Euro Retreats After ECB Holds Rates Steady, Trims Asset Purchases From April

08 Diciembre 2016 - 2:34AM

RTTF2

The euro trimmed its early gains against its major rivals in the

European session on Thursday, after the European Central Bank left

its key interest rates unchanged and retained its asset purchases

of EUR 80 billion a month till March, while tapering them to EUR 60

billion a month from April 2017.

The Governing Council, led by ECB President Mario Draghi, kept

the refi rate unchanged at a record low zero percent in the policy

session held in Frankfurt.

The deposit rate was held steady at -0.40 percent, and the

marginal lending facility rate at 0.25 percent. The rate decision

was in line with economists' expectation.

The bank also decided to continue its purchases under the asset

purchase programme, or APP, at the current monthly pace of EUR 80

billion until the end of March 2017.

From April 2017, the net asset purchases are set to be carried

out at a monthly pace of EUR 60 billion until the end of December

2017, or beyond, the bank said.

Draghi is set to begin his customary post-decision press

conference at 8.30 am ET, when he is set to face questions on the

scaling back of stimulus called 'tapering' and the 'no' vote in

Italy's referendum and the country's subsequent request for more

time to rescue the troubled Monte dei Paschi bank.

The currency showed mixed performance in the Asian session.

While the euro held steady against the franc and the pound, it rose

against the greenback. Against the yen, it declined.

The euro that appreciated to near a 4-week high of 1.0873

against the greenback immediately after the decision retreated to

1.0741 in a short while. At Wednesday's close, the pair was valued

at 1.0752. On the downside, 1.06 is possibly seen as the next

support level for the euro.

Pulling away from its recent 8-day high of 0.8571 against the

Sterling, the euro declined to 0.8478 shortly afterwards. The euro

is poised to locate support near the 0.84 area.

The Report on Jobs compiled by the Recruitment and Employment

Confederation and IHS Markit showed that U.K. permanent job

placements grew at the fastest pace in nine months in November.

The number of people placed in permanent jobs rose again in

November, with the rate of growth quickening to its sharpest since

February.

The single currency eased back to 1.0842 against the Swiss

franc, from near a 2-month high of 1.0898 set in the aftermath of

the announcement. Continuation of the euro's downtrend may see it

challenging support around the 1.07 region.

The 19-nation currency reversed from a new 4-week high of 1.4513

against the aussie, edging lower to 1.4372. The next possible

support for the euro-aussie pair is seen around the 1.42 mark.

The euro declined to a 3-day low of 1.4195 against the loonie,

after having advanced to 10-day high of 1.4354 soon after the ECB

decision. The euro is likely to challenge support near the 1.41

area.

Following a 2-day high of 1.5090 hit against the NZ dollar at

7:45 am ET, the euro retreated to 1.4945. The euro is seen finding

support around the 1.48 area.

On the flip side, the euro firmed to a 6-1/2-month high of

123.34 against the yen, up from a 2-day low of 121.99 hit at 10:30

pm ET. The next possible resistance for the euro-yen pair may be

located around the 126.00 mark.

Survey figures from the Cabinet Office showed that a measure of

peoples' assessment of the Japanese economy increased unexpectedly

in November to the strongest level in almost one year.

The current index of Economy Watchers' survey climbed to 48.6 in

November from 46.2 in the previous month. Meanwhile, economists had

expected the index to fall to 45.5.

Looking ahead, Canada building permits and house price index for

October and U.S. weekly jobless claims for the week ended December

3 are due to be released shortly.

Later in the day, Bank of Canada Governor Stephen Poloz, Canada

Minister of Finance Bill Morneau and Minister of Status of Women

Patty Hajdu are scheduled to attend an event in Gatineau, Quebec,

Canada.

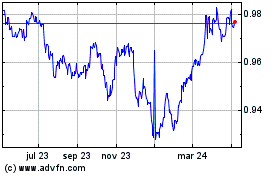

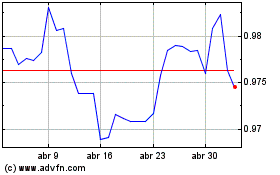

Euro vs CHF (FX:EURCHF)

Gráfica de Divisa

De Mar 2024 a Abr 2024

Euro vs CHF (FX:EURCHF)

Gráfica de Divisa

De Abr 2023 a Abr 2024