Banco Bradesco Profit Tumbles

10 Noviembre 2016 - 6:10AM

Noticias Dow Jones

SÃ O PAULO—Banco Bradesco SA on Thursday posted a near 22% drop

in third-quarter net profit, as the deterioration of its

nonperforming-loan rate led the bank to assume more provision

charges against the backdrop of the country's recession.

Brazil's fourth-largest bank by assets recorded a net profit of

3.24 billion Brazilian reais ($1.01 billion) in the quarter, down

from 4.12 billion reais a year earlier.

The bank opted to assume more provisions for bad loans. It said

provision charges totaled 5.74 billion reais in the latest period,

up nearly 50% from 3.85 billion reais a year earlier.

Bradesco's third-quarter nonperforming loan ratio, or NPL ratio,

increased to 5.4% from 3.8% in the year-earlier period, and was up

from 4.6% in the second-quarter.

The bank's NPL ratio is likely to continue deteriorating, as the

rate covering loans that were more than 60 days, also increased in

the period, to 6.4% from 4.7% in the year ago period.

With the country's economic recession and unemployment

worsening, Brazilians are facing challenges to pay their bills and

loans. After contracting 3.8% last year, Brazil's economy is

expected to shrink 3.2% in 2016, according to economists.

Bradesco's return on equity stood at 17.6% in the third quarter,

down from 20.7% in the year-ago period.

The bank's total credit portfolio increased in the period to 521

billion reais from 474 billion reais, while its assets increased

20.9% to 1.27 trillion reais.

Bradesco saw less demand for new loans from companies. Its loan

portfolio for companies increased 6.5% in the period, while loans

to individuals picked up 17.8%.

The bank, which bought HSBC's Brazilian operations there, in a

$5.2 billion deal in August 2015, said that HSBC Brazil operations

posted a net profit of 90 million reais in the third quarter.

Bradesco reviewed downward its view for the performance of its

credit portfolio this year and increased its forecasts regarding

expenses with provisions.

It now anticipates a portfolio performance of a contraction of

up to 7%, compared with a previous view for contraction of up to

4%.

The bank sees its provisions charges reaching up to 25 billion

reais this year, up from 20 billion reais, expected earlier.

Bradesco said that its new forecasts also assumes the integration

of HSBC unit.

Write to Rogerio Jelmayer at

rogerio.jelmayer@wsj.com<mailto:rogerio.jelmayer@wsj.com>

(END) Dow Jones Newswires

November 10, 2016 06:55 ET (11:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

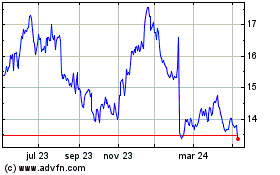

BRADESCO PN (BOV:BBDC4)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

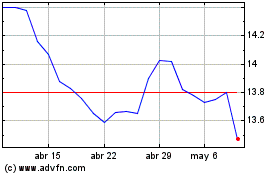

BRADESCO PN (BOV:BBDC4)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024