U.S. Dollar Falls On U.S. Political Uncertainty

24 Julio 2017 - 2:35AM

RTTF2

The U.S. dollar declined against its most major opponents in

European deals on Monday, as the resignation of Sean Spicer as

White House Press Secretary highlighted political upheaval in

Trump's team, which has been already engulfed by investigation

related to Russia's meddling in the U.S. election.

Spicer's resignation came after President Donald Trump decided

to name Wall Street financier Anthony Scaramucci as the new White

House communications director.

Spicer's top deputy, Sarah Huckabee Sanders, will serve as press

secretary.

The shake-up of Trump's communications team came against the

backdrop of news that special counsel Robert Mueller is broadening

Russia probe to include Trump's business transactions

Trump's son-in-law, Jared Kushner, testifies before the Senate

Intelligence Committee on Monday and the House of Representatives

Intelligence Committee on Tuesday. "No part of the meeting I

attended included anything about the campaign, there was no follow

up to the meeting that I am aware of, I do not recall how many

people were there (or their names), and I have no knowledge of any

documents being offered or accepted," Kushner said in a prepared

statement published ahead of the testimony.

Investors await Markit's flash PMI report for July and existing

home sales data for June later in the day for more clues about the

economy.

The currency has been trading in a negative territory in the

Asian session.

The greenback fell to 110.62 against the yen, its lowest since

June 15. Continuation of the greenback's downtrend may see it

challenging support around the 109.00 region.

Figures from the Cabinet Office showed that Japan's leading

index increased less than initially estimated in May.

The leading index, which measures the future economic activity,

rose to 104.6 in May from 104.2 April. The reading for May was

revised down slightly from 104.7.

Reversing from an early high of 1.2989 against the pound, the

greenback slipped to a 5-day low of 1.3049. The greenback is poised

to find support around the 1.32 area.

The greenback fell back to 0.9446 against the franc, from a high

of 0.9475 hit at 3:00 am ET. If the greenback-franc pair extends

slide, 0.93 is likely seen as its next support level.

The greenback dropped to a 4-day low of 0.7967 against the

aussie, after having advanced to 0.7901 at 5:00 pm ET. On the

downside, 0.81 is likely seen as the next support level for the

greenback.

On the flip side, the greenback rose to 1.1630 against the euro,

from an early near a 2-year low of 1.1684. The greenback is seen

finding resistance around the 1.13 region.

Flash data from IHS Markit showed that the Eurozone private

sector started the third quarter on a solid footing but the pace of

growth slowed for the second successive month in July.

The composite output index fell to a 6-month low of 55.8 in July

from 56.3 in June. The reading was expected to drop marginally to

56.2.

Looking ahead, Canada wholesale sales data for May, U.S.

Markit's flash PMI reports for July and existing home sales data

for June are slated for release in the New York session.

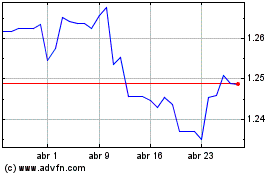

Sterling vs US Dollar (FX:GBPUSD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

Sterling vs US Dollar (FX:GBPUSD)

Gráfica de Divisa

De Abr 2023 a Abr 2024