NZ Dollar Rises On Rising Risk Appetite

07 Diciembre 2016 - 7:18PM

RTTF2

The New Zealand dollar strengthened against the other major

currencies in the Asian session on Thursday amid rising risk

appetite, following the record gains overnight on Wall Street and

on expectations that the European Central Bank will extend its

asset purchase program at its monetary policy meeting later in the

day.

The ECB is widely expected to leave interest rates unchanged for

a sixth straight session and also extend its asset purchase program

beyond March of 2017 on the recent political turmoil in Europe

following the referendum in Italy.

Meanwhile, the sentiment boosted earlier in the day after

Reserve Bank Governor Graeme Wheeler said he sees "continued strong

growth" in the economy in the next 18 months.

While speaking at a business conference in Greymouth, Wheeler

said, "The low point for CPI inflation has probably passed and,

supported by the improvement in global commodity prices in recent

months, we expect the December quarter 2016 CPI data to confirm

that annual CPI inflation is moving back within the 1 to 3 percent

target band,".

Wednesday, the NZ dollar rose 0.11 percent against the U.S.

dollar, 0.07 percent against the yen, and 0.31 percent against the

euro. Meanwhile, the kiwi fell against the aussie.

In the Asian trading, the NZ dollar rose to a 3-day high of

1.4910 against the euro and nearly a 1-year high of 82.01 against

the yen, from yesterday's closing quotes of 1.5001 and 81.49,

respectively. If the kiwi extends its uptrend, it is likely to find

resistance around 1.47 against the euro, and 83.00 against the

yen.

Against the U.S. and the Australian dollars, the kiwi advanced

to nearly a 4-week high of 0.7219 and nearly a 1-month high of

1.0381 from yesterday's closing quotes of 0.7164 and 1.0439,

respectively. The kiwi may test resistance near 0.74 against the

greenback and 1.02 against the aussie.

Looking ahead, the European Central bank will announce its

interest rate decision at 7:45 am ET. The economists expect the

central bank's deposit rate and refinancing rate to be unchanged at

-0.4 percent and 0 percent, respectively.

Following the announcement, European Central Bank President

Mario Draghi will hold the customary post-meeting press

conference.

In the New York session, Canada housing starts for November,

building permits and house price index, for October and U.S. weekly

jobless claims for the week ended December 3, are due to be

released.

Later in the day, Bank of Canada Governor Stephen Poloz, Canada

Minister of Finance Bill Morneau and Minister of Status of Women

Patty Hajdu are scheduled to attend an event in Gatineau, Quebec,

Canada.

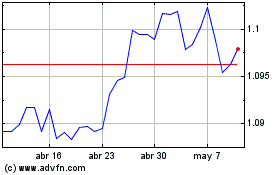

AUD vs NZD (FX:AUDNZD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

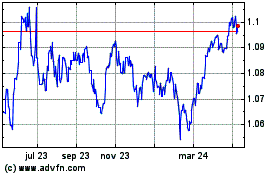

AUD vs NZD (FX:AUDNZD)

Gráfica de Divisa

De Abr 2023 a Abr 2024