Canadian Dollar Climbs On Oil Prices Rally As OPEC Meets

30 Noviembre 2016 - 12:10AM

RTTF2

The Canadian dollar gained ground against its key counterparts

in the early European session on Wednesday, as oil prices advanced

on optimism that an OPEC meeting that began in Vienna would agree

on a production deal to contain supply glut.

Crude for January delivery rose $2.17 to $47.40 per barrel.

Following yesterday's sell-off, oil prices rose over 1 percent

after an Iraqi Oil Minister Jabbar al-Luaibi signaled a greater

likelihood of an OPEC deal to cut production.

"There will be a cut, yes, definitely," he added.

Further underpinning oil was a report from the American

Petroleum Institute showing an unexpected drop of 717,000 barrels

in U.S. crude supplies for the week ended November 25. The Energy

Information Administration will release official supply data later

in the day.

Canada's GDP data for the third quarter is due later in the day.

Economists expect a growth of 3.4 percent on quarter, compared to a

1.6 percent drop in the second quarter.

Investors also focus on U.S. reports on private sector

employment, personal income and spending and pending home sales

later in the day for more direction.

The loonie showed mixed trading in the Asian session. While the

loonie rose against the euro and the yen, it held steady against

the aussie. Against the greenback, it fell.

The loonie advanced to 84.41 against the Japanese yen, a level

not seen since June 8. Continuation of the loonie's uptrend may see

it challenging resistance around the 86.00 mark.

Data from the Ministry of Land, Infrastructure, Transport and

Tourism showed that Japan's housing starts increased at a faster

pace in October.

Housing starts climbed 13.7 percent year-on-year in October,

following a 10 percent rise in September. Economists had forecast

growth to rise to 11 percent.

The loonie recovered to 1.3405 against the greenback, from a low

of 1.3452 hit at 10:15 pm ET. The loonie is seen finding resistance

around the 1.32 region.

The loonie reversed from an early 2-day low of 1.4317 against

the euro, climbing to 1.4264. The next possible resistance for the

loonie may be found around the 1.40 area.

Data from Destatis showed that Germany's unemployment rate

decreased slightly in October.

The jobless rate fell to an adjusted 4.1 percent in October from

4.2 percent in the previous month. In the corresponding month last

year, the rate was 4.5 percent.

The loonie spiked up to a 5-day high of 1.0004 against the

aussie, off its early low of 1.0062. On the upside, 0.98 is likely

seen as the next resistance level for the loonie.

Looking ahead, at 7:30 am ET, European Central Bank President

Mario Draghi is expected to speak about the future of Europe at the

University of Deusto Business School, in Madrid.

At 8:00 am ET, Federal Reserve Bank of Dallas President Robert

Kaplan is expected to speak before the Economic Club of New

York.

In the New York session, U.S. ADP private sector jobs data for

November, U.S. personal income and spending data for October, U.S.

Chicago PMI for November, U.S. pending home sales data for October,

U.S. crude oil inventories data, Canada GDP data for September,

industrial products and raw materials price indexes for October are

set to be announced.

At 11:00 am ET, German Bundesbank President Jens Weidmann is

expected to speak at the Axica Conference Center, in Berlin.

At 11:45 am ET, Federal Reserve Governor Jerome Powell will

deliver a speech titled "The View from the Fed" at the Brookings

Institution, in Washington DC.

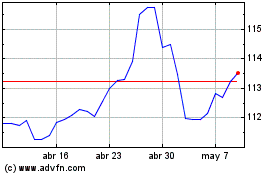

CAD vs Yen (FX:CADJPY)

Gráfica de Divisa

De Mar 2024 a Abr 2024

CAD vs Yen (FX:CADJPY)

Gráfica de Divisa

De Abr 2023 a Abr 2024