Dollar Rising Ahead Of April Employment Report

05 Mayo 2016 - 8:52AM

RTTF2

The dollar is climbing against all of its major rivals Thursday

afternoon. Investors are looking forward to the release of the U.S.

employment report for April tomorrow. The highly anticipated report

could have a significant impact on the outlook for whether the

Federal Reserve will raise interest rates at its next meeting in

June.

The Labor Department report is expected to show an increase of

about 200,000 jobs in April, while the unemployment index is

expected to edge down to 4.9 percent.

First-time claims for U.S. unemployment benefits rose by more

than expected in the week ended April 30th, according to a report

released by the Labor Department on Thursday. The report said

initial jobless claims climbed to 274,000, an increase of 17,000

from the previous week's unrevised level of 257,000. Economists had

expected claims to inch up to 262,000.

The European Central Bank said the economic recovery is expected

to proceed on domestic demand and investment but cautioned that the

recovery is weighed down by the ongoing balance sheet

adjustments.

"Domestic demand, in particular, continues to be supported by

the ECB's monetary policy measures," the bank said in its economic

bulletin published Thursday.

Their favorable impact on financing conditions and improvements

in corporate profitability underpin investment. At the same time,

accommodative monetary policy stance and employment gains together

with low oil prices lift disposable income of households.

Nonetheless, the bank said the recovery is still dampened by the

balance sheet adjustments in a number of sectors. The risks to the

euro area growth outlook still remain tilted to the downside.

The dollar has risen to nearly a 1-week high of $1.14 against

the Euro Thursday afternoon, from around $1.15 this morning.

The buck has climbed to around $1.4465 against the pound

sterling, from an early low of $1.4528.

The U.K. service sector activity expanded at the slowest pace in

more than three years in April largely reflecting economic

uncertainty ahead of the referendum on EU membership, survey data

from Markit showed Thursday.

The Chartered Institute of Procurement & Supply/Markit

services Purchasing Managers' Index fell more-than-expected to 52.3

in April from 53.7 in March.

The greenback reached a high of Y107.487 against the Japanese

Yen Thursday, but has since eased back to around Y107.245.

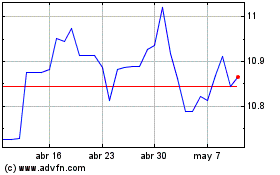

US Dollar vs SEK (FX:USDSEK)

Gráfica de Divisa

De Mar 2024 a Abr 2024

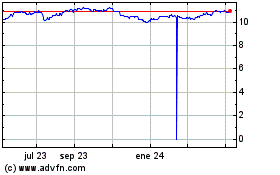

US Dollar vs SEK (FX:USDSEK)

Gráfica de Divisa

De Abr 2023 a Abr 2024