U.S. Dollar Climbs On Easing Trade War Worries

21 Mayo 2018 - 1:12AM

RTTF2

The U.S. dollar strengthened against its major counterparts in

early European deals on Monday, along with treasury yields, as U.S.

Treasury Secretary Steven Mnuchin remarked that China and US would

put trade war "on hold" amid "meaningful progress" in talks last

week.

Speaking to Fox News on Sunday, Mnuchin signaled a more

cooperative path for trade deals with China as Beijing reportedly

promised to increase purchases of American goods and services to

reduce the trade deficit.

"We have agreed to put the tariffs on hold while we try to

execute the framework," Mnuchin said.

Mnuchin added that both sides had agreed to halt imposing

tariffs against each other.

Investors await the minutes from the Federal Reserve's May

meeting due this week for more clues about the rate outlook for

this year.

Other major economic data include U.S. manufacturing and

services PMI, durable goods orders and existing home sales during

the week.

The greenback has been trading in a positive territory against

its major rivals in the Asian session.

The greenback spiked up to 1.1717 against the euro, a level

unseen since November 20, 2017. The next possible resistance for

the greenback is seen around the 1.16 level.

The greenback that closed last week's deals at 1.3457 against

the pound climbed to near a 5-month high of 1.3395. Next key

resistance for the greenback is likely seen around the 1.33

level.

The greenback advanced to 111.40 against the yen, its highest

since January 18. The greenback is poised to challenge resistance

around the 113.00 level.

Data from the Ministry of Finance showed that Japan logged a

merchandise trade surplus of 626.0 billion yen in April.

That exceeded expectations for a surplus of 440.0 billion yen

following the downwardly revised 797.0 billion yen surplus in

March.

The greenback was trading higher at 1.0000 against the franc, up

from a low of 0.9965 hit at 5:00 pm ET. The greenback is seen

finding resistance around the 1.02 level.

The greenback bounced off to 0.6884 against the kiwi, after

having fallen to 0.6932 at 5:30 pm ET. The greenback is likely to

find resistance around the 0.68 level.

Data from Statistics New Zealand showed that New Zealand retail

sales rose a seasonally adjusted 0.1 percent on quarter in the

first three months of 2018.

That was shy of expectations for a gain of 1.0 percent and down

from the downwardly revised 1.4 percent in the three months

prior.

On the flip side, the greenback edged down to 1.2854 against the

loonie, from a high of 1.2890 hit at 8:30 pm ET. On the downside,

1.27 is likely seen as the next support for the greenback.

The greenback eased back to 0.7529 against the aussie, heading

closer to pierce a 4-day low of 0.7534 hit at 10:15 pm ET. If the

greenback continues its fall, 0.77 is possibly seen as its next

support level.

At 12:15 pm ET, Atlanta Fed President Raphael Bostic speaks

about the economic outlook and price-level targeting at the Atlanta

Economics Club.

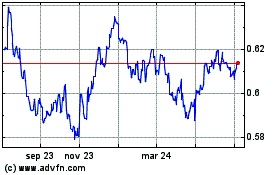

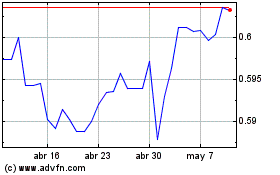

NZD vs US Dollar (FX:NZDUSD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

NZD vs US Dollar (FX:NZDUSD)

Gráfica de Divisa

De Abr 2023 a Abr 2024