UniCredit Net Profit Soars in Best 1Q Since 2007 -- Update

10 Mayo 2018 - 3:26AM

Noticias Dow Jones

By Pietro Lombardi

UniCredit SpA (UCG.MI) said Thursday that first-quarter net

profit increased by double digits, a result that Chief Executive

Jean Pierre Mustier deemed the bank's "best first quarter in more

than a decade."

The Italian bank's net profit rose almost 23% from a year

earlier to 1.11 billion euros ($1.32 billion), helped by lower

operating costs and net write downs on loans and provisions.

Jefferies said in a note that UniCredit's first-quarter results

are "another tick in the box on the restructuring story." The U.S.

bank points to better-than-expected net interest income, fees,

costs and provision trends combining with stronger capital

generation being redeployed to accelerate the rundown of

nonperforming loans. Jefferies adds that it expects the stock to

outperform on Thursday.

At 0751 GMT shares traded 2.7% higher, while Italy's FTSE MIB

was up 0.2%.

The result is ahead of analysts' expectations, which, according

to a consensus forecast provided by the bank and based on 25

estimates, stood at EUR766 million.

Operating income was roughly flat at EUR5.11 billion compared

with EUR5.15 billion a year earlier.

Fees and commissions rose 2.8% year-on-year to EUR1.75 billion,

lifted by investment and transactional fees. Net interest income

slipped 0.9% to EUR2.64 billion, it said.

Operating costs fell 5.2% to EUR2.74 billion, the company

said.

UniCredit said net write-downs on loans and provisions in the

period stood at EUR496 million compared with EUR766 million a year

earlier.

The bank confirmed the targets of its "Transform 2019" plan, and

it is accelerating the reduction of its nonperforming exposures. It

now targets gross NPEs of EUR37.9 billion for the group in 2019,

compared with a previous expectation of EUR40.3 billion.

"The group should benefit from the ongoing recovery in the

economic cycle during 2018, despite the extraordinarily low

interest rates and the still high level of liquidity, consequently

affecting the net interest income dynamics," the bank said.

UniCredit said it expects fee growth and cost reduction to be

key drivers of its performance this year.

UniCredit anticipates bringing forward the rundown of the non

core portfolio to 2021 from 2025.

"At the start of its second year, Transform 2019 is ahead of

schedule and yielding tangible results," Mr. Mustier said.

Write to Pietro Lombardi at pietro.lombardi@dowjones.com

(END) Dow Jones Newswires

May 10, 2018 04:11 ET (08:11 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

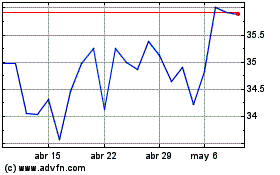

Unicredit (BIT:UCG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Unicredit (BIT:UCG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024