China's Producer Price Inflation Highest Since 2011; CPI Inflation Tops Forecast

08 Diciembre 2016 - 7:34PM

RTTF2

China's factory gate inflation increased to a more than

five-year high in November on higher commodity prices and consumer

price inflation exceeded expectations due to rising food costs.

Producer price inflation accelerated notably to 3.3 percent in

November from 1.2 percent in the previous month, the National

Bureau of Statistics showed Friday. Inflation was expected to rise

to 2.3 percent.

Producer price inflation had turned positive for the first time

in more than four years in September.

Consumer price inflation rose to 2.3 percent in November from

2.1 percent in October. A similar high rate was last seen in April.

The pace also exceeded the expected 2.2 percent.

Nonetheless, the figure continues to remain below the

government's full-year target of 3 percent.

Month-on-month, producer prices gained 1.5 percent and consumer

prices edged up 0.1 percent.

Food inflation climbed to 4 percent from 3.7 percent on higher

pork prices. Non-food inflation edged up to 1.8 percent from 1.7

percent.

The big picture is that China's stimulus driven recovery has

stoked domestic price pressure this year, Julian Evans-Pritchard, a

China economist at Capital Economics, said.

Looking ahead, the economist said this reflation may begin to

run out of steam next year as China's economy starts to slow again.

Producer price inflation is expected to peak around 5 percent

during the first half of next year, before beginning to edge down

again.

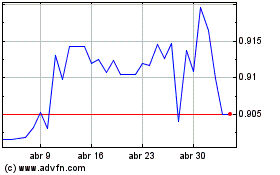

US Dollar vs CHF (FX:USDCHF)

Gráfica de Divisa

De Mar 2024 a Abr 2024

US Dollar vs CHF (FX:USDCHF)

Gráfica de Divisa

De Abr 2023 a Abr 2024