TIDMPRS

RNS Number : 5251S

Paternoster Resources PLC

26 June 2018

For immediate release 26 June 2018

Paternoster Resources plc

("Paternoster" or "the Company")

Financial Statements for the year ended 31 December 2017

The Company is pleased to announce that the financial statements

for the year ended 31 December 2017 - extracts from which are set

out below - will shortly be posted to shareholders, and made

available on the website www.paternosterresources.com

For more information, please contact:

Paternoster Resources plc: +44 (0) 20 7580 7576

Nicholas Lee, Chairman

Nominated Adviser: +44 (0) 20 7628 3396

Beaumont Cornish

Roland Cornish/Rosalind Hill Abrahams/Felicity Geidt

Joint Broker: +44 (0) 20 7186 0050

Shard Capital Partners LLP

Damon Heath

Erik Woolgar

Joint Broker:

Peterhouse Capital Limited +44 (0) 20 7562 3351

Lucy Williams

INTRODUCTION

During the year ended 31 December 2017, the Company has

continued to trade as an investment company focused on investing in

the natural resources sector.

FINANCIAL

During 2017, the Company made a loss from continuing operations

of GBP1,135,685 (2016: profit of GBP486,048). The net asset value

of the Company as at 31 December 2017 was GBP2,448,769 (2016:

GBP3,584,454).

The Company's investment portfolio at 31 December 2017 is

divided into the following categories:

Category Principal investments Cost or valuation

(GBP)

Metal Tiger plc, MX Oil plc,

Plutus Powergen plc, Arc Minerals

plc, Pires Investments plc,

I3 Energy plc, Cora Gold plc

Listed investments and Shumba Energy Limited 1,811,625

------------------------------------

Cash resources 211,795

Listed investments

and cash 2,023,420

----------------------------------------------------------

Unlisted investments 440,748

Total 2,464,168

----------------------------------------------------------

At 31 December 2017, the Company had cash balances amounting to

GBP211,795 (2016: GBP648,165).

Since the year end, the company has raised new funds and on 1

May 2018, the Company released its First Quarter Update 2018 which

showed that it had net assets, on an unaudited basis, of GBP3.1

million, the majority of which comprised listed investments of

GBP1.8 million and cash of GBP1.1 million.

REVIEW OF THE YEAR

During the year, the share price of Plutus PowerGen plc

("Plutus"), one of the Company's principal investments reduced

significantly, contributing to a reduction in the value of the

investment portfolio. This is compared against a very strong

performance of the Plutus share price during 2016 when it increased

by some 110%. Furthermore, whilst Cradle Arc Investments plc

(formerly Alecto Minerals plc) and Polemos plc which were both

suspended during the year have come back to the market post year

end, this has been at lower prices than was originally expected and

so, prudently, these reduced valuations have been reflected in the

2017 year end portfolio valuation.

During 2017, the Company's investment in Glenwick translated

into holdings in I3 Energy plc and Cora Gold plc and the share

prices of both of these companies struggled towards the end of

2017. However, since the year end, the I3 Energy plc share price

has increased by around 300%. Paternoster has realised some

significant profits from this investment whilst still retaining a

meaningful shareholding.

More details of the development of investments during the year

and significant developments since the year end are set out in the

Strategic Report.

OUTLOOK AND STRATEGY

On 18 January 2018, the Board of Paternoster Resources plc

announced that it had entered into an arrangement with RiverFort

Global Capital Ltd ("RiverFort"), the specialist provider of

capital to junior companies whereby Paternoster would have the

opportunity to invest in transactions arranged by RiverFort

alongside other co-investors. At the same time, the Company raised

GBP850,000 from both private and institutional investors.

RiverFort is a highly-respected provider of specialist

financing, primarily to the natural resources sector, providing

equity, convertible debt and senior project finance solutions.

RiverFort is the investment director of Cuart Investments PCC

Limited, a Gibraltar Experienced Investor Fund. Since its

formation, RiverFort has been able to arrange attractive returns

for its investors. In 2016, its first year of operation, Cuart

Investments PCC Limited - Cuart Growth Capital Fund I achieved an

increase in its audited NAV of over 15% between July and December

2016. The increase in NAV for 2017, on an unaudited basis, is

expected to be over 20%. From the date of its formation to 31 March

2018, RiverFort, on behalf of Cuart Growth Capital Fund I, its

co-investors and other investment partners, has arranged over US$76

million of investments. The RiverFort team has an international

footprint and a range of financial, entrepreneurial and industrial

expertise. Riverfort is authorised and regulated by the Financial

Conduct Authority.

On 21 February 2018, Andrew Nesbitt joined the board of

Paternoster. Andrew is a qualified mining engineer and is a

consultant to RiverFort. He holds a BSc (Eng) Mining and an MBA and

has over 20 years of experience in the natural resources sector. He

has held various production and technical roles with both De Beers

and Goldfields and has carried out a number of feasibility studies

across the world with the leading technical consulting group SRK.

In addition, Andrew is also an experienced investor, having

previously worked as a partner and portfolio manager for Craton

Capital Pty Limited, a global precious metals fund with over US$400

million of assets under management.

On 20 April 2018, the Board announced that, as a first step in

the development of its arrangement with RiverFort, it had agreed to

invest around GBP250,000 in a portfolio of income-yielding

investments arranged by RiverFort which comprise investments in the

form of both senior and convertible debt. This portfolio

represented, on average, around 2.8% of the total investment

amounts originally arranged by RiverFort and therefore demonstrates

the scope for Paternoster to scale-up the size of its investments

as it develops its relationship with RiverFort. This should enable

the Company to quickly grow its portfolio with investments that can

generate both attractive cash returns whilst providing downside

protection.

On 8 June 2018, Paternoster held a general meeting both to

increase its share allotment authorities and to approve the

entering into of an investment adviser agreement with RiverFort.

All resolutions were passed with significant majorities. Going

forward, the Company is now well placed to build its portfolio

significantly and rapidly through making investments that can

generate income and capital growth whilst offering downside

protection.

Nicholas Lee

Chairman

25 June 2018

REVIEW OF THE BUSINESS AND FUTURE DEVELOPMENTS

LISTED INVESTMENTS

PLUTUS POWERGEN PLC

Plutus PowerGen plc ("Plutus"), which is listed on AIM, is a

power company focused on the development, construction and

operation of flexible electricity and gas power generation in the

UK.

In Q1 2017, the company's share price fell significantly as a

result of the uncertainty surrounding the OFGEM statement regarding

TRIAD payments to local embedded power generators. Given that

Plutus benefits from multiple earnings streams, it believes that

its business model going forward continues to be attractive. It

also has a number of projects in the pipeline that are expected to

deliver additional fees and revenues. The company is continuing to

broaden its exposure to the UK energy sector which includes looking

to develop battery energy storage projects. It has also received

planning for two further renewable green diesel power generation

sites and has recently signed a joint venture with a leading UK

supplier of gas and diesel generators.

Plutus has commissioned two new 20MW flexible energy generation

sites in Stowmarket, Suffolk and has energised two sites in

Ipswich. The company now has 120MW of flexible energy generation

sites in operation with a further three 20MW sites expected to come

into operation in 2018. More generally, the company is focused on

moving into gas powered energy generation, energy storage and

hybrid generation sites during 2018. Gas powered sites offer

significantly more attractive returns compared to diesel powered

sites and hybrid sites allow power generation sites of various

types to partner with storage technologies giving the company

access to additional revenue streams.

MX OIL PLC

MX Oil plc ("MX Oil") holds an indirect investment in a Nigerian

oil and gas licence, OML 113, which includes the Aje Field. During

the year, the two wells in the Aje Field within block OML 113 have

continued to produce notwithstanding an interruption in production

at Aje 5 whilst some subsurface intervention was carried out.

As part of the oil production process, a significant quantity of

new data about the underlying reservoir and related geology has

been collected. Consequently, the partners in the licence

commissioned the preparation of an updated Competent Persons Report

("CPR") in order to take into account this new data and to provide

a more accurate update of the future potential of the field.

The revised CPR has now been completed which is an update to the

CPR prepared previously in July 2014 and incorporates all the

developments and new data generated by the project since that date.

The level of reserves reported in this latest CPR represents a

significant increase compared to the previous report and highlights

the future potential of the Aje Field.

Now that the company has received the updated CPR, work is

currently underway on modelling the potential for new oil wells in

both the Turonian and Cenomanian. Subject to the outcome of this

work, it expects to see further development drilling in 2019, with

a view to progressing to a full scale oil and gas integrated

project thereafter.

Also, during the year, shareholders approved the adoption of a

revised investing policy by the company to include interesting

opportunities in adjacent areas of oil services, energy, power and

related technologies.

METAL TIGER PLC

Metal Tiger plc ("Metal Tiger") which is listed on AIM, is

focused on investing in mineral projects with a precious metals and

strategic metals focus. During the year, the company has continued

to invest in MOD Resources Limited ("MOD") which is continuing to

make good progress on its high-grade copper and silver deposit

("T3") in Botswana. The company is looking forward to the results

of the next resource upgrade on this asset, the finalisation of the

definitive feasibility study and further exploration work in this

licence area.

The company has also progressed the IPO of its joint venture in

Thailand, however, the timing of this has been postponed pending

greater clarity of the Thailand Government's Mineral Management

Master Plan.

The company also raised GBP4.85 million by way of a private

placement and further funds through the exercise of warrants.

SHUMBA ENERGY LIMITED

During the year Shumba Energy Limited has continued to develop

its coal and energy interests in Botswana. It currently has three

advanced stage projects and one earlier stage alternative energy

project.

ARC MINERALS PLC (formerly ORTAC RESOURCES LIMITED)

The company has made significant progress during the year. It is

now focused on its two high potential African mining assets namely:

Casa Mining Limited ("CASA") a private company that holds

prospective gold mining and exploration licences in the Democratic

Republic of Congo; and Zamsort Limited ("Zamsort"), a company based

in Zambia with interests in copper and cobalt. The company now owns

some 90% of CASA having, during the year, made an offer to acquire

the shares that it did not already own. It has also increased its

ownership in Zamsort to 55%. During the period, the board of the

company has also been restructured.

POLEMOS PLC

Polemos plc is an investment company listed on AIM with a

specific focus on the natural resources sector. During the year,

Polemos plc invested in Oyster Oil and Gas Limited ("Oyster"), a

company already listed on the TSX-V. Oyster currently operates four

blocks in the Republic of Djibouti (100% interest) of which three

blocks are located onshore and one block offshore. It also operates

a 100% working interest in a large onshore block in the Republic of

Madagascar. In July 2017, Polemos raised around GBP500,000 for

working capital purposes and to fund the seeking of investment

opportunities.

In September 2017, Polemos announced the potential acquisition

of a cyber security business SecurLinx Corporation, a US based

cyber security company. As this would constitute a reverse

takeover, its shares weresuspended pending the publication of an

admission document. This transaction, however, could not be

completed and so the company came back to the market on 9 March

2018 as an AIM Rule 15 cash shell which effectively means that it

needs to secure an alternative reverse takeover transaction within

six months of this date.

PIRES INVESTMENTS PLC

Pires Investments plc is an investment company listed on AIM

with a specific focus on the natural resources sector. It is

currently seeking interesting investment opportunities. The

company's principal assets comprise cash and an investment in Eco

(Atlantic) Oil and Gas Limited which, since the year end, has

increased in value significantly. As a result, the company is now

well placed to pursue exciting investment opportunities.

CORA GOLD LIMITED

Cora Gold Limited is a West African focused gold exploration

company. The company's principal project is the Sanankoro gold

discovery in southern Mali. The company listed on AIM in October

2017. Since then it has commenced drilling at Sanankoro which has

yield some positive results. It has also commenced drilling at its

Tekeledougou project in southern Mali which has also produced some

good results. Consequently, the company's share price has increased

by some 40% since the year end.

I3 ENERGY PLC

I3 Energy Limited ("I3 Energy") owns a 100% operated interest in

the Liberator field, an oil discovery situated within Block 13/23d

of the North Sea, immediately adjacent to the Blake field and

situated 2 kilometres from Blake's producing drill centre. The

company was introduced to AIM in July 2017.During Q1 2018, the

companyraised additional funds and also announced that it was in

advanced discussions with various possible partners regarding a

potential joint venture relating to its 100% owned Liberator Oil

Field and its 30(th) Offshore Licencing Round application. In May

2018, it announced that it had been awarded its sole 30(th)

Offshore Licensing Round application target, Block 13/23c 123 km(2)

, on a 100% Interest basis.

Since the year end, I3 Energy's share price has increased by

around 300%. Paternoster has realised some significant gains on

this investment.

UNLISTED INVESTMENTS

CRADLE ARC MINERALS PLC (formerly ALECTO MINERALS PLC)

In December 2016, the company announced the proposed acquisition

of the Mowana Copper Mine in Botswana ("Mowana"). This acquisition

constituted a reverse takeover under the AIM Rules for Companies

and, as a result, the company's shares were suspended. Mowana is a

former producing copper mine that has already been brought back

into production. Unfortunately, the company was not able to

complete the acquisition of Mowana prior to the company being

delisted. However, since then, the company has worked hard to

complete the acquisition and raise the appropriate level of funding

such that it was able to come back to AIM in early 2018, albeit at

a lower price than originally envisaged. Since then, it has

announced a maiden JORC resource for Mowana and an increase in

production at the mine.

GLENWICK PLC

In February 2017, Paternoster subscribed for new ordinary shares

in Glenwick plc ("Glenwick"), principally to gain exposure to its

pre-IPO investment in I3 Energy plc. During the year, I3 Energy plc

("I3 Energy") was introduced to AIM and Paternoster received shares

in I3 Energy. At the same time, Glenwick was progressing the

acquisition of 100% of the share capital of Cora Gold Limited

("Cora Gold"). This transaction ultimately did not take place as

Cora Gold completed its own IPO instead. However, in order to

compensate Glenwick for costs incurred, it received a number of

Cora Gold shares which were then distributed to Glenwick

shareholders. Post period end, Glenwick is now in the process of

being wound up and, whilst the share prices of I3 Energy and Cora

Gold did not perform very well during 2017, post period end they

have both improved, with I3 Energy increasing very significantly.

As a result, Paternoster has made a very attractive return from its

investment in Glenwick.

ERIDGE CAPITAL LIMITED (formerly NEW WORLD OIL AND GAS PLC)

Eridge Capital Limited is an investment company with net assets

comprising cash and a convertible loan in Big Sofa Technologies plc

("Big Sofa"), a company listed on AIM. During the year, the company

changed its name and has migrated to the British Virgin Islands as

this was believed to be a more appropriate jurisdiction for an

unlisted investment company compared to remaining in Jersey. The

company is actively working on a revised strategy in order to

deliver a return to shareholders. Post period end, the Company's

loan in Big Sofa has been repaid and part of the loan has been

converted into shares.

ELEPHANT OIL LIMITED

Elephant Oil Limited, is an oil and gas exploration company

focused on West Africa, which holds a 100% interest in Block B,

onshore Benin, on the prolific West Africa Transform Margin. The

company continues to look at options to develop its asset and

presence in the region.

STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEARED 31 DECEMBER 2017

2017 2016

Note GBP GBP

--------------------------------------------------- ---- ----------- ---------

CONTINUING OPERATIONS:

Net (loss)/gain on investments 4 (811,467) 770,086

Investment income 5 11,934 15,090

--------------------------------------------------- ---- ----------- ---------

TOTAL INCOME (799,533) 785,176

Administrative expenses (336,152) (299,128)

(LOSS)/PROFIT BEFORE TAXATION (1,135,685) 486,048

Taxation 10 - -

--------------------------------------------------- ---- ----------- ---------

(LOSS)/PROFIT FOR THE YEAR AND TOTAL COMPREHENSIVE

INCOME (1,135,685) 486,048

--------------------------------------------------- ---- ----------- ---------

EARNINGS PER SHARE 11

Basic and fully diluted (loss)/earnings per

share (0.112p) 0.051p

--------------------------------------------------- ---- ----------- ---------

STATEMENT OF FINANCIAL POSITION

FOR THE YEARED 31 DECEMBER 2017

2017 2016

Note GBP GBP

----------------------------- ---- ----------- -----------

NON-CURRENT ASSETS

Investments held for trading 12 2,252,373 2,949,517

----------------------------- ---- ----------- -----------

2,252,373 2,949,517

----------------------------- ---- ----------- -----------

CURRENT ASSETS

Trade and other receivables 13 37,863 29,142

Cash and cash equivalents 14 211,795 648,165

----------------------------- ---- ----------- -----------

249,658 677,307

----------------------------- ---- ----------- -----------

TOTAL ASSETS 2,502,031 3,626,824

----------------------------- ---- ----------- -----------

CURRENT LIABILITIES

Trade and other payables 15 53,262 42,370

53,262 42,370

----------------------------- ---- ----------- -----------

NET ASSETS 2,448,769 3,584,454

----------------------------- ---- ----------- -----------

EQUITY

Share capital 16 4,269,546 4,269,546

Share premium account 16 3,191,257 3,191,257

Capital redemption reserve 17 27,000 27,000

Share option reserve 17 73,150 73,150

Retained losses (5,112,184) (3,976,499)

----------------------------- ---- ----------- -----------

TOTAL EQUITY 2,448,769 3,584,454

----------------------------- ---- ----------- -----------

STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 31 DECEMBER 2017

Other

reserves

Share (Note Retained Total

capital Share premium 18) losses equity

GBP GBP GBP GBP GBP

------------------------------ ---------- -------------- ---------- ------------ ------------

BALANCE AT 1 JANUARY

2016 4,175,796 3,135,007 119,407 (4,481,804) 2,948,406

Profit for the year and

total comprehensive income - - - 486,048 486,048

------------------------------ ---------- -------------- ---------- ------------ ------------

Share issue 93,750 56,250 - - 150,000

Transfer on cancellation

of options - - (19,257) 19,257 -

------------------------------ ---------- -------------- ---------- ------------ ------------

Transactions with owners 93,750 56,250 (19,257) 19,257 150,000

------------------------------ ---------- -------------- ---------- ------------ ------------

BALANCE AT 31 DECEMBER

2016 4,269,546 3,191,257 100,150 (3,976,499) 3,584,454

Loss for the year and

total comprehensive expense - - - (1,135,685) (1,135,685)

------------------------------ ---------- -------------- ---------- ------------ ------------

BALANCE AT 31 DECEMBER

2017 4,269,546 3,191,257 100,150 (5,112,184) 2,448,769

------------------------------ ---------- -------------- ---------- ------------ ------------

STATEMENT OF CASHFLOWS

FOR THE YEARED 31 DECEMBER 2017

2017 2016

Note GBP GBP

------------------------------------------ ---- ----------- ---------

CASH FLOWS FROM OPERATING ACTIVITIES

(Loss)/profit before tax - continuing

operations (1,135,685) 486,048

Share based payment expense - -

Investment income (11,934) (15,090)

Net losses/(gains) on investments 811,467 (770,086)

OPERATING CASH FLOWS BEFORE MOVEMENTS

IN WORKING CAPITAL (336,152) (299,128)

(Increase) in trade and other receivables (8,721) (16,296)

Increase/(decrease) in trade and

other payables 10,892 (44,299)

NET CASH USED BY OPERATING ACTIVITIES (333,981) (359,723)

------------------------------------------ ---- ----------- ---------

INVESTING ACTIVITIES

Purchase of investments (321,167) (527,351)

Disposal of investments 206,844 1,055,579

Investment income received 11,934 15,090

------------------------------------------ ---- ----------- ---------

NET CASH USED IN INVESTING ACTIVITIES (102,389) 543,318

------------------------------------------ ---- ----------- ---------

NET (DECREASE)/INCREASE IN CASH AND

CASH EQUIVALENTS (436,370) 183,595

Cash and cash equivalents at the

beginning of the year 648,165 464,570

CASH AND CASH EQUIVALENTS AT THE OF THE YEAR 14 211,795 648,165

------------------------------------------ ---- ----------- ---------

NOTES TO THE FINANCIAL STATEMENTS

1 FOR THE YEARED 31 DECEMBER 2017

GENERAL INFORMATION

Paternoster Resources plc is a public limited company incorporated

in the United Kingdom. The shares of the Company are listed

on the AIM stock exchange. The address of its registered

office is 30 Percy Street, London W1T 2DB. The Company's

principal activities are described in the Directors' Report.

2 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The principal accounting policies adopted in the preparation

of these financial statements are set out below. These policies

have been consistently applied throughout all periods presented

in the financial statements.

As in prior periods, the Company financial statements have

been prepared in accordance with International Financial

Reporting Standards (IFRS) as adopted by the European Union.

The financial statements have been prepared using the measurement

bases specified by IFRS for each type of asset, liability,

income and expense. The measurement bases are more fully

described in the accounting policies below.

The financial statements are presented in pounds sterling

(GBP) which is the functional currency of the Company. The

comparative figures are for the year ended 31 December 2016.

An overview of standards, amendments and interpretations

to IFRSs issued but not yet effective, and which have not

been adopted early by the Company are presented below under

'Statement of Compliance'.

GOING CONCERN

The directors have, at the time of approving the financial

statements, a reasonable expectation that the Company has

adequate resources to continue in existence for the foreseeable

future. Thus they continue to adopt the going concern basis

of accounting in preparing the financial statements.

CRITICAL ACCOUNTING ESTIMATES AND JUDGEMENTS

The preparation of financial statements in conformity with

IFRS requires the use of estimates and assumptions that affect

the reported amounts of assets and liabilities at the date

of the financial statements and the reported amounts of revenues

and expenses during the reporting year. These estimates and

assumptions are based upon management's knowledge and experience

of the amounts, events or actions. Actual results may differ

from such estimates.

Estimates and judgements are continually evaluated and are

based on historical experience and other factors, including

expectations of future events that are believed to be reasonable

under the circumstances.

In certain circumstances, where fair value cannot be readily

established, the Company is required to make judgements over

carrying value impairment, and evaluate the size of any impairment

required.

SHARE BASED PAYMENTS

The calculation of the fair value of equity-settled share

based awards and the resulting charge to the statement of

comprehensive income requires assumptions to be made regarding

future events and market conditions. These assumptions include

the future volatility of the Company's share price. These

assumptions are then applied to a recognised valuation model

in order to calculate the fair value of the awards.

FAIR VALUE OF FINANCIAL INSTRUMENTS

The Company holds investments that have been designated as

held for trading on initial recognition. Where practicable

the Company determines the fair value of these financial

instruments that are not quoted (Level 3), using the most

recent bid price at which a transaction has been carried

out. These techniques are significantly affected by certain

key assumptions, such as market liquidity. Other valuation

methodologies such as discounted cash flow analysis assess

estimates of future cash flows and it is important to recognise

that in that regard, the derived fair value estimates cannot

always be substantiated by comparison with independent markets

and, in many cases, may not be capable of being realised

immediately.

STATEMENT OF COMPLIANCE

The financial statements comply with IFRS as adopted by the

European Union. The following new and revised Standards and

Interpretations have been adopted in the current period by

the Company for the first time and do not have a material

impact on the group.

IFRS 12 Disclosures of interests in other entities

-

A number of new standards and amendments to standards and

interpretations have been issued but are not yet effective

and not early adopted. None of these are expected to have

a significant effect on the financial statements of the Company.

REVENUE RECOGNITION

INVESTMENT INCOME

Dividend income from financial assets at fair value through

profit or loss is recognised in the statement of comprehensive

income on an ex-dividend basis. Interest on fixed interest

debt securities is recognised using the effective interest

rate method. Bank deposit interest is recognised on an accruals

basis.

CURRENT TAX

Current taxation is the taxation currently payable on taxable

profit for the year.

Deferred income taxes are calculated using the liability

method on temporary differences. Deferred tax is generally

provided on the difference between the carrying amounts of

assets and liabilities and their tax bases. However, deferred

tax is not provided on the initial recognition of an asset

or liability unless the related transaction is a business

combination or affects tax or accounting profit. Temporary

differences include those associated with shares in subsidiaries

and joint ventures and are only not recognised if the Company

controls the reversal of the difference and it is not expected

for the foreseeable future. In addition, tax losses available

to be carried forward as well as other income tax credits

to the Company are assessed for recognition as deferred tax

assets.

DEFERRED TAX

Deferred tax liabilities are provided in full, with no discounting.

Deferred tax assets are recognised to the extent that it

is probable that the underlying deductible temporary differences

will be able to be offset against future taxable income.

Current and deferred tax assets and liabilities are calculated

at tax rates that are expected to apply to their respective

period of realisation, provided they are enacted or substantively

enacted at the statement of financial position date. Changes

in deferred tax assets or liabilities are recognised as a

component of tax expense in the income statement, except

where they relate to items that are charged or credited to

equity in which case the related deferred tax is also charged

or credited directly to equity.

SEGMENTAL REPORTING

The accounting policy for identifying segments is now based

on internal management reporting information that is regularly

reviewed by the chief operating decision maker, which is

identified as the Board of Directors.

In identifying its operating segments, management generally

follows the Company's service lines which represent the main

products and services provided by the Company. The Directors

believe that the Company's continuing investment operations

comprise one segment.

FINANCIAL ASSETS

The Company's financial assets comprise investments held

for trading, associated undertakings, cash and cash equivalents

and loans and receivables, and are recognised in the Company's

statement of financial position when the Company becomes

a party to the contractual provisions of the instrument.

INVESTMENTS HELD FOR TRADING

All investments determined upon initial recognition as held

at fair value through profit or loss were designated as investments

held for trading. Investment transactions are accounted for

on a trade date basis. Assets are de-recognised at the trade

date of the disposal. Assets are sold at their fair value,

which comprises the proceeds of sale less any transaction

cost. The fair value of the financial instruments in the

balance sheet is based on the quoted bid price at the balance

sheet date, with no deduction for any estimated future selling

cost. Unquoted investments are valued by the directors using

primary valuation techniques such as recent transactions,

last price and net asset value. Changes in the fair value

of investments held at fair value through profit or loss

and gains and losses on disposal are recognised in the consolidated

statement of comprehensive income as "Net gains on investments".

Investments are initially measured at fair value plus incidental

acquisition costs. Subsequently, they are measured at fair

value in accordance with IAS 39. This is either the bid price

or the last traded price, depending on the convention of

the exchange on which the investment is quoted.

ASSOCIATED UNDERTAKINGS

Associated undertakings are those entities in which the Company

has significant influence, but not control, over the financial

and operating policies. Investments that are held as part

of the Company's investment portfolio are carried in the

statement of financial position at fair value even though

the Company may have significant influence over those companies.

This treatment is permitted by IAS 28 "Investment in Associates",

which requires investments held by a company as a venture

capital provider to be excluded from its scope where those

investments are designated, upon initial recognition, as

at fair value through profit or loss and accounted for in

accordance with IAS 39, with changes in fair value recognised

in the statement of comprehensive income in the period of

the change. The Company has no interests in associates through

which it carries on its business.

CASH AND CASH EQUIVALENTS

Cash and cash equivalents comprise cash on hand and demand

deposits, together with other short-term, highly liquid investments

that are readily convertible into known amounts of cash and

which are subject to an insignificant risk of changes in

value.

LOANS AND RECEIVABLES

Loans and receivables from third parties are initially recognised

at fair value and subsequently carried at amortised cost

using the effective interest rate method.

IMPAIRMENT OF FINANCIAL ASSETS

Financial assets, other than those at FVTPL, are assessed

for indicators of impairment at each balance sheet date.

Financial assets are impaired where there is objective evidence

that, as a result of one or more events that occurred after

the initial recognition of the financial asset, the estimated

future cash flows of the investment have been impacted.

A provision for impairment is made when there is objective

evidence that, as a result of one or more events that occurred

after the initial recognition of the financial asset, the

estimated future cash flows have been affected. Impaired

debts are derecognised when they are assessed as uncollectible.

FINANCIAL LIABILITIES

The Company's financial liabilities comprise trade payables.

Financial liabilities are obligations to pay cash or other

financial assets and are recognised when the Company becomes

a party to the contractual provisions of the instruments.

TRADE PAYABLES

Trade payables are initially measured at fair value and are

subsequently measured at amortised cost, using the effective

interest rate method.

SHARE-BASED PAYMENTS

All share based payments are accounted for in accordance

with IFRS 2 - "Share-based payments". The Company issues

equity-settled share based payments in the form of share

options to certain directors and employees. Equity settled

share based payments are measured at fair value at the date

of grant. The fair value determined at the grant date of

equity-settled share based payments is expensed on a straight

line basis over the vesting period, based on the Company's

estimate of shares that will eventually vest.

Fair value is estimated using the Black-Scholes valuation

model. The expected life used in the model has been adjusted,

on the basis of management's best estimate for the effects

of non-transferability, exercise restrictions and behavioural

considerations. At each balance sheet date, the Company revises

its estimate of the number of equity instruments expected

to vest as a result of the effect of non-market based vesting

conditions. The impact of the revision of the original estimates,

if any, is recognised in profit or loss such that the cumulative

expense reflects the revised estimate, with a corresponding

adjustment to retained earnings.

DIVIDS

Dividend distributions payable to equity shareholders are

included in "current financial liabilities" when the dividends

are approved in general meeting prior to the statement of

financial position date.

EQUITY

Equity comprises the following:

* "Share capital" represents the nominal value of

equity shares.

* "Share premium" represents the excess over nominal

value of the fair value of consideration received for

equity shares, net of expenses of the share issue.

* "Capital redemption reserve" represents the nominal

value of shares repurchased or redeemed by the

Company.

* "Option reserve" represents the cumulative cost of

share based payments.

* "Retained losses" represents retained losses.

3 SEGMENTAL INFORMATION

The Company is organised around business class and the results

are reported to the Chief Operating Decision Maker according

to this class. There is one continuing class of business,

being the investment in the natural resources sector.

Given that there is only one continuing class of business,

operating within the UK no further segmental information

has been provided.

4 NET GAIN/(LOSS) ON INVESTMENTS

2017 2016

GBP GBP

---------------------------------------- --------- -------

Net realised gains/(losses) on disposal

of investments 92,473 468,239

Movement in fair value of investments (903,940) 301,847

Net (loss)/gain on investments (811,467) 770,086

----------------------------------------------------------- --------- -------

5 INVESTMENT INCOME

2017 2016

GBP GBP

---------------------------- ------ ------

Dividends from investments - 412

Deposit interest receivable 1,871 -

Other interest receivable 10,063 14,678

11,934 15,090

----------------------------------------------- ------ ------

6 PROFIT/(LOSS) FOR THE YEAR

2017 2016

GBP GBP

---------------------------------------------- -------- -------

Profit for the year has been arrived at

after charging:

Wages and salaries 131,329 141,227

----------------------------------------------------------------- -------- -------

AUDITOR'S REMUNERATION

During the year the Company obtained the following services

from the Company's auditor:

2017 2016

GBP GBP

---------------------------------------------- -------- -------

Fees payable to the Company's auditor

for the audit of the parent company and

the Company financial statements 12,000 12,000

Fees payable to the Company's auditor

and its associates for other services:

Other services relating to taxation 2,100 600

----------------------------------------------------------------- -------- -------

14,100 12,600

----------------------------------------------------------------- -------- -------

7 DIRECTORS' EMOLUMENTS

2017 2016

GBP GBP

------------------------------------- ------- -------

Aggregate emoluments 120,000 141,749

Social security costs 11,329 8,478

131,329 150,227

-------------------------------------------------------- ------- -------

Total Total

Name of director Fees Benefits 2017 2016

GBP GBP GBP GBP

----------------- ------ ---------- ------- -------

N Lee 84,000 - 84,000 72,000

A van Dyke 36,000 - 36,000 20,333

G Haselden - - - 8,500

M Lofgran - - - 40,916

120,00 - 120,00 141,749

------------------------------------ ------ ---------- ------- -------

8 EMPLOYEE INFORMATION

2017 2016

GBP GBP

-------------------------------------- ---------------------- ----------------------

Wages and salaries 120,000 141,749

Social security costs 11,329 8,478

131,329 150,227

--------------------------------------------------------- ---------------------- ----------------------

Average number of persons employed:

2017 2016

Number Number

-------------------------------------- ---------------------- ----------------------

Office and management 2 2

--------------------------------------------------------- ---------------------- ----------------------

COMPENSATION OF KEY MANAGEMENT PERSONNEL

There are no key management personnel other than the Directors

of the Company.

9 SHARE BASED PAYMENTS

EQUITY-SETTLED SHARE OPTION SCHEME

The Company operates share-based payment arrangements to

remunerate directors and key employees in the form of a

share option scheme. Equity-settled share-based payments

are measured at fair value (excluding the effect of non-market

based vesting conditions) at the date of grant. The fair

value determined at the grant date of the equity-settled

share-based payments is expensed on a straight-line basis

over the vesting period, based on the Company's estimate

of shares that will eventually vest and adjusted for the

effect of non-market based vesting conditions.

On 26 October 2011, Nicholas Lee was granted options to

subscribe for 28,000,000 new ordinary shares in the Company

at an exercise price of 0.32p per share. The options are

exercisable for a period of ten years from the date of grant,

with one third becoming exercisable on the first, second

and third anniversaries of the date of grant respectively.

On 13 March 2012, Nicholas Lee was granted options to subscribe

for 14,000,000 new ordinary shares in the Company at an

exercise price of 0.48p per share. The options are exercisable

for a period of ten years from the date of grant, with one

third becoming exercisable on the first, second and third

anniversaries of the date of grant respectively. The fair

value of these options was determined using the Black-Scholes

option pricing model and was GBP0.22p per option.

On 17 September 2014, Matt Lofgran was granted options to

subscribe for 20,000,000 new ordinary shares in the Company

at an exercise price of 0.26p per share. These options were

cancelled in 2016.

All remaining options were cancelled subsequent to the year

end.

EQUITY-SETTLED SHARE OPTION SCHEME

The significant inputs to the model in respect of the options

granted in 2014, 2012 and 2011 were as follows:

2014 2012 2011

Grant date share

price 0.26p 0.48p 0.32p

Exercise share price 0.26p 0.48p 0.32p

No. of share options 20,000,000 14,000,000 28,000,000

Risk free rate 2.5% 3% 3%

Expected volatility 50% 40% 40%

Option life 10 years 10 years 10 years

Calculated fair value

per share 0.14p 0.22p 0.15p

The total share-based payment expense recognised in the

income statement for the year ended 31 December 2017 in

respect of the share options granted was GBPNil (2016: GBPNil).

Number Number

of Granted Exercised of Exercise Vesting Expiry

options in the in the options price Date date

at year year Cancelled at

1 Jan in the 31 Dec

2017 year 2017

------------ ------------ ----------- ------------ ---------- ------------- ---------- -------------

9,333,334 - - - 9,333,334 0.32p 26.10.2012 26.10.2021

4,666,667 - - - 4,666,667 0.48p 13.03.2013 13.03.2022

9,333,333 - - - 9,333,333 0.32p 26.10.2013 26.10.2021

4,666,667 - - - 4,666,667 0.48p 13.03.2014 13.03.2022

9,333,333 - - - 9,333,333 0.32p 26.10.2014 26.10.2021

4,666,667 - - - 4,666,666 0.48p 13.03.2015 13.03.2022

42,000,000 - - - 42,000,000 0.37p

------------ ------------ ----------- ------------ ---------- ------------- ---------- -------------

10 INCOME TAX EXPENSE

2017 2016

GBP GBP

------------------------------------------------------ ------------ ---------

Current tax - continuing operations - -

------------------------------------------------------ ------------ ---------

The tax on the Company's profit before tax differs from

the theoretical amount that would arise using the weighted

average rate applicable to profits of the Consolidated entities

as follows:

2017 2016

GBP GBP

------------------------------------------------------ ------------ ---------

Profit/(loss) before tax from continuing

operations (1,135,685) 486,048

-------------------------------------------------------------------------- ------------ ---------

Profit/(loss) before tax multiplied by

rate of corporation tax in the UK of 19.25%

(2016: 20%) (218,619) 97,210

Expenses not deductible for tax purposes 2,728 3,034

Offset against tax losses brought forward - (100,244)

Unrelieved tax losses carried forward 215,891 -

Total tax - -

-------------------------------------------------------------------------- ------------ ---------

Unrelieved tax losses of GBP4,485,000 (2016: GBP3,366,000)

remain available to offset against future taxable trading

profits. No deferred tax asset has been recognised in respect

of the losses as recoverability is uncertain.

11 EARNINGS PER SHARE

The basic earnings per share is based on the loss for the

year divided by the weighted average number of shares in

issue during the year. The weighted average number of ordinary

shares for the year assumes that all shares have been included

in the computation based on the weighted average number

of days since issue.

2017 2016

GBP GBP

------------------------------------------------ ------------- -----------

Profit/(loss) attributable to equity holders

of the Company:

Profit/(loss) from continuing operations (1,135,685) 486,048

-------------------------------------------------------------------- ------------- -----------

Profit/(loss) for the year attributable

to equity holders of the Company (1,135,685) 486,048

-------------------------------------------------------------------- ------------- -----------

Weighted average number of ordinary shares

in issue for basic and fully diluted earnings* 1,016,607,956 959,230,907

EARNINGS/(LOSS) PER SHARE

BASIC AND FULLY DILUTED:

- Basic (loss)/earnings per share from

continuing and total operations (0.112p) 0.051p

- Fully diluted (loss)/earnings per share

from continuing and total operations (0.112p) 0.051p

-------------------------------------------------------------------- ------------- -----------

*No adjustment to earnings per share for fully diluted earnings

has been made as the exercise of options would be anti-dilutive.

12 INVESTMENTS HELD FOR TRADING

2017 2016

GBP GBP

------------------------------------------- --------- -----------

At 1 January - fair value 2,949,517 2,557,659

Acquisitions 321,167 677,351

Disposal proceeds (206,844) (1,055,579)

Net gain/(loss) on disposal of investments 92,473 468,239

Movement in fair value of investments (903,940) 301,847

--------------------------------------------------------------- --------- -----------

.At 31 December - fair value 2,252,373 2,949,517

--------------------------------------------------------------- --------- -----------

Categorised as:

Level 1 - Quoted investments 1,811,625 2,557,368

Level 2 - Unquoted investments 263,513 -

Level 3 - Unquoted investments 177,235 392,149

--------------------------------------------------------------- --------- -----------

2,252,373 2,949,517

--------------------------------------------------------------- --------- -----------

The table of investments sets out the fair value measurements

using the IFRS 7 fair value hierarchy. Categorisation within

the hierarchy has been determined on the basis of the lowest

level of input that is significant to the fair value measurement

of the relevant asset as follows:

Level 1 - valued using quoted prices in active markets for

identical assets.

Level 2 - valued by reference to valuation techniques using

observable inputs other than quoted prices included within

Level 1.

Level 3 - valued by reference to valuation techniques using

inputs that are not based on observable market data.

The valuation techniques used by the company are explained

in the accounting policy note, "Investments held for trading".

LEVEL 2 FINANCIAL ASSETS

Level 2 financial assets comprise a convertible loan note

valued by reference to its nominal value, and two equity

investments whose shares were suspended at the year-end

which have been valued at the bid price of the shares on

lifting of the suspension subsequent to the year-end.

LEVEL 3 FINANCIAL ASSETS

Reconciliation of Level 3 fair value measurement of financial

assets

2017 2016

GBP GBP

--------------------------------------- -------------- --------------

Brought forward 392,149 947,221

Reclassified from Level 1 - 293,295

Reclassified to Level 1 - (390,320)

Disposal proceeds - (170,698)

Loss on disposals - (154,095)

Movement in fair value (214,914) (133,254)

--------------------------------------- -------------- --------------

Carried forward 177,235 392,149

--------------------------------------- -------------- --------------

Level 3 valuation techniques used by the Company are explained

on page 22 (Fair value of financial instruments)

In line with the investment strategy adopted by the Company,

Nicholas Lee is on the boards of the following investee

companies:

%age holding

2017 2016

--------------------------------------- -------------- --------------

Pires Investments plc 24.8% 24.8%

MX Oil plc 0.9% 0.9%

Eridge Capital Limited 7.7% 7.7%

--------------------------------------- -------------- --------------

13 TRADE AND OTHER RECEIVABLES

2017 2016

GBP GBP

------------------------------- ------ ------

Other receivables 20,816 20,894

Prepayments and accrued income 17,047 8,248

--------------------------------------------------- ------ ------

37,863 29,142

--------------------------------------------------- ------ ------

The Directors consider that the carrying amount of other

receivables is approximately equal to their fair value.

14 CASH AND CASH EQUIVALENTS

2017 2016

GBP GBP

-------------------------- ------- -------

Cash and cash equivalents 211,795 648,165

---------------------------------------------- ------- -------

The Directors consider the carrying amount of cash and cash

equivalents approximates to their fair value.

15 TRADE AND OTHER PAYABLES

2017 2016

GBP GBP

----------------- ------ ------

Trade payables 22,067 16,920

Accrued expenses 31,195 25,450

-------------------------------------- ------ ------

53,262 42,370

-------------------------------------- ------ ------

The Directors consider that the carrying amount of trade

payables approximates to their fair value.

16 SHARE CAPITAL

Number of shares Share capital Share

Deferred Ordinary Deferred Ordinary premium

GBP GBP GBP

-------------------- ------------ ------------- ----------- ---------- ---------

ISSUED AND FULLY

PAID:

At 1 January 2016:

Deferred shares

of 9.9p each 32,857,956 3,252,938

Ordinary shares

of 0.1p each 922,857,956 922,858 3,135,007

---------------------------------------- ------------ ------------- ----------- ---------- ---------

At 1 January 2016 32,857,956 922,857,956 3,252,938 922,858 3,135,007

Issue of shares 93,750,000 93,750 56,250

---------------------------------------- ------------ ------------- ----------- ---------- ---------

At 31 December 2016

and 2017 32,857,956 1,016,607,956 3,252,938 1,016,608 3,191,257

---------------------------------------- ------------ ------------- ----------- ---------- ---------

17 OTHER RESERVES

Capital Share

redemption option Total

reserve reserve Other reserves

GBP GBP GBP

--------------------------------- --------------- --------- ----------------

Balance at 1 January 2016 27,000 92,407 119,407

Transfer to Profit and loss on

cancellation of options - (19,257) (19,257)

----------------------------------------------------- --------------- --------- ----------------

Balance at 31 December 2016 and

2017 27,000 73,150 100,150

----------------------------------------------------- --------------- --------- ----------------

18 RISK MANAGEMENT OBJECTIVES AND POLICIES

The Company is exposed to a variety of financial risks which

result from both its operating and investing activities.

The Company's risk management is coordinated by the Board

of Directors and focuses on actively securing the Company's

short to medium term cash flows by minimising the exposure

to financial markets.

The main risks the Company is exposed to through its financial

instruments are credit risk, foreign currency risk, liquidity

risk and market price risk.

CAPITAL RISK MANAGEMENT

The Company's objectives when managing capital are:

* to safeguard the Company's ability to continue as a

going concern, so that it continues to provide

returns and benefits for shareholders;

* to support the Company's growth; and

* to provide capital for the purpose of strengthening

the Company's risk management capability.

The Company actively and regularly reviews and manages its

capital structure to ensure an optimal capital structure

and equity holder returns, taking into consideration the

future capital requirements of the Company and capital efficiency,

prevailing and projected profitability, projected operating

cash flows, projected capital expenditures and projected

strategic investment opportunities. Management regards total

equity as capital and reserves, for capital management purposes.

The Company is not subject to externally imposed capital

requirements.

CREDIT RISK

The Company's financial instruments that are subject to

credit risk are cash and cash equivalents and loans and

receivables. The credit risk for cash and cash equivalents

is considered negligible since the counterparties are reputable

financial institutions. The credit risk for loans and receivables

is mainly in respect of short term loans, made on market

terms, which are monitored regularly by the Board.

The Company's maximum exposure to credit risk is GBP232,611

(2016: GBP728,165) comprising cash and cash equivalents

and loans and receivables.

The ageing profile of trade and other receivables was:

2017 2016

Total book Total book

value value

GBP GBP

----------------------------------------- -------------- --------------

Current 20,816 20,894

Overdue for less than one year - -

20,816 20,894

------------------------------------------------------------- -------------- --------------

18 RISK MANAGEMENT OBJECTIVES AND POLICIES continued

LIQUIDITY RISK

Liquidity risk arises from the possibility that the Company

might encounter difficulty in settling its debts or otherwise

meeting its obligations related to financial liabilities.

The Company manages this risk through maintaining a positive

cash balance and controlling expenses and commitments. The

Directors are confident that adequate resources exist to

finance current operations.

FOREIGN CURRENCY RISK

The Directors do not consider the Company has significant

exposure to movements in foreign currency in respect of

its monetary assets.

MARKET PRICE RISK

The Company's exposure to market price risk mainly arises

from potential movements in the fair value of its investments.

The Company manages this price risk within its long-term

investment strategy to manage a diversified exposure to

the market. If each of the Company's equity investments

were to experience a rise or fall of 10% in their fair value,

this would result in the Company's net asset value and statement

of comprehensive income increasing or decreasing by GBP225,000

(2016: GBP295,000).

19 FINANCIAL INSTRUMENTS

The Company uses financial instruments, other than derivatives,

comprising cash to provide funding for the Company's operations.

CATEGORIES OF FINANCIAL INSTRUMENTS

The IAS 39 categories of financial asset included in the

statement of financial position and the headings in which

they are included are as follows:

2017 2016

GBP GBP

----------------------------------------------- ---------- ----------

FINANCIAL ASSETS:

Cash and cash equivalents 211,795 648,165

Loans and receivables 20,816 20,894

Investments held for trading 2,252,373 2,949,517

------------------------------------------------------------------- ---------- ----------

FINANCIAL LIABILITIES AT AMORTISED COST:

The IAS 39 categories of financial liabilities included

in the statement of financial position and the headings

in which they are included are as follows:

2017 2016

GBP GBP

----------------------------------------------- ---------- ----------

Trade and other payables 22,067 16,920

------------------------------------------------------------------- ---------- ----------

20 RELATED PARTY TRANSACTIONS

The compensation payable to Key Management personnel comprised

GBP120,000 (2016: GBP141,749) paid by the Company to the

Directors in respect of services to the Company. Full details

of the compensation for each Director are provided in Note

7.

Nicholas Lee's directorships of companies in which Paternoster

has an investment are detailed in Note 12.

21 Contingent LIABILITIES AND CAPITAL COMMITMENTS

There were no contingent liabilities or capital commitments

at 31 December 2017 or 31 December 2016.

22 POST YEAR END EVENTS

On 18 January 2018, the Company announced that it had entered

into an arrangement with RiverFort Global Capital Ltd ("RiverFort"),

the specialist provider of capital to junior companies whereby

Paternoster would have the opportunity to invest in transactions

arranged by RiverFort alongside other co-investors. At the

same time, the Company raised GBP850,000 from both private

and institutional investors as a result of a placing of

772,727,270 new ordinary shares at 0.11p per share.

On 20 April 2018, the Board announced that it had agreed

to invest around GBP250,000 in a portfolio of income-yielding

investments arranged by RiverFort which comprise investments

in the form of both senior and convertible debt.

On 8 June 2018, Paternoster held a general meeting both

to increase its share allotment authorities and to approve

the entering into of an investment adviser agreement with

RiverFort. All resolutions were passed.

23 ULTIMATE CONTROLLING PARTY

The Directors do not consider there to be a single ultimate

controlling party.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR BRGDLRUDBGIU

(END) Dow Jones Newswires

June 26, 2018 02:00 ET (06:00 GMT)

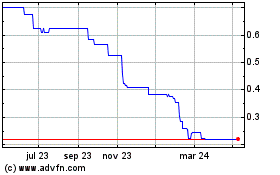

Riverfort Global Opportu... (LSE:RGO)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

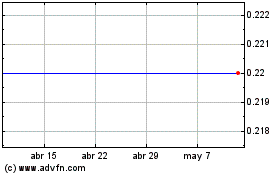

Riverfort Global Opportu... (LSE:RGO)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024