@vallourec.com |

| Individual

shareholdersToll Free Number (from France): 0 805 65 10 10

actionnaires@vallourec.com |

|

- Vallourec - CP Succès restructuration financière 01.07.2021

(eng) 01.07.2021

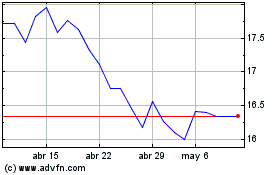

Vallourec (EU:VK)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Vallourec (EU:VK)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024