UniCredit Signs Agreement With Dorotheum to Dispose of Italian Pawncredit Business

30 Noviembre 2017 - 1:42AM

Noticias Dow Jones

By Marc Bisbal Arias

UniCredit SpA (UCG.MI) said Thursday that it has signed a

binding agreement with Dorotheum GmbH & Co KG for the disposal

of its Italian pawncredit business.

The transaction envisages a consideration of 141 million euros

($167.1 million) at closing and a potential earn-out in favor of

UniCredit of up to EUR10 million after three years, the bank

said.

The operation is subject to regulatory approvals.

Completion of the deal is expected in the first half of 2018

through the contribution of the pawncredit business to a newly set

up financial company that will be wholly owned by Dorotheum,

UniCredit said.

A close to EUR100 million positive impact will be generated for

UniCredit next year, as well as almost 4 basis points on its

consolidated common equity tier 1 ratio, which is a key measure of

capital strength for banks, it said.

Dorotheum, which intends to expand its business throughout

Italy, has been an Austrian pawncredit service provider and auction

house for more than 310 years. With this agreement, it will become

the largest operator in Europe, UniCredit said.

Write to Marc Bisbal Arias at marc.bisbalarias@dowjones.com

(END) Dow Jones Newswires

November 30, 2017 02:27 ET (07:27 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

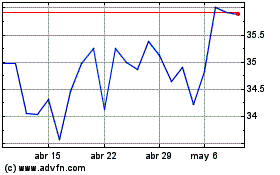

Unicredit (BIT:UCG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Unicredit (BIT:UCG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024