The European Central Bank left its key interest rates unchanged

for a seventh consecutive policy session and maintained its asset

purchases, which will continue at a reduced pace till the end of

this year, as the solid economic momentum is sustained in the euro

area despite the continuing political flux.

The Governing Council, led by ECB President Mario Draghi, left

all its three interest rates unchanged. The main refi rate was kept

unchanged at a record low zero percent and the deposit rate at

-0.40 percent. The marginal lending facility rate was held at 0.25

percent.

"The Governing Council continues to expect the key ECB interest

rates to remain at present or lower levels for an extended period

of time, and well past the horizon of the net asset purchases," the

ECB said in a statement.

The bank also retained its asset purchases of EUR 80 billion a

month till March and to continue them at a reduced size of EUR 60

billion a month till December 2017.

Asset purchases can be extended beyond December if necessary,

until the Governing Council sees a sustained adjustment in the path

of inflation consistent with its inflation aim, the ECB added.

The net purchases will be made alongside reinvestments of the

principal payments from maturing securities purchased under the

asset purchase programme, the ECB said.

"If the outlook becomes less favourable, or if financial

conditions become inconsistent with further progress towards a

sustained adjustment in the path of inflation, the Governing

Council stands ready to increase the programme in terms of size

and/or duration," the central bank said.

Draghi is set to begin his customary post-decision press

conference at 8.30 am ET in Frankfurt.

Markets regarded the December reduction of the size of the

monthly asset purchases beyond March to be 'tapering', though

Draghi rejected even discussing any such measure.

Economists widely expect the central bank to hold fire until

April, when the pace of asset purchases would be reduced, and to

continue trimming stimulus further thereafter.

"After the December decisions, the ECB will in our view stay on

autopilot, at least until the summer," ING Bank economist Carsten

Brzeski said last week.

The economist pointed out that the ECB will want to see a

pick-up in core inflation and political certainty before it would

announce a further reduction of the monthly bond purchases.

"We shouldn't see such a scenario unfolding before the second

half of the year," Brzeski added.

Headline inflation rose to 1.1 percent in December, the highest

level since September 2013, driven by rising energy costs. Core

inflation that excludes energy, food, alcohol and tobacco, rose

only slightly to 0.9 percent.

The ECB aims for inflation "below, but close to 2 percent".

What could be a possible hurdle to further tapering is the high

political uncertainty in Europe with the looming "Brexit" talks and

elections in key member states. Rising protectionist sentiment,

especially after the Trump-win in the United States, is a major

risk to the currency union and trade.

UK Prime Minister Theresa May this week signaled a "hard

Brexit", which implies a complete separation from the European

Union, when she announced her country will not remain in the single

market. However, she said the government will try to gain maximum

access to the single market. The "Brexit" negotiations are set to

begin by late March.

European leaders, including German Chancellor Angela Merkel,

have reiterated that the UK will not be allowed to "cherry pick",

meaning the country cannot just enjoy the benefits of EU membership

without sharing any obligations.

The minutes, which the ECB calls "the account", of the December

policy session showed that the extension of asset purchases till

December received broad support from the Governing Council though

there were differences.

The bank said that those members who already had reservations

about asset purchases were not in favor of extending the same and

some even sought a scale back. This suggests there were no new

opposition to the measure and the bias is likely to be towards more

stimulus going forward, given the high political uncertainty

domestically as well as globally.

"President Draghi is likely to restate the Governing Council's

commitment to the plan despite the recent sharp rise in inflation

and he may well reiterate that even greater support is possible,"

Capital Economics economist Jennifer McKeown said ahead of the rate

decision.

"But we suspect that the hurdle for this will be high as the

Bank nears its policy limits."

Eurozone has had a solid run of positive economic figures

recently, that would underpin the ECB's expansionary stance as

policymakers wait for a sustained pick-up in inflation and growth.

Industrial production and business confidence have strengthened and

order books are strong.

However, the ECB faces strong opposition to its stimulus from

Germany, the biggest and the most influential euro area economy.

German politicians are likely to be more vociferous in this

election year, claiming the low interest rates are punishing German

savers, while rewarding inefficient economies.

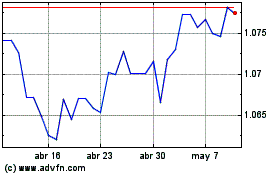

Euro vs US Dollar (FX:EURUSD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

Euro vs US Dollar (FX:EURUSD)

Gráfica de Divisa

De Abr 2023 a Abr 2024