By Riva Gold

Shares of global technology companies are outpacing other

sectors this year by the widest margin since the height of the

dot-com era, with a handful of key players dictating how markets

are performing around the world.

That dynamic was on display again Tuesday, when the Nasdaq

Composite rose 1.06% to end at its 67th record close in 2017, the

highest number of record closes in any year.

Shares of Apple Inc. rose 1.9%, while International Business

Machines Corp. added 1%. Microsoft Corp. was also up 1.4%, putting

the three tech giants among the biggest contributors to the Dow

industrials' gains on Tuesday.

Tech gains boosted the broader market. The S&P 500 and Dow

Jones Industrial Average also closed at record highs, rebounding

after a rare down stretch during the previous two weeks. Blue-chip

stock indexes in Europe and Asia closed higher.

In a sign that the tech rally is going global, Chinese internet

company Tencent Holdings Ltd. rose 2.4% after intraday gains

briefly put the company's market capitalization at around $530

billion, larger than Facebook's $528 billion. Tencent hit $500

billion for the first time Monday.

Just eight companies -- Facebook Inc., Apple, Amazon.com Inc.,

Netflix Inc., Alphabet Inc., Baidu Inc., Alibaba Group Holding and

Tencent -- have increased by $1.4 trillion in market cap in 2017, a

sum roughly equivalent to the combined annual GDP of Spain and

Portugal.

Tech giants' powerful user networks, large cash piles and access

to consumer data have led many investors to expect the big will

only get bigger.

"You need critical mass to support continuing innovation," said

Christopher Dyer, director of global equity at Eaton Vance. While

there are exceptions, "China and the U.S. would be natural

destinations for incremental dollar investment within tech," he

said.

While technology companies have helped take U.S. and some Asian

stock markets to record highs, less tech-heavy bourses of Europe,

Canada and Australia haven't enjoyed the same success.

For MSCI Europe, roughly 85% of its underperformance relative to

world stocks can be attributed to differences in the weight and

performance of their technology sectors, according to Morgan

Stanley.

"There's no doubt the markets that have high tech components

will have been the best performers this year," said Paul Markham, a

global equities portfolio manager at Newton Investment Management,

who has invested in many of the tech behemoths. "The narrow nature

of this rally has to be seen as something of a concern...but these

are cash-generative companies who are being seen as the bedrock of

the new economy."

Global tech stocks are up 42% this year, roughly double the

gains of the broad-based MSCI AC World Index. So far in 2017, the

tech sector is up 21 percentage points more than the next best

sector, materials -- leading by the widest margin of any sector

since 1999, according to analysis by Morgan Stanley.

The sector's dominance could make leading markets vulnerable

should investors' enthusiasm fade for tech or regulation hamper

development of these companies, some analysts say.

But most don't see that happening soon as the giants of this

space continue to deliver on earnings, meaning tech could continue

to be the differentiator among global markets in the years to

come.

Samsung Electronics, Tencent and Alibaba and Taiwan

Semiconductor Manufacturing Co. make up a combined 17% of the MSCI

Emerging Market Index, even more influential than Facebook, Apple,

Netflix, Amazon and Alphabet, which make up around 11% of the

S&P 500, according to S&P Dow Jones Indices.

MSCI Europe has a less than 5% weighting to technology

companies, compared with a 25% weight in MSCI USA and a 17% weight

in MSCI World.

Tech isn't the only factor behind this year's global rally. A

synchronized pickup in growth has buoyed earnings around the world,

and a continued hunt for yield has left few alternatives to stocks.

There are also risks for this year's winning sector, including the

prospect of greater regulation or investors simply rotating out of

areas that have already climbed a long way.

But some analysts dismiss comparisons with the dot-com boom.

Tech valuations in the U.S. are just a fraction of where they were

during that era. In early 2000, the S&P 500 tech sector traded

at a forward price-to-earnings ratio of 52, according to FactSet.

Today, that PE is 19, compared with 18 for the S&P 500 as a

whole.

In the third quarter of this year, S&P 500 technology

companies beat expectations by the widest margin of any sector,

with an earnings growth rate of 21% -- nearly double the next best

performer outside the energy sector.

Many market participants think this rally still has legs,

pushing record weekly inflows into tech earlier this month, with

U.S. and Chinese tech funds gaining particular traction, according

to fund-tracker EPFR Global.

"In 1999 [tech companies] were incredibly expensive and didn't

yet have a lot of earnings, " said Mark Phelps, an equities chief

at AllianceBernstein. But today, not only are their earnings

keeping up, "they've got more data, more processing power, and

they're giving the consumer a really good product," he said.

Write to Riva Gold at riva.gold@wsj.com

(END) Dow Jones Newswires

November 21, 2017 18:18 ET (23:18 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

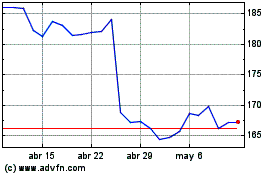

International Business M... (NYSE:IBM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

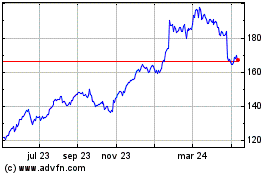

International Business M... (NYSE:IBM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024