U.S. Dollar Strengthens As Durable Goods Orders Rise More Than Forecast

27 Julio 2017 - 5:38AM

RTTF2

The U.S. dollar spiked up against its major counterparts in

early New York deals on Thursday, after new orders for U.S.

manufactured durable goods showed a substantial increase in June,

reflecting a sharp jump in orders for transportation equipment.

Data from the Commerce Department showed that durable goods

orders spiked by 6.5 percent in June after edging down by a revised

0.1 percent in May.

Economists had expected durable goods orders to surge up by 3.0

percent compared to the 1.1 percent drop originally reported for

the previous month.

Excluding orders for transportation equipment, durable goods

orders edged up by 0.2 percent in June after climbing by 0.6

percent in May. Ex-transportation orders had been expected to rise

by 0.4 percent.

Meanwhile, data from the Labor Department showed that first-time

claims for U.S. unemployment benefits rose more than expected in

the week ended July 22.

The report said initial jobless claims climbed to 244,000, an

increase of 10,000 from the previous week's revised level of

234,000.

Economists had expected jobless claims to rise to 241,000 from

the 233,000 originally reported for the previous week.

Investors await second quarter GDP data due tomorrow for more

clues about the health of the economy. Annualized GDP is expected

to rebound to 2.5 percent from the prior quarter's growth rate of

1.4 percent.

Traders digested the latest decision from the U.S. central bank,

which indicated that it would begin to unwind its bloated balance

sheet "relatively soon". Policy makers did not offer a specific

timeline for further rate hikes, but will probably hold off until

December barring an unexpected spike in inflation.

The greenback has been trading in a positive territory against

its major rivals in the European session, with the exception of the

pound.

The greenback rose to 1.3106 against the pound, after having

fallen to more than a 10-month low of 1.3159 at 6:00 am ET. The

next possible resistance for the greenback is seen around the 1.28

region.

The latest monthly Distributive Trades Survey from the

Confederation of British Industry revealed that British retailers

reported pick up in sales during July, exceeding expectations for

minimal growth.

A balance of 22 percent reported an increase in sales in July,

exceeding economists' forecast of 10 percent.

The greenback advanced to 111.54 against the Japanese yen, from

an early 3-day low of 110.78. Continuation of the greenback's

uptrend may see it challenging resistance around the 113.00

area.

The greenback remained higher against the euro with the pair

trading at 1.1699, after having fallen to a 2-1/2-year low of

1.1777 at 11:30 pm ET. On the upside, 1.13 is likely seen as the

next resistance level for the greenback.

Data from the European Central Bank showed that Eurozone

monetary aggregate rose at a slightly faster pace in June.

The M3 broad monetary aggregate climbed 5 percent annually,

slightly faster than the revised 4.9 percent growth logged in

May.

The greenback hit a 9-day high of 0.9622 against the Swiss

franc, off early low of 0.9490. Next key resistance for the

greenback is seen around the 0.98 area.

The greenback edged up to 1.2500 versus the loonie, 0.7986

versus the aussie and 0.7508 versus the kiwi, off its early low of

1.2415, more than 2-year lows of 1.8066 and 0.7558, respectively.

The greenback is likely to target resistance around 1.26 against

the loonie, 0.78 against the aussie and 0.74 against the kiwi.

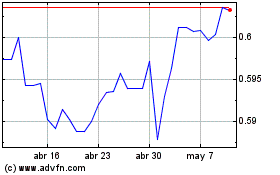

NZD vs US Dollar (FX:NZDUSD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

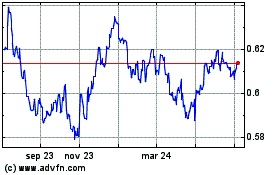

NZD vs US Dollar (FX:NZDUSD)

Gráfica de Divisa

De Abr 2023 a Abr 2024