Euro Falls As Eurozone PMI Hits 14-month Low, German Business Sentiment Worsens

22 Marzo 2018 - 12:58AM

RTTF2

The euro declined against its major rivals in the European

session on Thursday, as Eurozone business activity expanded at the

weakest pace in more than a year in March and German business

sentiment deteriorated, while European shares dropped ahead of U.S.

President Donald Trump's tariff announcement aimed at China.

Flash data from IHS Markit showed that the composite output

index dropped to 55.3 in March from 57.1 in February. The score

signaled the weakest growth in the private sector since January

2017.

The reading was expected to ease moderately to 56.8.

Survey data from Ifo institute showed that German business

climate index dropped to 114.7 from February's initially estimated

115.4. The score was forecast to fall to 114.6.

The current conditions index slid to 125.9, which was below the

expected level of 125.6.

Traders weighed the impact of Trump's plan to impose tariffs

against China worth upto $60 billion over intellectual-property

violations. The move is likely to spark retaliation from Beijing

and a trade war.

The currency held steady against its major rivals in the Asian

session, with the exception of the yen.

The euro weakened to near a 2-month low of 0.8704 against the

pound, from a high of 0.8742 hit at 3:45 am ET. The next possible

support for the euro is seen around the 0.86 level.

Figures from the Office for National Statistics showed that U.K.

retail sales rebounded at a faster than expected pace in

February.

Retail sales volume grew 0.8 percent month-on-month in February,

in contrast to a 0.2 percent drop in January. Sales were expected

to grow moderately by 0.3 percent.

Following an 8-day high of 1.2388 hit at 3:30 am ET, the euro

retreated to 1.2321 against the greenback. On the downside, 1.21 is

seen as the next support level for the euro.

The single currency slipped to a 9-day low of 1.1676 against the

Swiss franc, reversing from an early high of 1.1724. The euro is

poised to test support around the 1.15 level.

The 19-nation currency reversed from an early high of 131.02

against the yen, falling to a 3-day low of 130.15. Further

downtrend may see the euro challenging support around the 128.00

level.

Data from the Ministry of Economy, Trade and Industry showed

that Japan's all industry activity decreased for the first time in

four months in January, in line with expectations.

The all industry activity index fell 1.8 percent

month-over-month in January, reversing a 0.6 percent rise in

December.

The euro dropped to a 9-day low of 1.5844 against the loonie and

a 3-day low of 1.7010 against the kiwi, off its early highs of

1.5956 and 1.7110, respectively. If the euro falls further, it may

find support around 1.55 against the loonie and 1.67 against the

kiwi.

On the flip side, the euro held steady against the aussie, after

having advanced to 1.5975 at 12:45 am ET. The pair closed

Wednesday's trading at 1.5887.

Data from the Australian Bureau of Statistics showed that

Australia's jobless rate rose a seasonally adjusted 5.6 percent in

February.

That was above expectations for 5.5 percent, which would have

been unchanged from the January reading.

Looking ahead, at 8:00 am ET, the Bank of England's interest

rate decision is scheduled for release. Economists widely expect

the BoE to maintain interest rate at 0.50 percent and

asset-purchase program at GBP 435 billion.

The U.S. weekly jobless claims for the week ended March 17,

house price index for January, leading index for February and

Markit's manufacturing PMI for March are scheduled for release in

the New York session.

At 1:00 pm ET, the Bank of England Deputy Governor David Ramsden

delivers closing remarks at the International FinTech Conference in

London.

The Bank of Canada Deputy Governor Carolyn Wilkins speaks at the

Rotman School of Management in Toronto at 3:00 pm ET.

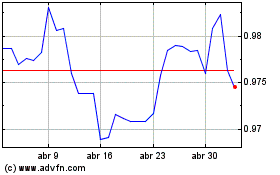

Euro vs CHF (FX:EURCHF)

Gráfica de Divisa

De Mar 2024 a Abr 2024

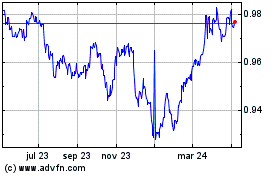

Euro vs CHF (FX:EURCHF)

Gráfica de Divisa

De Abr 2023 a Abr 2024