Yen Rises As Japan Retail Sales Gain

27 Febrero 2017 - 8:03PM

RTTF2

The Japanese yen strengthened against other major currencies in

the Asian session on Tuesday, after data showed that retail sales

in Japan rose more than expected in January.

Data from the the Ministry of Economy, Trade and Industry showed

that retail sales in Japan were up a seasonally adjusted 0.5

percent on month in January. That beat expectations for an increase

of 0.3 percent after dropping an upwardly revised 1.6 percent in

December. On a yearly basis, retail sales advanced 1.0 percent, in

line with expectations and up from 0.6 percent in the previous

month.

At the same time, the METI also showed that industrial

production in Japan was down 0.8 percent on month in January. That

missed forecasts for an increase of 0.4 percent following the 0.7

percent gain in December.

On a yearly basis, industrial production climbed 3.2 percent,

also shy of expectations for 4.4 percent but unchanged from the

previous month.

Meanhwile, investors are awaiting a speech by U.S. President

Donald Trump to a joint session of Congress later in the day, and

will look for details on Trump's promises of tax reform,

deregulation and infrastructure spending.

In other economic news, data from the Ministry of Land,

Infrastructure, Transport and Tourism showed that Japan's housing

starts growth accelerated unexpectedly to 12.8 percent in January

from 3.9 percent in December. Economists had forecast the growth to

slow to 3.3 percent. This was the seventh consecutive rise in

housing starts. Annualized housing starts climbed to 1.0 million

from 923,000 a month ago. The expected level was 916,000.

Meanwhile, construction orders received by 50 big contractors

grew only 1.1 percent after rising 7.1 percent in December.

Data from Shoko Chukin Bank showed Japan's small business

confidence weakened for the second straight month in February. The

small business confidence indicator dropped to 47.7 in February

from 48.3 in January. In December, the score was 48.3.

In the Asian trading, the yen rose to nearly a 3-week high of

85.21 against the Canadian dollar, from yesterday's closing value

of 85.48. The yen may test resistance near the 84.00 region.

Against the euro, the pound and the Swiss franc, the yen

advanced to 118.79, 139.67 and 111.32 from yesterday's closing

quotes of 119.31, 140.23 and 111.59, respectively. If the yen

extends its uptrend, it is likely to find resistance around 117.00

against the euro, 134.00 against the pound and 110.00 against the

franc.

Against the U.S. and the New Zealand dollars, the yen climbed to

112.45 and 80.74 from yesterday's closing quotes of 112.69 and

81.04, respectively. The yen may test resistance near 110.00

against the greenback and 79.00 against the kiwi.

Looking ahead, Swiss KOF leadig indicator for February is due to

be released at 3:00 am ET.

At 4:15 am ET, the Bank of England's chief operating officer

Charlotte Hogg is expected to speak at Appointment Hearing in

London.

In the New York session, U.S. GDP for the fourth quarter,

advance goods trade balance for January, wholesale inventories for

January, U.S. S&P/Case-Shiller home price index for December

and U.S. consumer confidence index for February and Canada

industrial and raw materials price indexes January are slated for

release.

At 3:00 pm ET, Federal Reserve Bank of Philadelphia President

Patrick Harker is expected to speak on the economic outlook before

an event hosted by the Temple University College of Liberal Arts,

in Philadelphia, U.S.

At 3:30 pm ET, San Francisco Fed President John Williams will

deliver a speech on the economic outlook before the Santa Cruz

Chamber of Commerce, in Santa Cruz, U.S.

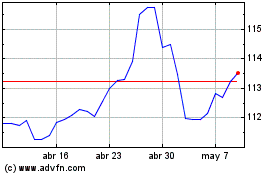

CAD vs Yen (FX:CADJPY)

Gráfica de Divisa

De Mar 2024 a Abr 2024

CAD vs Yen (FX:CADJPY)

Gráfica de Divisa

De Abr 2023 a Abr 2024