BNP Paribas to Pay $90 Million Fine for Dollar Benchmark Manipulation

29 Agosto 2018 - 4:11PM

Noticias Dow Jones

By Robert Barba

BNP Paribas SA agreed to pay a $90 million fine to settle

charges that its traders tried to manipulate a global interest rate

benchmark, making it the seventh bank punished by regulators for

the financial crisis-era scheme.

The Commodity Futures Trading Commission said that between May

2007 and August 2012, multiple traders and supervisors of the

bank's securities unit attempted to manipulate the U.S. Dollar

International Swaps and Derivatives Association Fix, a benchmark

referenced in a range of interest-rate products. It did so, the

CFTC said, to benefit the bank's derivatives positions in

instruments such as cash-settled options on interest rate swaps and

certain exotic structured products.

The regulator said BNP Paribas traders attempted to manipulate

the benchmark by bidding, offering and executing transactions at 11

a.m. Eastern Time, when the reference rates are captured and sent

to submitting banks.

A spokeswoman for BNP Paribas said in an email that the firm has

accepted the fine and is pleased to resolve the investigation. She

added that the bank has since strengthened its compliance and

controls.

BNP Paribas follows banks like JPMorgan Chase, Barclays PLC,

Citigroup Inc., Goldman Sachs Group Inc., Deutsche Bank Securities

Inc., and Royal Bank of Scotland Group PLC in settling similar

benchmark manipulation cases .

"This matter, the seventh enforcement action relating to the USD

ISDAFIX benchmark, further demonstrates that the CFTC will continue

to be vigilant and aggressive in protecting the integrity of our

markets," said James McDonald, CFTC's enforcement director, in

prepared remarks.

Write to Robert Barba at Robert.Barba@wsj.com

(END) Dow Jones Newswires

August 29, 2018 16:56 ET (20:56 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

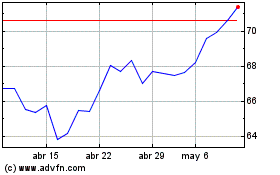

BNP Paribas (EU:BNP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

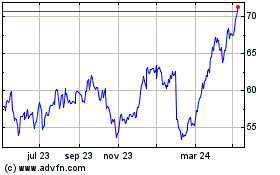

BNP Paribas (EU:BNP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024