Indian Rupee Rises Against U.S. Dollar As RBI Leaves Key Rates Unchanged

07 Junio 2017 - 12:51AM

RTTF2

The Indian rupee advanced against the U.S. dollar in afternoon

deals on Wednesday, after the Reserve Bank of India kept its key

repo rate unchanged for the fourth straight meeting, while cutting

the statutory liquidity ratio to grant more liquidity to banks.

At its second bi-monthly monetary policy meeting, policymakers

of the Reserve Bank of India decided to maintain the repo rate at

6.25 percent and the reverse repo rate at 6.00 percent.

The central bank also reduced the SLR of all banks by 50 basis

points to 20 percent from 20.50 percent of their net deposits with

effect from June 24.

The decision of the MPC is consistent with a neutral stance of

monetary policy in consonance with the objective of achieving the

medium-term inflation target, while supporting growth, the bank

said.

Indian markets rose, with the benchmark BSE Sensex rising 64.30

points or 0.21 percent to 31,255, while the broader Nifty index was

up 21 points or 0.22 percent at 9,656.

The rupee rose to 64.31 against the greenback, up by 0.3 percent

from a 6-day low of 64.51 set in morning deals. The next possible

resistance for the rupee is seen around the 63.00 region. The pair

finished Tuesday's trading at 64.40.

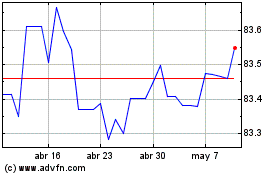

US Dollar vs INR (FX:USDINR)

Gráfica de Divisa

De Mar 2024 a Abr 2024

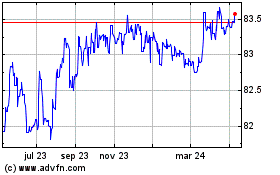

US Dollar vs INR (FX:USDINR)

Gráfica de Divisa

De Abr 2023 a Abr 2024