Euro Eases As ECB Members See Increased Uncertainty To Eurozone Outlook

24 Mayo 2018 - 4:29AM

RTTF2

The euro retreated from its early highs against its major

counterparts in the European session on Thursday, after the minutes

from the recent monetary policy meeting showed that the

policymakers of European Central Bank agreed that risks to Eurozone

growth outlook continued to be broadly balanced, but increased

uncertainties arising from the threat of increased protectionism

had become more prominent.

Members observed that the underlying growth momentum in the euro

area and its largest economies remained broadly intact, and

expressed confidence in the continuation of the expansion at a

solid pace, the minutes from April 25-26 meeting showed.

"It was widely felt that uncertainty surrounding the outlook had

increased and caution was seen as warranted in interpreting recent

developments, also because the moderation in growth appeared to be

broad-based across countries and sectors."

Members broadly agreed that an ample degree of monetary policy

accommodation was still required to accompany the economic

expansion and secure the gradual convergence of inflation to levels

below, but close to, 2 percent.

Survey data from market research group GfK showed that Germany's

consumer confidence is set to weaken in June.

The forward-looking consumer sentiment index dropped by 0.1

points to 10.7 in June. The score was forecast to remain at

10.7.

The currency showed mixed trading against its major rivals in

the Asian session. While the euro fell against the yen and the

franc, it held steady against the pound. Against the greenback, it

rose.

The European currency weakened to a 3-day low of 0.8738 against

the pound, from a high of 0.8778 hit at 4:00 am ET. The euro is

seen finding support around the 0.86 region.

Data from the Office for National Statistics showed that U.K.

retail sales grew at a faster than expected pace in April after

declining a month ago.

Retail sales volume, including auto fuel, expanded 1.6 percent

month-on-month, in contrast to a 1.1 percent fall in March. Sales

were forecast to climb 0.9 percent.

Having advanced to 1.1746 against the greenback at 4:30 am ET,

the euro reversed direction and eased to 1.1706. Next key support

for the euro is likely seen around the 1.16 mark.

The euro retreated to 128.34 against the yen, within a striking

distance of near a 1-year low of 127.97 seen at 9:45 pm ET. The

euro is poised to challenge support around the 126.00 level.

Data from the Cabinet Office showed that Japan's leading index

weakened more than initially estimated in March.

The leading index, which measures the future economic activity,

dropped to 104.4 in March from 105.9 in February. The flash score

for March was 105.0.

The single currency edged down to 1.1599 against the Swiss

franc, from a high of 1.1653 hit at 3:00 am ET. The next possible

support for the euro is seen around the 1.14 level.

The single currency eased back to 1.6918 against the kiwi, from

a high of 1.6981 seen at 4:30 am ET. This may be compared to a

5-week low of 1.6879 set in the early Asian session. On the

downside, 1.68 is likely seen as the next support for the euro.

Looking ahead, U.S. existing home sales for April are due

shortly.

Atlanta Fed President Raphael Bostic will deliver speech at a

research event on technology-enabled economic disruptions,

co-hosted by the Atlanta Fed and Dallas Fed in Dallas at 10:35 am

ET.

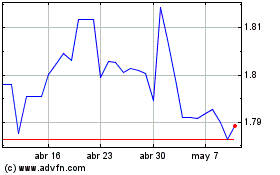

Euro vs NZD (FX:EURNZD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

Euro vs NZD (FX:EURNZD)

Gráfica de Divisa

De Abr 2023 a Abr 2024