Today's Top Supply Chain and Logistics News From WSJ

08 Noviembre 2017 - 6:23AM

Noticias Dow Jones

By Paul Page

Sign up: With one click, get this newsletter delivered to your

inbox.

New air-pollution rules on marine fuel don't go into effect for

more than two years but they're already reverberating across the

energy and shipping industries. Big fuel producers including

ExxonMobil Corp. and Total SA have invested billions to upgrade

refineries to producer lower-sulfur fuel that meets the global

standards, the WSJ's Christopher M. Matthews and Christopher Alessi

write, signaling a shift in maritime energy supply chains as

carriers and shipbuilders adjust to the rule. The International

Maritime Organization has mandated that vessels cut the sulfur

content in their fuel by more than 85% starting in 2020. Ship

operators can either undertake costly retrofits or use cleaner

fuels such as low-sulfur diesel. Container shipping giant CMA CGM

SA is taking another route, announcing it will use liquefied

natural gas to power the nine megaships it recently ordered. That's

the biggest move so far in shipping toward LNG power, and CMA CGM

is already in talks with ports and other suppliers about providing

the infrastructure needed to move beyond bunker fuel.

The Petya cyberattack slowed but didn't stop earnings growth at

the world's biggest container shipping line. Maersk Line earned

$211 million last quarter even as losses from the computer-systems

attack pushed parent A.P. Moller-Maersk into a net loss, the WSJ's

Costas Paris and Ian Walker report. The profit at the liner

business despite the loss of tens of thousands of container

bookings highlights the strength of the broader shipping-industry

recovery, and suggests why Maersk is upbeat about coming quarters.

Maersk says its freight rates were up 14% from a year ago even as

volumes dropped because. Even within Maersk, however, the shipping

rebound hasn't spread evenly. The Damco freight forwarding

operation lost $6 million in the quarter despite rising revenue

while port manager APM Terminals saw profit and margins hurt by

overcapacity. And falling freight shipping rates this quarter along

with rising fuel costs suggest clouds on the horizon.

China's No. 2 e-commerce company is adding some American protein

to its distribution channels. company JD.com plans to import $2

billion worth of U.S. beef and other food products, the WSJ's Lisa

Lin reports, in one of a series of trade agreements being lined up

for President Donald Trump's visit to China. The deal with JD

follows China's agreement in May to allow imports of U.S. beef to

resume after a ban of nearly 14 years on most imports. That could

open a big market for U.S. ranchers that have coped with lower

prices in recent years due to a buildup in supply. It also may give

JD an opening as it targets China's expanding middle class and the

growing demands for higher-quality imported food. The

business-to-consumer operator will add the meat to a growing

perishables distribution line that it's been bulking up this year

with fruits, vegetables and a growing lineup of refrigerated

distribution centers.

SUPPLY CHAIN STRATEGIES

America's love for coffee may have gotten overcaffeinated. The

number of coffee shops across the U.S. has grown by 16% in five

years, the WSJ's Julie Jargon writes, boosting supply chains for

Arabica while hurting business owners as the relentless spread of

specialty coffees cuts into profit margins. The plethora of options

is cutting into business, with consumers visiting traditional

coffee shops less often and spreading their spending from Starbucks

to McDonald's Corp. and the expanding coffee spaces at grocery

stores. The coffee world's woes are similar to those plaguing the

broader food-retail and restaurant industries, which have an

oversupply of retail space competing against a proliferation of new

food options. The storefronts also are being hurt by e-commerce --

not necessarily because people are buying more java online but

simply because they are staying at home rather than out shopping.

That has many storefronts slowing down their growth plans, as if

the jolt from a morning espresso is wearing off.

QUOTABLE

IN OTHER NEWS

In a Guest Voices commentary, MIT's Yossi Sheffi writes

corporations face a "soft skills" shortage in their supply-chain

ranks and that schools can help companies adjust. (WSJ)

The economies of central and southeastern Europe are on course

for their strongest growth year since the financial crisis.

(WSJ)

Russia has ramped up its crude exports this year, potentially

undermining a deal to restrict global supply to boost prices.

(WSJ)

The European Union is poised to propose a 30% cut in

carbon-dioxide emissions from cars and vans through 2030. (WSJ)

Waymo LLC is unleashing the first fleet of robot vehicles on

public roads without humans behind the wheel. (WSJ)

Toyota Motor Corp. is facing shortages of its most popular

vehicles in the U.S. as it seeks to increase sales. (WSJ)

German car maker BMW AG raised its full-year outlook despite a

drop in quarterly revenue and profit from its core business.

(WSJ)

U.S. department stores are putting off new orders from suppliers

as they seek to keep inventories lean this fall. (Reuters)

IKEA struck deals to add distribution centers in Texas outside

Houston and in California north of Oakland. (Houston Chronicle)

Tesla Inc. acquired manufacturing automation company Perbix.

(Bloomberg)

FedEx Corp. expanded an agreement with Walgreen's that will add

pickup and dropoff points in 7,500 U.S. drugstores. (Memphis

Commercial Appeal)

Food suppliers Kraft Heinz and Mondelez International are

pouring big research funding into online consumer sales. ( Chicago

Tribune)

Some 60% of small U.S. trucking companies haven't added the

electronic monitors that will be required starting next month.

(Commercial Carrier Journal)

Third-quarter profit at truckload carrier Schneider National

Inc. was almost flat at $36.9 million, well below expectations.

(Heavy Duty Trucking)

Rail supplier Vertex Railcar Carp. laid off workers for the

second time in a month. (WECT)

The Georgia Ports Authority wants more federal money for a

Savannah River deepening project they say needs $100 million a

year. (Atlanta Journal-Constitution)

The Port of Oakland expects to reduce its diesel emissions by

16% by 2020. (Logistics Management)

British truckers facing chronic severe delays serving London

Heathrow Airport's cargo facilities. (Motor Transport)

ABOUT US

Paul Page is deputy editor of WSJ Logistics Report. Follow him

at @PaulPage, and follow the entire WSJ Logistics Report team:

@brianjbaskin , @jensmithWSJ and @EEPhillips_WSJ. Follow the WSJ

Logistics Report on Twitter at @WSJLogistics.

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

November 08, 2017 07:08 ET (12:08 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

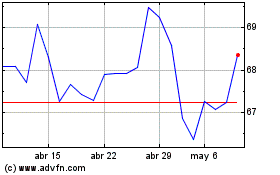

TotalEnergies (EU:TTE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

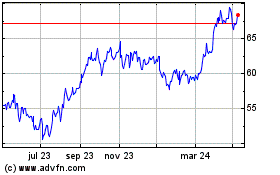

TotalEnergies (EU:TTE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024