Canadian Dollar Falls On Weakening Oil Prices

09 Enero 2017 - 3:22AM

RTTF2

The Canadian dollar weakened against its major counterparts in

the European session on Monday, as oil prices declined on

indications of increasing oil output from the U.S. and rising oil

exports from Iran, outweighing optimism over the efforts by the

OPEC and other nations to reduce global output.

Crude for February delivery declined $1.10 to $52.89 per

barrel.

Data from oil service provider Baker Hughes showed last week

that oil rig count rose for the 10th consecutive week, increasing

by 4 to 529 in the week ended December 30.

OPEC's second-biggest producer Iraq sold over 13 million barrels

of oil held on tankers at sea, while its exports from Basra port

grew by a record 3.51 million barrels per day in December.

European stocks are mostly lower, with a slew of negative

corporate news and resurfacing hard-Brexit worries dampening

investor sentiment.

The currency has been trading in a negative territory against

its major rivals in the Asian session, with the exception of the

yen.

The loonie weakened to a 4-day low of 1.3277 against the

greenback, compared to Friday's closing value of 1.3237. If the

loonie extends slide, 1.34 is possibly seen as its next support

level.

The loonie was trading lower at 1.3957 against the euro, off its

early high of 1.3932. Continuation of the loonie's downtrend may

see it challenging support around the 1.42 mark.

Preliminary data from Eurostat showed that Eurozone jobless rate

remained unchanged in November at its lowest level since the middle

of 2009.

The seasonally adjusted unemployment rate was 9.8 percent,

unchanged from October, and in line with economists' expectations.

The rate was the lowest since July 2009.

Reversing from an early high of 0.9654 against the aussie, the

loonie dropped to 0.9725. The loonie is poised to find support

around the 0.98 area.

The latest survey from the Australian Industry Group showed that

Australia's construction sector continued to contract in December,

albeit at a slower pace, with a Performance of Construction Index

score of 47.0.

That's up from 46.6 in November, although it remains beneath the

boom-or-bust line of 50 that separates expansion from

contraction.

The loonie, having advanced to more than a 3-week high of 88.66

versus the yen at 12:00 am ET, reversed direction and edged down to

87.84. Further weakness may take the loonie to a support around the

86.00 zone.

Looking ahead, the Federal Reserve Bank of Atlanta President

Dennis Lockhart speaks on monetary policy before the Rotary Club of

Atlanta at 12:45 pm ET.

Federal Reserve Bank of Chicago President Charles Evans speaks

on economic outlook before the CFA Society Chicago at 1:00 pm

ET.

The U.S. consumer credit for November is due at 3:00 pm ET.

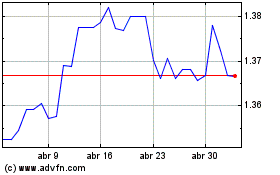

US Dollar vs CAD (FX:USDCAD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

US Dollar vs CAD (FX:USDCAD)

Gráfica de Divisa

De Abr 2023 a Abr 2024