Canadian Dollar Drops Amid Oil Prices Slide

06 Diciembre 2016 - 3:39AM

RTTF2

The Canadian dollar slipped against its major counterparts in

the European session on Tuesday, following a decline in oil prices

on fears about the impact of OPEC's deal to curb oil

production.

Analysts say non-OPEC producers like the US and Canada may pick

up the slack if Saudi Arabia and Russia cut output.

In fact, Russia and Saudi Arabia may flood the markets

themselves before the deal kicks in next month.

Data released last week showed that Russian daily oil production

averaged 11.21 million barrels per day in November, its strongest

in almost 30 years.

The American Petroleum Institute will release weekly crude

inventories data later in the day, while the U.S. Energy

Information Administration will publish its official data on

Wednesday.

Data from Statistics Canada showed that Canada's merchandise

trade deficit narrowed to C$1.1 billion in October, the

smallest since January 2016, from a record C$4.4 billion

in September.

Imports fell 6.3 percent to C$44.7 billion in October,

while exports increased 0.5 percent to

C$43.6 billion.

The currency was higher against its major rivals in the Asian

session, with the exception of the greenback.

The loonie declined to 0.9921 against the aussie, off its early

4-day high of 0.9858. The loonie is seen finding support around the

1.01 mark.

The loonie eased back to 1.4281 against the euro, not far from

its early 6-day low of 1.4306. Continuation of the loonie's

downtrend may see it finding support near the 1.45 region.

Figures from Destatis showed that German factory orders

increased at the fastest pace in more than two years in

October.

Factory orders grew 4.9 percent month-on-month in October,

reversing a revised 0.3 percent drop in September. This was the

fastest growth since July 2014, when orders advanced 6.5 percent.

Orders were expected to rise 0.6 percent in October.

The loonie pared gains to 85.59 against the yen, from a high of

86.12 hit at 5:00 am ET. The next possible support for the loonie

may be found around the 84.00 area.

Official data showed that Japan's labor cash earnings added just

0.1 percent on year in October.

That was shy of expectations for an increase of 0.2 percent

following the downwardly revised flat reading in September.

The loonie reached as low as 1.3312 against the greenback,

reversing from its early high of 1.3252. On the downside, 1.34 is

possibly seen as the next support level for the loonie.

Data from the Commerce Department showed that the U.S. trade

deficit widened roughly in line with estimates in the month of

October.

The report said the trade deficit widened to $42.6 billion in

October from $36.2 billion in September. Economists had expected

the deficit to widen to $42.0 billion.

Looking ahead, U.S. factory orders and durable goods orders for

October and Canada Ivey PMI data for November are due shortly.

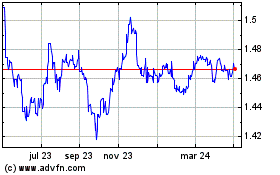

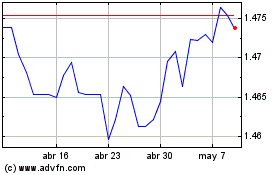

Euro vs CAD (FX:EURCAD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

Euro vs CAD (FX:EURCAD)

Gráfica de Divisa

De Abr 2023 a Abr 2024