GE's Profit Falls as Power Division Remains a Drag

20 Julio 2018 - 6:14AM

Noticias Dow Jones

By Thomas Gryta

General Electric Co.'s (GE) second-quarter profit dropped 30% as

the company's power division continued to offset growth in other

major units.

While the conglomerate backed its 2018 profit goal, it said free

cash flow would be at the low end of its previous estimate. The

industrial conglomerate's adjusted earnings of 19 cents a share

beat Wall Street expectations of 17 cents a share for the period,

according to Thomson Reuters. Revenue of $30.1 billion also topped

consensus projections of $29.3 billion.

GE recently unveiled its road map for restructuring under new

Chief Executive John Flannery, a series of moves to significantly

dismantle the conglomerate without a complete breakup of the

onetime bellwether. Over several years, GE separated its Healthcare

unit into a separate company and exited its majority holding in

oil-and-gas firm Baker Hughes. GE said Friday that its plan to sell

$20 billion in assets is "substantially complete."

"We saw continued strength across many of our segments,

especially in Aviation and Healthcare," Mr. Flannery said in

prepared remarks, noting that GE cut costs in its industrial

divisions by $1.1 billion in the first half of 2018.

"We expect the power market to remain challenging, and we

continue our focus on operational improvement," he said.

By Thomas Gryta at thomas.gryta@wsj.com

(END) Dow Jones Newswires

July 20, 2018 06:59 ET (10:59 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

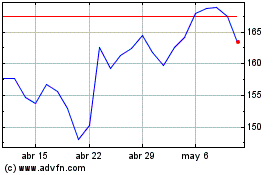

GE Aerospace (NYSE:GE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

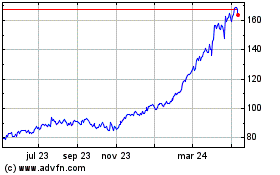

GE Aerospace (NYSE:GE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024