By Becky Yerak

Gibson Brands Inc. pushed back at criticism of a plan to hand

ownership to a bondholder group led by KKR & Co., with the

bankrupt guitar maker saying none of 58 other parties it has

contacted have made a better offer.

Gibson, founded in 1894, sought protection from creditors in May

with a reorganization plan allowing senior secured bondholders led

by KKR to convert their debt into equity.

Blackstone Group LP's lending arm, GSO Capital Partners LP, and

other Gibson creditors, including electronics company Koninklijke

Philips NV, have criticized what they say is a weak effort by the

Nashville, Tenn.-based company to find a better offer. GSO, whose

claims include $77 million owed on a secured term loan, and

unsecured creditors have also questioned consulting and management

contracts proposed for two top executives.

In a filing Monday in U.S. Bankruptcy Court in Wilmington, Del.,

Gibson said it "extensively marketed" itself for more than six

months before its chapter 11 filing to potential strategic and

financial investors that it thought might be interested in a

refinancing or an equity deal.

"The market responded with only one 'bid'"-- that of the KKR

group, Gibson said.

No one else, Gibson said, was willing to make an investment at

least equal to the approximately $500 million in secured debt on

the balance sheet.

Gibson said it contacted 58 parties about potentially buying the

company or investing in it. Of those, 27 signed nondisclosure

agreements. Two made nonbinding "expressions of interest," one

before the bankruptcy and another during bankruptcy.

Gibson said the party expressing interest before the bankruptcy

hasn't been in touch recently and hasn't accessed the data room

since late June.

Gibson also said, since filing for bankruptcy, it has continued

to provide data-room access for interested parties but that it

still hasn't received "any proposal for a viable alternative

transaction."

Gibson also entered bankruptcy with KKR and other holders of its

$375 million in senior secured notes overwhelmingly agreeing to

provide up to $135 million in financing to the business to help it

get through chapter 11 proceedings.

In a filing earlier this week, GSO said it was willing to

provide additional financing to give Gibson more time to consider

alternative offers. GSO said it, too, earlier offered financing to

help Gibson get through bankruptcy -- and at terms more favorable

and that would have given the company more leeway to market itself

in chapter 11.

Gibson, however, says GSO isn't the white knight that it is

portraying itself as.

Gibson said restructuring talks with bondholders, now positioned

to own the company, accelerated "only after GSO made clear it would

not provide" the company with additional waivers past April 2018

for defaults on its term loan agreement.

Gibson also said GSO's earlier offer for financing to help it

get through bankruptcy hinged on an additional $10 million paydown

of an outstanding debt before the bankruptcy -- money Gibson didn't

have.

So GSO's arguments that Gibson failed to adequately market

itself before bankruptcy "ring hollow in the face of the facts that

GSO accelerated" Gibson's restructuring through "repeated demands

for millions of dollars."

"Similarly hollow," Gibson said, is GSO's "new expressions of

'willingness' to 'help' finance" a sales process. Gibson said GSO

"is the subject of an ongoing investigation regarding its

pre-bankruptcy conduct" with the company.

A representative for GSO had no immediate comment.

Also, Gibson said, GSO hasn't explained how its new financing

would address current senior secured debt -- namely $57 million of

bankruptcy financing, which could rise to about $135 million if

GSO's term loan is refinanced, as well as the $383 million of

principal and interest owed to secured bondholders.

Gibson wonders, for example: Is GSO offering to refinance those

debts in full while a "hypothetical bidding process is run and take

the risk of a failed auction?"

"GSO does not provide any details," Gibson said.

Gibson also said Philips' claim that it is owed $57.2 million is

"substantially inflated."

Gibson's chief executive and president, who are also board

members, would receive management or consulting payments totaling

almost $5.5 million under the restructuring plan, as well as

warrants exercisable into a combined 4.4% of the new equity in the

business.

Gibson said the two executives bought the company in 1986 and

"have a wealth of" operational, customer, employee and industry

knowledge that the secured bondholders will "seek to tap as the new

owners of the business."

Write to Becky Yerak at becky.yerak@wsj.com

(END) Dow Jones Newswires

July 24, 2018 17:15 ET (21:15 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

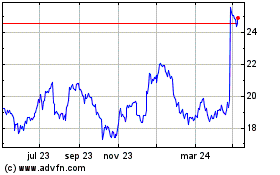

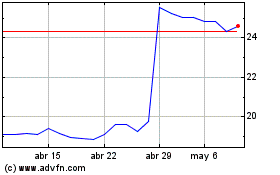

Koninklijke Philips NV (EU:PHIA)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Koninklijke Philips NV (EU:PHIA)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024