U.S. Dollar Advances On Rising U.S. Bond Yields

17 Mayo 2018 - 12:55AM

RTTF2

The U.S. dollar climbed against its major counterparts in early

European deals on Thursday, as U.S. treasury yields rose, with the

10 year yield above 3.10 percent for the first time since July

2011.

Solid economic data on U.S. retail sales, factory production and

housing starts released this week pointed to a strengthening

economy.

The benchmark yield on 10-year note rose 3.11 percent, while

that of 2-year equivalent was up by 2.59 percent. Yields move

inversely to bond prices.

Investors await U.S. reports on weekly jobless claims, leading

economic indicators and Philadelphia-area manufacturing activity

due later in the day for more direction.

Also in focus is the start of the second round of trade talks

between the U.S. and China today in a bid to avert a potential

trade war.

The greenback traded mixed against its major counterparts in the

Asian session. While it held steady against the franc and the euro,

it rose against the yen. Against the pound, it declined.

The greenback recovered to 1.3493 against the pound, from a

2-day low of 1.3569 hit at 10:00 pm ET. The greenback is seen

challenging resistance around the 1.32 area.

Having fallen to 0.9987 against the franc at 10:30 pm ET, the

greenback reversed direction and advanced to 1.0020. The greenback

is likely to find resistance around the 1.03 level.

The greenback reversed from an early low of 1.1837 against the

euro, rising to 1.1793. The next possible resistance for the

greenback is seen around the 1.16 area.

The greenback spiked up to 110.74 against the yen, its highest

since January 23. The greenback is poised to challenge resistance

around the 112.00 mark.

Data from the Cabinet Office showed that Japan core machine

orders fell 3.9 percent on month in March.

That missed expectations for a decline of 3.0 percent following

the 2.1 percent increase in February. The greenback was trading at

0.7532 against the aussie and 0.6894 against the kiwi, up from

early 3-day lows of 0.7548 and 0.6938, respectively. If the

greenback continues its rise, 0.73 and 0.66 are possibly seen as

its next resistance levels against the aussie and the kiwi,

respectively.

On the flip side, the greenback fell back to 1.2753 against the

loonie, just few pips short of its early 3-day low of 1.2750. On

the downside, 1.26 is possibly seen as the next support level for

the greenback.

Looking ahead, U.S. weekly jobless claims for the week ended May

12 and leading index for April are scheduled for release in the New

York session.

The Bank of England Chief Economist Andy Haldane will give

speech at the Economic Statistics Centre of Excellence Conference

on Economic Measurement in London at 12:00 pm ET.

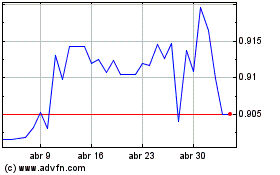

US Dollar vs CHF (FX:USDCHF)

Gráfica de Divisa

De Mar 2024 a Abr 2024

US Dollar vs CHF (FX:USDCHF)

Gráfica de Divisa

De Abr 2023 a Abr 2024