Yen Extends Rise Amid Rising Risk Aversion

26 Febrero 2017 - 7:16PM

RTTF2

The Japanese yen continued to be strong against the other major

currencies in the Asian session on Monday amid rising risk

aversion, as lower commodity prices weighed on resources stocks.

Investors also digested local corporate earnings results as the

earnings reporting season winds down.

Investors also preferred to stay on the sidelines as they await

more details on U.S. President Donald trump's fiscal stimulus

plans. Trump is set to make his first address to a joint session of

Congress on Tuesday.

Meanwhile, the crude oil futures eased from 2017 highs on

Friday, holding losses after data showed U.S. oil rig count jumped

for the 15th week in 16. The U.S. oil-rig count increased by five

to a total of 602 this week, according to Baker Hughes. That's

nearly double the lowest point after the oil market crash a few

years ago.

Last Friday, the yen had risen 0.65 percent against the euro,

1.19 percent against the pound, 0.42 percent against the U.S.

dollar and 0.59 percent against the franc.

In the Asian trading, the yen rose to 118.25 against the euro,

from Friday's closing value of 118.37. The yen is likely to find

resistance around the 116.00 region.

Against the pound and the U.S. dollar, the yen advanced to near

3-week highs of 139.01 and 111.92 from last week's closing quotes

of 139.73 and 112.14, respectively. If the yen extends its uptrend,

it is likely to find resistance around 136.00 against the pound and

110.00 against the greenback.

The yen climbed to nearly a 3-month high of 111.07 against the

Swiss franc, from Friday's closing value of 111.22. The yen may

test resistance near the 110.00 region.

Against the New Zealand and the Canadian dollars, the yen rose

to a 2-month high of 80.51 and nearly a 3-week high of 85.35 from

last week's closing quotes of 80.64 and 85.58, respectively. The

yen is likely to find resistance around 79.00 against the kiwi and

84.00 against the loonie.

Looking ahead, Eurozone M3 money supply data for January and

business climate index for February are due to be released later in

the day.

At 7:30 am ET, Swiss National Bank Governing Board Member Fritz

Zurbrugg will deliver a speech titled "Cash - tried and tested, and

with a future" at the World Banknote Summit, in Basel.

In the New York session, U.S. durable goods orders and pending

home sales data, both for January, are slated for release.

In the New York session, Federal Reserve Bank of Dallas

President Robert Kaplan is expected to speak at the University of

Oklahoma's Distinguished Speaker Series.

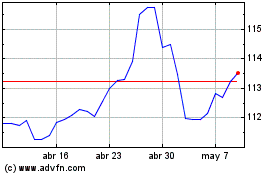

CAD vs Yen (FX:CADJPY)

Gráfica de Divisa

De Mar 2024 a Abr 2024

CAD vs Yen (FX:CADJPY)

Gráfica de Divisa

De Abr 2023 a Abr 2024