Euro Falls As Draghi Says Sustained Increase In Inflation Needed To End QE

14 Marzo 2018 - 1:17AM

RTTF2

The euro dropped against its major counterparts in the European

session on Wednesday, after the European Central Bank President

Mario Draghi cautioned that there should be more evidence that

inflation is moving towards to the goal to bringing net asset

purchases to a gradual end.

Speaking at the annual ECB watchers conference in Frankfurt,

Draghi said that inflation has been converging towards the aim over

the medium term, but the policy makers are waiting for further

evidence that inflation dynamics are moving in the right

direction.

"There is a very clear condition for us to bring net asset

purchases to an end: we need to see a sustained adjustment in the

path of inflation towards our aim," he told.

"So monetary policy will remain patient, persistent and

prudent," he added.

Data from Eurostat showed that Eurozone industrial production

declined for the first time in four months in January.

Industrial production decreased 1 percent month-on-month in

January, in contrast to December's 0.4 percent rise. This was the

first fall since last September and also bigger than the forecast

of 0.4 percent drop.

The currency traded mixed against its major rivals in the Asian

session. While it rose against the yen and the greenback, it held

steady against the pound and the franc.

The single currency retreated to 1.2364 against the greenback,

from a 6-day high of 1.2413 hit at 1:30 am ET. On the downside,

1.21 is seen as the next possible support level for the euro.

The euro eased back to 0.8865 against the pound, after having

advanced to 0.8879 at 4:00 am ET. The euro is seen finding support

around the 0.87 region.

The 19-nation currency edged down to 131.73 against the yen, off

its early high of 132.28. Next key support for the euro is likely

seen around the 128.00 region.

Minutes from the Bank of Japan's January 22-23 meeting showed

that members of the monetary policy board said that the country's

economic growth is continuing at a satisfactory rate.

The members added that exports were on a rising trend, which was

helping to fuel the recovery.

The euro reversed from its early highs of 1.5783 against the

aussie, 1.6926 against the kiwi and 1.6068 against the loonie,

dropping to 1.5673, 1.6872 and 1.6009, respectively. The next

possible support for the euro is seen around 1.55 against the

aussie, 1.68 against the kiwi and 1.56 against the loonie.

Following a 4-day high of 1.1709 hit at 4:00 am ET, the euro

pulled back to 1.1692 against the Swiss currency. The euro is

poised to find support around the 1.14 level.

Looking ahead, U.S. retail sales and producer prices for

February, as well as business inventories for January are scheduled

for release in the New York session.

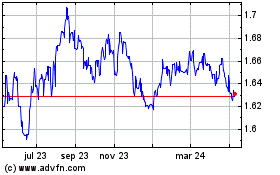

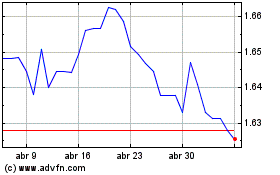

Euro vs AUD (FX:EURAUD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

Euro vs AUD (FX:EURAUD)

Gráfica de Divisa

De Abr 2023 a Abr 2024