Canadian Dollar Weakens On Falling Oil Prices; BoC Decision In Focus

07 Diciembre 2016 - 3:34AM

RTTF2

The Canadian dollar slipped against its major counterparts in

the European session on Wednesday, as oil prices declined on

lingering worries over whether the planned output cuts by the OPEC

and Russia would halt oversupply and restore balance in the

market.

Crude for January delivery fell $0.48 to $50.45 per barrel.

Both OPEC and Russia have reported record production in

November, while Saudi Arabia has cut its selling price of Arab

Light crude for Asian consumers in January, casting skepticism

about the impact of the OPEC deal that is aimed to rein in supply

glut.

OPEC and non-OPEC oil producers will meet in Vienna this weekend

to finalize the output deal approved on November 30. The nations

have agreed for an overall output reduction of around 1.5 million

barrels per day from January 2017.

The Bank of Canada decision is due at 10:00 am ET, with

economists expecting the benchmark rate to be kept unchanged at

0.50 percent. The rate has been on hold since July 2015.

Market participants await the monetary policy statement to

assess the consequences of protectionist policies proposed by the

U.S. President-elect Donald Trump and its risks on trade relations

with Canada.

The loonie showed mixed performance in the Asian session. While

the loonie rose against the aussie and the yen, it held steady

against the euro and the greenback.

The loonie fell to 1.4261 against the euro, off its early high

of 1.4210. The loonie may locate support around the 1.45 mark.

Figures from Destatis showed that Germany's industrial

production recovered in October.

Industrial production grew 0.3 percent in October from

September, when it declined by revised 1.6 percent. Nonetheless,

the pace of growth was weaker than the expected 0.8 percent

increase.

The loonie pared gains to 1.3287 against the greenback, from a

high of 1.3263 hit at 5:00 am ET. The loonie is seen finding

support near the 1.35 region.

The loonie reversed from an early session's high of 86.12

against the yen, easing back to 85.79. The next possible support

for the loonie-yen pair is seen around the 83.5 mark.

Preliminary figures from the Cabinet Office showed that Japan's

leading index increased less-than-expected in October to the

highest level in nearly a year.

The leading index rose to 101.0 in October from 100.0 in the

previous month, Economists had expected the index to climb to

101.4.

The loonie, having advanced to a 5-day high of 0.9852 against

the aussie at 7:45 pm ET, reversed direction and fell back to

0.9909. The loonie may possibly target support near the 1.01

level.

Looking ahead, U.S. crude oil inventories data and consumer

credit for October are set to be published in the New York

session.

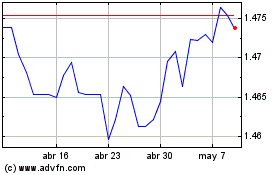

Euro vs CAD (FX:EURCAD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

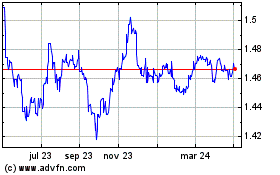

Euro vs CAD (FX:EURCAD)

Gráfica de Divisa

De Abr 2023 a Abr 2024