European Commission Orders Luxembourg to Recover EUR120 Million From Engie -- Update

20 Junio 2018 - 7:54AM

Noticias Dow Jones

By Max Bernhard and Pietro Lombardi

The European Commission has ordered Luxembourg to recover about

120 million euros ($139 million) in unpaid taxes plus interest from

Engie SA (ENGI.FR), after finding that the country allowed two of

the French company's subsidiaries to dodge taxes on most of their

profits for almost a decade.

"This is illegal under EU state aid rules because it gives Engie

an undue advantage," the commission said in a statement on

Wednesday.

An investigation concluded that two Luxembourg tax rulings

"artificially lowered" Engie's tax burden in the country, the

commission said.

"The rulings enabled Engie to avoid paying any tax on 99% of the

profits generated by Engie LNG Supply and Engie Treasury Management

in Luxembourg," it said.

The two Engie companies, Engie Treasury Management Sarl. and

Engie LNG Supply SA, are both incorporated in Luxembourg.

The commission said that for almost a decade, Engie's effective

tax rate for profits in the country was less than 0.3%.

Engie denied it had received any state aid from Luxembourg and

said in a statement it "fully complied with the applicable tax

legislation." The company added that it doesn't expect the decision

to hit its 2018 results.

"Engie will assert all its rights to challenge the state aid

classification considering that the commission did not demonstrate

that a selective tax advantage was granted. Therefore, Engie will

apply for annulment of the commission's decision before the

competent courts," it said.

Total SA (FP.FR) agreed in November 2017 to acquire Engie's LNG

business, including Engie LNG Supply.

Write to Max Bernhard at max.bernhard@dowjones.com;

@mxbernhard

(END) Dow Jones Newswires

June 20, 2018 08:39 ET (12:39 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

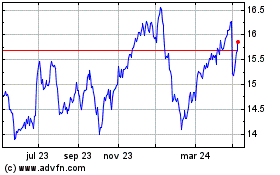

Engie (EU:ENGI)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

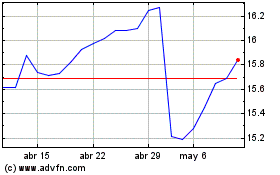

Engie (EU:ENGI)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024