Oil Rally Aiding BHP Billiton Shale Sale, Says CEO

15 Mayo 2018 - 9:39AM

Noticias Dow Jones

By Rhiannon Hoyle

Higher oil prices and U.S. tax reform are encouraging interest

in the shale operations BHP Billiton is looking to sell, and bids

are expected from suitors in the coming weeks, Chief Executive

Andrew Mackenzie said Tuesday.

BHP, the world's largest listed miner by market value, said last

year it planned to offload its U.S. onshore energy business, and

Mr. Mackenzie said Tuesday the company was making good progress

with its exit.

"We have timed it well. The environment is supportive," he said

at an industry conference in Florida.

Oil trades at a multiyear high, underpinned by signs that major

oil producers are committed to reducing supply. Turmoil in the

Middle East and U.S. trade sanctions against major oil producer

Iran have also supported oil prices.

BHP's decision to put the business up for sale followed months

of campaigning by Elliott, the New York hedge fund that questioned

the fit of its shale business with its main units that mine iron

ore, copper and other minerals. The company holds more than 838,000

acres in shale-rich U.S. regions.

Mr. Mackenzie also said higher prices for commodities including

coal and iron ore increased BHP's return on capital employed to

roughly 14% from about 2% two years ago.

He said BHP still aimed to achieve a further $2 billion in

productivity gains by mid-2019, at a time when rising costs are

expected to start pressuring margins. The company has recorded

roughly $12 billion in improvements since 2012, when falling prices

sparked a race to reduce costs and make mines more efficient.

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

May 15, 2018 10:24 ET (14:24 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

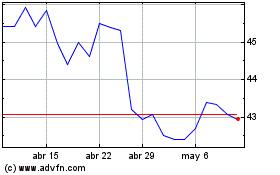

BHP (ASX:BHP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

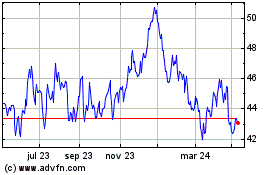

BHP (ASX:BHP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024