Unilever Shows Unrivaled Gains -- WSJ

02 Febrero 2018 - 2:02AM

Noticias Dow Jones

By Saabira Chaudhuri

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 2, 2018).

LONDON -- Unilever PLC bucked a trend roiling its American

rivals by selling more products at higher prices during last year's

final quarter.

Consumer-goods giants Procter & Gamble Co., Kimberly Clark

Corp. and Colgate-Palmolive have reported weak sales as

brick-and-mortar retailers like Walmart Inc. push for steep

discounts as they compete with Amazon.com Inc. and as input costs

rise. P&G, the maker of Tide detergent and Pampers diapers,

last week said that average prices on its products fell in the most

recent quarter for the first time since 2011.

Unilever reported 0.7% growth in prices for the fourth quarter

on the back of volume growth of 3.2%. Overall, sales grew 4% on an

underlying basis -- which excludes acquisitions and disposals and

the effect of currency moves -- to EUR12.8 billion.

Unilever's focus on emerging markets, coupled with a portfolio

that includes high-end skin-care products and fancy mustard, means

the company has more of a buffer from price pressures than its

rivals, Unilever finance chief Graeme Pitkethly said in an

interview.

"We have less reliance than our rivals like P&G on

categories under pressure like razor blades and diapers," he said.

"We see the same trends but we don't see the same impact."

The company in 2014 created a prestige division and has since

acquired a string of premium skin-care brands, among others, to

strengthen this unit.

Mr. Pitkethly says he thinks Unilever will continue to push

through higher prices in North America in 2018, but warned that as

the company's e-commerce sales grow, price pressures will mount.

Unilever currently makes about 5% of its North America sales

online, and that segment is growing at 50%. "That brings the

pressure on," Mr. Pitkethly said.

While Unilever often has achieved sales gains by raising prices,

for the fourth quarter the company's volume growth impressed

analysts. Investors generally perceive price-led sales growth as

inferior to that driven by recruiting more customers or just

selling more to existing ones.

"This is a much-improved performance from Unilever," said RBC

analyst James Edwardes Jones.

For the year, Unilever reported its sales grew 1.9% to EUR53.72

billion, or up 4.9% on a constant-currency basis. Net profit for

the maker of Magnum ice cream and Dove shampoo grew 17% to EUR6.05

billion.

Like rivals, Unilever has been grappling with various headwinds.

Consumers in big, developed markets are increasingly opting for

niche brands they see as more desirable. In emerging economies,

increased competition is coming from increasingly sophisticated

local players, while at the same time big markets like India and

Brazil are suffering macroeconomic disruptions.

The tumult in the sector has attracted activist investors like

Nelson Peltz to P&G and Daniel Loeb to Nestlé SA, and created

an opening for Kraft Heinz Co. last year to approach Unilever with

an unwelcome $143 billion acquisition bid. Since then, Unilever has

agreed to sell its spreads arm, where sales growth has long been

declining. It also has launched a share buyback, set a new

operating margin target of 20% by 2020 and sought ways to simplify

its dual-listed structure, which holds it back from making big

acquisitions.

Unilever also has embarked on a companywide restructuring to

become more responsive to local trends, including giving increased

autonomy to its local managers. It made 11 acquisitions in 2017,

including buying hair- and skin-care company Sundial Brands in the

U.S.,and organic herbal tea brand Pukka Herbs in the U.K.

The company launched five new personal-care brands last year,

including Hijab Fresh -- a shampoo aimed at Muslim women that wear

head coverings -- and Love, Beauty and Planet -- an eco-friendly

hair and body-care brand aimed at millennials.

On Thursday, the company's home-care arm reported underlying

fourth-quarter sales growth of 6.5%, while personal-care sales grew

of 4.4%. The foods business saw sales rise 1.4%, and refreshments

-- which houses tea and ice cream -- rose 4%. After being

challenged by rival HaloTop in the U.S. Unilever's ice cream sales

returned to growth in the fourth quarter.

For the year, Unilever reported an underlying operating margin

of 17.5%, up 1.1 percentage point from 2016.

Unilever gave annual guidance of underlying sales growth of 3%

to 5% and an improvement in its underlying operating margin, as it

takes aim at its 2020 target.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

February 02, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

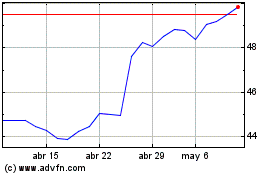

Unilever (EU:UNA)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

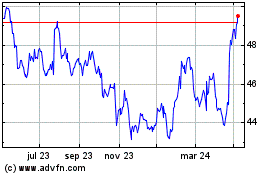

Unilever (EU:UNA)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024