TIDMPNS

RNS Number : 9019B

Panther Securities PLC

26 September 2018

The information contained within this announcement is deemed by

the

Company to constitute inside information as stipulated under the

Market

Abuse Regulations (EU) No. 596/2014 ("MAR"). With the

publication of

this announcement via a Regulatory Information Service, this

inside

information is now considered to be in the public domain.

PANTHER SECURITIES PLC

(the "Company" or the "Group")

Interim results

Panther Securities PLC has today announced its interim results

for the six months ended 30 June 2018.

For further information:

Panther Securities plc Tel: 01707 667 300

Andrew Perloff/Simon Peters

Allenby Capital Limited (NOMAD and Joint Broker) Tel: 020 3328 5656

David Worlidge/ Alex Brearley

CHAIRMAN'S STATEMENT

It gives me great pleasure to report our results for the six

months ended 30 June 2018 which show a profit of GBP11,193,000

before tax which is our record interim high compared to

GBP6,731,000 for the equivalent six-month period to 30 June 2017

(which was our previous record). The figures for this period were

only slightly influenced by a small reduction of GBP1,259,000 in

our swap liability which now also includes a new liability for an

additional swap on GBP25,000,000 from 2021 at a much reduced rate

to that which we are currently paying, which expires in 2021.

Thus, most of our profits are derived from our basic property

investment and disposals where the Group realised a number of

prices far in excess of the previous independently valued

figures.

Our rents receivable during this period amounted to GBP7,069,000

compared to GBP6,377,000 in the comparative period ended 30 June

2017. This was mainly due to our acquisition of shopping centres in

Hinckley, Leicestershire and Springburn, a suburb of Glasgow. These

properties have higher than usual running costs which our team are

addressing and which we anticipate in due course will produce

improved net returns.

Disposals

There has been an unusual amount of activity with regard to

sales in this period. With some of the larger sales we have kept

shareholders abreast with appropriate Stock Exchange announcements,

mentioned in more detail later.

Margate

In January 2018 we sold 34 Marine Terrace, Margate for

GBP450,000, which had only just been revalued at GBP250,000, to a

special purchaser for a loss of rental income of only GBP16,000

p.a.

In February 2018, the following three properties, detailed

below, were sold at auction. Stonehouse, Gloucester, 19 Queen

Street, Ramsgate and High Street, Dudley.

Stonehouse - Gloucester

MRG, a former subsidiary, occupied our freehold office at The

Mill at Stonehouse, Gloucester. This former mill of 15,000 sq ft

had been let to MRG Systems at GBP93,000 p.a. The letting assisted

them in being independent before the employee and management buyout

last year. We received GBP900,000 which shows a very good profit on

original cost.

Ramsgate

19 Queen Street, Ramsgate a small freehold shop investment

producing rental income of GBP12,000 p.a. sold for GBP147,000

resulting in a small profit on book value.

Dudley

High Street, Dudley a large freehold vacant shop in very poor

condition held for development realised GBP276,000 which was

considerably in excess of its previously revalued book value.

Stockport

In March 2018 we completed the sale of Grove House, Stockport, a

vacant freehold shop and office building which we had held for many

years during most of which time it had produced a good rental

return for us. Despite the building being in good condition, a

developer purchased it to convert to residential units. We received

GBP900,000 which was well above the previously revalued book

figure.

Croydon

In March 2018 we finally completed the sale of the vacant upper

parts of 49/61 High Street, Croydon for GBP800,000, just above its

book value, which leaves us with the ground floor let to

Sainsbury's PLC and Princess Alice Hospice and produces circa

GBP108,000 p.a.

Material Disposals

Post this period accounting date we have concluded three

substantial sales, two of which were contracted for sale before 30

June 2018 and therefore profit is included, and their disposal

recognised in this period.

The larger sales were of our sites in (1) Holloway Head,

Birmingham, (2) St Nicholas House, a freehold shop and office

investment in Sutton, Surrey, sold jointly with our major tenant,

the Crown Agents, and (3) the former Wimbledon Studios, a large

freehold industrial/studio building in South Wimbledon/Merton.

I give a brief synopsis below.

Holloway Head, Birmingham

The completion of the sale of the Group's development site in

Holloway Head, Birmingham was finally completed on 31 August

2018.

A payment of GBP850,000 was received last year but due to the

uncertain nature of the transaction we did not accrue full

proceeds. GBP400,000 additional deposit was received in May 2018, a

third deposit of GBP500,000 was received after the period end and

finally we received GBP9,520,000 on 31 August 2018 giving us a

total received for the site of GBP11,270,000.

As it has now completed, profit on this transaction has been

brought into the Interim 2018 accounts as the sale was

unconditionally contracted before 30 June 2018.

Sale of St Nicholas House, Sutton

In April 2018 we exchanged contracts to sell the joint

freehold/long leasehold interest in St Nicholas House which, after

a few delays, was completed on 7 September 2018. Surrey Motors

Limited, acquired in 1987, is a wholly owned subsidiary of Panther

Securities PLC. Its sole asset was the freehold of St Nicholas

House, Sutton, which is a building of approximately 140,000 sq ft

gross accommodation. The basement and ground floor are used for

retail/ancillary storage and parking. The nine upper floors are

offices.

The building was originally constructed in the early 1960s with

the offices purpose built for the Crown Agents, (the main tenants

in occupation when we purchased Surrey Motors Ltd) a

quasi-government organisation, which originally took a 99-year

lease at a ground rent which had proportionate rental reviews every

21 years. This lease had an option to extend for 25 years (on the

same terms), but ignoring the option, had approximately 44 years to

run at a low ground rent and thus our tenants lease had a

significant value.

Early last year, the Crown Agents approached the Company

indicating that it wanted to dispose of its interest in the

building and it was agreed that the Company and the Crown Agents

should offer for sale their joint interests which would enable the

freehold of the site to be offered with vacant possession at an

early date, giving it development possibilities and increased joint

"marriage" value.

After a marketing campaign by the joint agents, Carter Jonas, a

number of offers were received, and the Company exchanged contracts

to sell the joint freehold/long leasehold interest to Saint

Nicholas House Ltd, a newly formed company, with a completion due

three months after exchange. There is a possible small overage, but

this is not currently anticipated to be material. The total

consideration receivable by both the Group and the Crown Agents for

the joint freehold/long leasehold interest in St. Nicholas House is

GBP12,750,000. The Group's share of the gross sale price proceeds

amounts to approximately GBP7,837,500, compared to a December 2017

revalued book figure of GBP5,540,000.

Following completion, the Company no longer receives the

GBP320,000 p.a. rental income on this investment property.

The sales of Holloway Head, Birmingham and St Nicholas House,

Sutton has resulted in a significant increase in our trade and

other receivables balance to GBP21,817,000 compared to GBP3,677,000

at 30 June 2017.

Wimbledon Studios

In July 2018 we simultaneously exchanged and completed on the

sale of our freehold investment in Wimbledon Studios for

GBP18,800,000. This was sold to a nominee of the Scottish Widows

Property Authorised Contractual Scheme.

The studios were built in 1970 and provide internal

accommodation of circa 140,000 square foot over circa 4.5 acres. It

has a long history as studios and many household name productions

took place there, including 'The Bill' for over 30 years, 'The Iron

Lady', 'I'm a celebrity...get me out of here', and several popular

music videos. This property had a book value of GBP13,550,000 as at

31 December 2017 and was originally purchased vacant, including

stock, equipment and fixed assets for circa GBP4,750,000 (plus

stamp duty) in September 2010.

Being an entrepreneurial and opportunistic organisation, after

buying the vacant property the Group initially attempted to run its

own film studio in this property but unfortunately this was not a

successful venture.

The tenants, Marjan Television Network Ltd, took occupation in

November 2014 and pay rent of GBP1,050,000 p.a. They had spent a

significant amount on internal works bringing it up to a state of

the art, modern functioning television and film studio.

This was a very interesting and ultimately rewarding set of

transactions. These half year accounts recognise a large valuation

increase on this property, but not the full proceeds achieved in

July.

The final year's accounts will include a further GBP2,900,000

realised profit on this sale.

Progress Report

Swindon

We have literally gone back to the drawing board and asked our

architects to redesign the scheme to produce a building of only

seven or eight storeys in height with lower building costs. The

Council has also agreed in principle to adjust some of their

requirements so that the smaller scheme with only 50/60 flats plus

4 or 5 retail/restaurant units on the ground floor will not only be

an attractive visual asset to the community but also now hopefully

viable.

Wickford

All planning details were agreed after a delayed response from

the Council. However, due to the long delays the two adjoining

owners/neighbours who were originally part of the scheme will no

longer be partnering with us. In one case they were not able to

arrange a move to an alternative site and the other gave a long

lease to their occupier rather than risk losing their income. A new

application is thus in hand. Eventually those seeking nice new

homes in the Wickford area may have a few more houses to choose

from!!

Maldon

We have agreed to let the major buildings on the site on a

short-term lease at GBP650,000 p.a. We are currently carrying out

some roof works to bring it up to the tenant's requirements. We

will still have some space available which may yield a further

GBP100,000 p.a. rental. This was previously let for GBP500,000 and

we took a GBP1,950,000 surrender in March 2017.

Business Rates

Problems with the high street premises continue. These are

almost entirely due to government greed and failure to act sensibly

in good time. As well as central government/bureaucratic financial

incompetence which we all expect, I would have thought that the

political implications for the government which shows the dreadful

state of the high street are immense as on every high street other

than within the M25, with its numerous vacant or closing down

stores is a billboard advertising the failure of government

policies. The high street should be the beating heart of most

communities and if its vibrancy improves most of its area residents

'happiness factor' improves.

Finance

Shortly after the period end we paid down our revolving facility

loan of GBP15,000,000, which can be redrawn.

At the time of writing these accounts we had circa GBP26,000,000

in the bank. We still have written into our facility agreement a

possible GBP10,000,000 loan extension which requires credit

approval.

Some of the above funds will be utilised to pay corporation tax,

VAT and for other working capital purposes. Even after these costs

and cash requirements we will still have circa GBP45,000,000 funds

available for investment opportunities.

One of our current swaps ends in 2021. We entered into a further

swap on GBP25,000,000 nominal value, which commences in 2021, and

results in Panther having a saving of GBP625,000 p.a. loan interest

costs, compared to our current financing structure. This swap has a

10-year term.

Dividends

An interim dividend of 6p per share will be paid to shareholders

on 29 November 2018 (ex-dividend on 8 November 2018 to shareholders

on the register on 10 November 2018). In the light of the

exceptional sales in the period and subsequently, the Board will

assess the opportunities, but expects to pay no less than 12p per

share for the year.

Prospects

With all the disposals we are in a strong position to weather

uncertain economic conditions and able to take advantage of

investment opportunities for the long-term benefit of our

shareholders.

Andrew S Perloff

Chairman

26 September 2018

CHAIRMAN'S RAMBLINGS

My childhood was spent in Sutton, a leafy suburb south of

London. Nearby was Carshalton, the older part of which was known as

"Carshalton Beaches", something that then always puzzled me as we

were far from the sea in landlocked Surrey (it was, of course,

beeches).

Despite this, it did have a park with a very large pond divided

in two by a road/bridge and, most importantly, it was within easy

walking distance from home. I could often be found there equipped

with my fishing rod, net and a bamboo stick from which dangled a

piece of string and a bent safety pin temptingly loaded with

bread.

I always optimistically took my jam jar with its string handle

for my haul. I often caught sticklebacks, tadpoles (if they were in

season) and newts which I would rehome in our garden - probably

wreaking havoc with the ecosystem.

Paddling with my shorts rolled up, childhood seemed idyllic, and

pleasures so much simpler than today.

Upon arriving one day, looking forward to a few hours fishing,

and my rod at the ready, a noisy scuffle was taking place. A

smaller boy was pinned to the ground by a slightly larger boy who

was punching him. The smaller boy's cries were piteous and a nearby

girl was entreating them to stop.

Although I did not know what had caused the fracas - I felt I

should try to stop it somehow. Looking at them laying on the ground

I thought they both looked much smaller than me, thus approaching

them, I shouted "Stop it - pick on someone your own size" in a loud

voice. To my utter astonishment they looked up and did indeed stop.

The young victim was small but not stupid and took this opportunity

to quickly scuttle off with the girl!

My pleasure at my success turned quickly to dismay when the

aggressor stood up and faced me. I saw then I had misjudged his

size and he was at least 6 inches taller than me. He loomed towards

me and punched me in the face! The pain wasn't as bad as the shock

of my miscalculation. "That'll teach you a lesson to mind your own

business", he said, before turning on his heel and walking off. He

was right. It taught me not to pick a fight with bigger and

stronger opponents.

Some years later, I was a married man with two young children

living in a leafy suburb north of London. My son, aged around 8,

was attending a local private prep school in a pleasant Georgian

house set in its own grounds. The teachers were a dedicated and

excellent team. They managed to keep control of pupils with a

degree of

rigour. The majority of the children were the usual products of affluent parts of north London - molly-coddled, spoilt and when the opportunity arose, a wild and noisy bunch. Upon meeting parents this was no surprise as they were mostly a pushy, cliquey, materialistic and ferociously upwardly mobile bunch, shown at its worst in the car park when the 4 x 4s and sports cars were delivering or collecting their "precious ones". The school, however, produced the good results the parents wanted.

For some weeks, although I hadn't noticed, my then wife had

observed that our son had seemed depressed and miserable, often

coming home and going straight to his room. She managed to find out

that, surprisingly, he was being bullied. She then ordered me to

see the Headmaster to try and resolve matters.

I wasn't wholly convinced this was how to handle things and

asked my son for more information. He said that he was being

pushed, punched and ridiculed at playtime by one boy in particular.

When he told me who the ringleader was, I was very surprised as he

was a small, weedy looking boy. My son, although clumsy and rather

gangly, was so much bigger. I suggested that next time he just held

him at arms-length. My son was then afraid that this would

exacerbate the situation and I then said in that case, a good punch

in the face might work! He was still worried about the consequences

of such action, so I told him "he is going to start with you anyway

so, at the very least he will think twice before starting with you

again".

He arrived home a few days later, delivered by whoever was doing

the dreaded rota and came through the front door with a huge grin

on his face and raised his fists to the sky and shouted "Yes,

yes!"

He then proudly told me that he had followed my advice, but when

the boy started punching him and he swung a hard punch at his

tormentor which landed on his face, who then fell to the ground and

ran away, crying. He was never bullied again, and they became

friends for the remaining days at that school.

These two incidents remind us that there are lessons for life in

business to be learnt from our school days, i.e., there are always

bullies out there and they are often corporate bullies in business

and may need to be dealt with in different ways.

Of course, it comes down to who has the most power which is

usually based on corporate size and how much their

services/products are vitally needed.

I am sure most of you will think that my top corporate bully

would be the banks but in reality they are way down the list, often

forced into foolish and harsh decisions by the regulations and

farcical fines placed upon them by regulations/government agencies,

staffed by people who have little idea of the impact of their

rules, but the banks do have a degree of commercial

competition.

The biggest bully boys are obviously the government and its

agencies as they make the rules which are always biased in their

favour with potentially, excessive and harsh penalties for anyone

breaking their often vague and difficult to interpret rules. When

you go over the line, as defined by them, they can bring down the

full might of the law at enormous cost to the taxpayer and also the

unfortunate offender. Those doing the punishing do not pay the cost

an alleged offender does and even if the defender is entirely

innocent, rarely recovers the costs of defence paid back to them,

whilst those prosecuting a weak or incorrect case and, sometimes

incompetently which loses, do not have to worry about costs, it's

not their money. Retrospectively, laws and grey areas of taxation

can affect normal taxpayers adversely.

The next down the list of bullies are the local authorities who

have been given too many powers which they often abuse and when

they do there is rarely any comeback on the officers who threw

their weight about and when proved to have acted incorrectly, e.g.,

if a landowner has rubbish dumped on vacant property/land, the

Council often threatens the owner (the victim) with prosecution or

an A.S.B.O. The Council can refuse to accept Planning Applications,

if they do not like them, thus not showing on their refusals.

Next would be the utility companies who were given extra powers

when privatised and regularly use and abuse them. They have the

right to break in and enter premises and cause damage if a bill has

not been paid even if it has nothing to do with the owner of the

property or they arbitrarily change your tariff rate.

Next would be the big corporates that have contact with the

general public, e.g., the airlines, most of whom treat their

customers arbitrarily like cattle.

And so on and so on down the scale of power.

I have only mentioned a couple of minor points that spring to

mind, but there are many more examples, and everyone probably has

their own experiences.

The problem arises when one is forced or desires to respond.

Often it is not just the financial costs involved which are often

irrecoverable but also the time wasted factor. It is unfair because

most of the officials on the bureaucracy side have a penchant for

time wasting delays, as they are paid and pensioned well, whether

they act correctly, or not, or sensibly or diligently or even

fairly.

Andrew S Perloff

Chairman

26 September 2018

CONDENSED CONSOLIDATED INCOME STATEMENT

for the six months ended 30 June 2018

Notes Six months Six months Year

ended ended ended

30 June 30 June 31 December

2018 2017 2017

GBP'000 GBP'000 GBP'000

Restated*

Unaudited Unaudited Audited

Revenue 2 7,069 6,377 12,946

Cost of sales 2 (2,072) (1,784) (3,779)

----------- ----------- ---------------------

Gross profit 4,997 4,593 9,167

Other income 263 1,469 1,905

Administrative expenses (1,526) (1,263) (2,105)

----------- ----------- ---------------------

3,734 4,799 8,967

Profit on disposal of investment

properties 6,487 1,061 1,071

Movement in fair value of investment

properties 6 2,300 - 16,776

----------- ----------- ---------------------

12,521 5,860 26,814

Finance costs - bank loan interest (1,304) (1,130) (2,302)

Finance costs - swap interest (1,284) (1,360) (2,726)

Investment income 1 48 27

Profit realised on the disposal

of available for sale investments

(shares) - 859 1,128

Movement in derivative financial

liabilities 7 1,259 2,454 1,850

Profit before income tax 11,193 6,731 24,791

Income tax expense 3 (1,830) (965) (3,490)

----------- ----------- ---------------------

Profit for the period 9,363 5,766 21,301

Profit/ (loss) for the period from

discontinued operations - 19 (59)

----------- ----------- ---------------------

Profit for the period 9,363 5,785 21,242

=========== =========== =====================

Discontinued operations attributable

to:

Equity holders of the parent - 15 (52)

Non-controlling interest - 4 (7)

----------- ----------- ---------------------

Profit/ (loss) for the period - 19 (59)

----------- ----------- ---------------------

Continuing operations attributable

to:

Equity holders of the parent 9,363 5,766 21,301

Non-controlling interest - - -

----------- ----------- ---------------------

Profit/ (loss) for the period 9,363 5,766 21,301

----------- ----------- ---------------------

Earnings/ (loss) per share

Basic and diluted - continuing

operations 52.9p 32.6p 120.2p

----------- ----------- ---------------------

Basic and diluted - discontinued

operations - p 0.1p (0.3)p

----------- ----------- ---------------------

* 2017 balances restated due to the disposal of MRG Systems Ltd

now disclosed as a discontinued operation.

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

for the six months ended 30 June 2018

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2018 2017 2017

GBP'000 GBP'000 GBP'000

Unaudited Unaudited Audited

Profit for the period 9,363 5,785 21,242

----------- ----------- ------------

Other comprehensive income

Items that may be reclassified

subsequently to profit or loss

Movement in fair value of available

for sale investments (shares)

taken to equity - 46 279

Realised fair value on disposal

of available for sale investments

(shares) previously taken to equity - - (269)

Deferred tax relating to movement

in fair value of available for

sale investments (shares) taken

to equity - (9) (53)

Realised tax relating to disposal

of available for sale investments

(shares) previously taken to equity - - 51

Other comprehensive income for

the period, net of tax - 37 8

Total comprehensive income for

the period 9,363 5,822 21,250

----------- ----------- ------------

Attributable to:

Equity holders of the parent 9,363 5,818 21,257

Non-controlling interest - 4 (7)

9,363 5,822 21,250

----------- ----------- ------------

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

Company number 293147

As at 30 June 2018

Notes 30 June 30 June 31 December

2018 2017 2017

GBP'000 GBP'000 GBP'000

ASSETS Unaudited Unaudited Audited

Non-current assets

Plant and equipment 43 68 54

Investment property 6 189,235 176,769 201,825

Deferred tax asset - 986 -

Available for sale investments (shares) 17 326 17

---------- ---------- ----------------

189,295 178,149 201,896

Current assets

Inventories (MRG) - 115 -

Stock properties 448 448 448

Trade and other receivables 21,817 4,140 3,677

Cash and cash equivalents* 9,150 9,123 5,941

---------- ---------- ----------------

31,415 13,826 10,066

Total assets 220,710 191,975 211,962

---------- ---------- ----------------

EQUITY AND LIABILITIES

Equity attributable to equity holders

of the parent

Capital and reserves

Share capital 4,437 4,437 4,437

Share premium account 5,491 5,491 5,491

Treasury shares (213) - (213)

Capital redemption reserve 604 604 604

Retained earnings 87,250 66,350 80,893

---------- ---------- ----------------

97,569 76,882 91,212

Non-controlling interest - 100 -

Total equity 97,569 76,982 91,212

---------- ---------- ----------------

Non-current liabilities

Long-term borrowings 7 73,772 69,764 74,270

Derivative financial liability 7 25,141 25,796 26,400

Deferred tax liabilities 863 - 1,183

Obligations under finance leases 7,512 6,768 7,552

---------- ---------- ----------------

107,288 102,328 109,405

Current liabilities

Trade and other payables 11,905 10,411 10,945

Accrued dividend payable 4 1,238 1,215 -

Short-term borrowings 7 1,159 158 159

Current tax payable 1,551 881 241

---------- ---------- ----------------

15,853 12,665 11,345

Total liabilities 123,141 114,993 120,750

---------- ---------- ----------------

Total equity and liabilities 220,710 191,975 211,962

---------- ---------- ----------------

*Of this balance GBP1,494,000 (30 June 2017: GBP1,017,000, 31

December 2017: GBPNIL) is restricted by the Group's lenders i.e. it

can only be used for purchase of investment property (or otherwise

by agreement).

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the six months ended 30 June 2018

Share Share Treasury Capital Retained Total

Capital Premium Shares Redemption Earnings

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 January

2017 (audited) 4,437 5,491 - 604 61,747 72,279

Total comprehensive

income for the period - - - - 5,818 5,818

Dividends due - - - - (1,215) (1,215)

-------- -------- --------- ----------- --------- --------

Balance at 30 June

2017 (unaudited) 4,437 5,491 - 604 66,350 76,882

-------- -------- --------- ----------- --------- --------

Balance at 1 January

2017 (audited) 4,437 5,491 - 604 61,747 72,279

Total comprehensive

income for the period - - - - 21,257 21,257

Treasury shares - - (213) - - (213)

Dividends paid - - - - (2,111) (2,111)

-------- -------- --------- ----------- --------- --------

Balance at 1 January

2018 (audited) 4,437 5,491 (213) 604 80,893 91,212

Total comprehensive

income for the period - - - - 9,363 9,363

Dividends paid - - - - (1,768) (1,768)

Dividends due - - - - (1,238) (1,238)

Balance at 30 June

2018 (unaudited) 4,437 5,491 (213) 604 87,250 97,569

======== ======== ========= =========== ========= ========

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

for the six months ended 30 June 2018

Notes 30 June 30 June 31 December

2018 2017 2017

GBP'000 GBP'000 GBP'000

Restated*

Unaudited Unaudited Audited

Cash flows from operating activities

Profit from operating activities 3,734 4,799 8,967

Add: Depreciation charges for

the period 10 7 9

Add: Loss on write down of stock - 124 124

Less: Rent paid treated as interest (286) (258) (528)

Profit before working capital

change 3,458 4,672 8,572

(Increase)/ decrease in receivables (903) 51 302

Increase/ (decrease) in payables 708 (300) 293

---------- ---------- ------------------------------

Cash generated from operations 3,263 4,423 9,167

Interest paid (2,065) (2,164) (4,324)

Income tax paid (840) (204) (1,194)

---------- ---------- ------------------------------

Net cash generated from continuing

operating activities 358 2,055 3,649

Net cash used in discontinued

operating activities - (39) (35)

Cash flows from investing activities

Purchase of plant and equipment - (12) (10)

Purchase of investment properties (145) (136) (8,870)

Corporate disposal (net of cash

sold) - - (12)

Proceeds from sale of investment

property 4,343 911 2,239

Proceeds from sale of available

for sale investments (shares) - 1,486 2,046

Dividend income received - 47 21

Interest income received 1 2 6

---------- ---------- ------------------------------

Net cash generated from/ (used

in) investing activities from

continuing operations 4,199 2,298 (4,580)

Cash flows from financing activities

New loans received 500 - 4,503

Repayments of loans (80) (78) (159)

Purchase of own shares - - (213)

Dividends paid (1,768) - (2,111)

Net cash used in financing activities (1,348) (78) 2,020

Net increase in cash and cash

equivalents 3,209 4,236 1,054

Cash and cash equivalents at the

beginning of period 5,941 4,887 4,887

Cash and cash equivalents at the

end of period** 9,150 9,123 5,941

---------- ---------- ------------------------------

* 2017 balances restated due to the disposal of MRG Systems Ltd

now disclosed as a discontinued operation.

** Of this balance GBP1,494,000 (30 June 2017: GBP1,017,000, 31

December 2017: GBPNIL) is restricted by the Group's lenders i.e. it

can only be used for the purchase of investment property (or

otherwise by agreement).

Panther Securities P.L.C.

NOTES TO THE INTERIM FINANCIAL REPORT

for the six months ended 30 June 2018

1. Basis of preparation of interim financial statements

The results for the year ended 31 December 2017 have been

audited whilst the results for the six months ended 30 June 2017

and 30 June 2018 are unaudited.

The financial information set out in this interim financial

report does not constitute statutory accounts as defined in Section

434 of the Companies Act 2006. The Group's statutory accounts for

the year ended 31 December 2017 which were prepared under

International Financial Reporting Standards ("IFRS") as adopted for

use in the European Union, were filed with the Registrar of

Companies. The auditors reported on these accounts, their report

was unqualified and did not include reference to any matters to

which the auditors drew attention by way of emphasis without

qualifying their report and did not contain any statements under

Section 498 (2) or Section 498 (3) of the Companies Act 2006.

These condensed consolidated interim financial statements are

for the six-month period ended 30 June 2018. They have been

prepared using accounting policies consistent with IFRS as adopted

for use in the European Union. IFRS is subject to amendment and

interpretation by the International Accounting Standards Board

("IASB") and the IFRS Interpretations Committee and there is an

ongoing process of review and endorsement by the European

Commission. The financial information has been prepared on the

basis of IFRS that the Board of Directors expect to be applicable

as at 31 December 2018.

IFRS 9 Financial Instruments and IFRS 15 Revenue from Contracts

with Customers have been applied by the Group for the first time in

preparing this interim financial report. The Directors consider

that the application of these standards has not had a material

impact on the recognition and measurement of items in the interim

financial report.

2. Revenue and cost of sales

The Group's only operating segment is investment and dealing in

property and securities. All revenue, cost of sales and profit or

loss before taxation is generated in the United Kingdom. The Group

is not reliant on any key customers. MRG was sold in 2017 but was

previously shown as a separate segment.

3. Income tax expense

The charge for taxation comprises the following:

30 June 30 June 31 December

2018 2017 2017

GBP'000 GBP'000 GBP'000

Unaudited Unaudited Audited

Current period UK corporation

tax 2,150 765 1,115

Prior period UK corporation

tax - 53 54

---------- ---------- ------------

2,150 818 1,169

Current period deferred

tax (320) 147 2,321

---------- ---------- ------------

Income tax expense for

the period 1,830 965 3,490

========== ========== ============

The taxation charge is calculated by applying the Directors'

best estimate of the annual effective tax rate to the profit for

the period.

4. Dividends

Amounts recognised as distributions to equity holders in the

period:

30 June 30 June 31 December

2018 2017 2017

GBP'000 GBP'000 GBP'000

Unaudited Unaudited Audited

Final dividend for the

year ended 31 December - 1,215* 1,227**

2016 of 9p per share*

Interim dividend for the

year ended 31 December

2017 of 5p per share - - 884

Special dividend for the

year ended 31 December 1,768 - -

2017 of 10p per share

Final dividend for the

year ended 31 December 1,238* - -

2017 of 7p per share

3,006 1,215 2,111

========== ========== ============

The final dividend of 7p per share for the year ended 31

December 2017 was not paid at the period end but declared and

approved (being accrued in these accounts) and was paid on 5

September 2018.

*Accrued at half year and paid after period end.

**Andrew Perloff waived his personal entitlement to the Group's

final dividend for the year ended 31 December 2016 on his personal

shareholding of 4,244,360 resulting in a reduction in the dividend

liability of GBP382,000 (at the period end).

5. Earnings per ordinary share (basic and diluted)

The calculation of basic and diluted earnings per ordinary share

is based on earnings, after excluding non-controlling interests,

being a profit of GBP9,363,000 (30 June 2017 - profit of

GBP5,766,000 and 31 December 2017 - profit of GBP21,301,000).

The basic earnings per share is based on the weighted average of

the ordinary shares in existence throughout the period, being

17,683,469 to 30 June 2018 (17,715,199 to 31 December 2017 and

17,746,929 to 30 June 2017). There are no potential shares in

existence for any period therefore diluted and basic earnings per

share are equal.

In the year ended 31 December 2017 Panther Securities PLC bought

63,460 ordinary shares that it currently holds in treasury.

6. Investment Properties

30 June 30 June 31 December

2018 2017 2017

GBP'000 GBP'000 GBP'000

Unaudited Unaudited Audited

Fair value of investment

properties

At 1 January 201,825 176,489 176,489

Additions 145 136 8,870

Acquisition of subsidiary - - -

Transfer from stock property - 164 164

Fair value adjustment

on property

held on operating leases - - 846

Disposals (15,035) (20) (1,320)

Revaluation increase 2,300 - 16,776

189,235 176,769 201,825

========== ========== ============

The directors consider that the fair value of the investment

properties has not materially changed with the exception of

Wimbledon Studios that was sold post period end, and as such this

was revalued to the Board's perceived market value at the period

end, since it was last valued by an independent valuations firm at

the 31 December 2017 Statement of Financial Position date.

7. Derivative financial instruments

The main risks arising from the Group's financial instruments

are those related to interest rate movements. Whilst there are no

formal procedures for managing exposure to interest rate

fluctuations, the Board continually reviews the situation and makes

decisions accordingly. Hence, the Company will, as far as possible,

enter into fixed interest rate swap arrangements. The purpose of

such transactions is to manage the interest rate risks arising from

the Group's operations and its sources of finance.

30 June 30 June 31 December

2018 2017 2017

GBP'000 GBP'000 GBP'000

Bank loans Unaudited Rate Unaudited Rate Audited Rate

Interest is charged

as to:

Fixed/ Hedged

HSBC Bank plc* 35,000 7.01% 35,000 7.01% 35,000 7.01%

HSBC Bank plc** 25,000 6.58% 25,000 6.58% 25,000 6.58%

Unamortised loan arrangement

fees (407) (572) (489)

Floating element

HSBC Bank plc 15,000 9,997 14,501

Shawbrook Bank plc 338 497 417

---------- -------- ----------

74,931 69,922 74,429

========== ======== ==========

* Fixed rate came into effect on 1 September 2008. The rate

includes 1.95% margin. The contract includes mutual breaks, the

next one being on 23 December 2019 (and every 5 years

thereafter).

** This arrangement came into effect on 1 December 2011 when

HSBC exercised an option to enter the Group into this interest swap

arrangement. The rate includes a 1.95% margin. This contract

includes a mutual break on the fifth anniversary and its duration

is until 1 December 2021.

Bank loans totalling GBP60,000,000 (2017 - GBP60,000,000) are

fixed using interest rate swaps removing the Group's exposure to

interest rate risk. Other borrowings are arranged at floating

rates, thus exposing the Group to cash flow interest rate risk.

The derivative financial assets and liabilities are designated

as held for trading.

Hedged Rate Duration 30 June 30 June 31 December

amount (without of contract 2018 2017 2017

margin) remaining Fair value Fair value Fair value

GBP'000 years GBP'000 GBP'000 GBP'000

Unaudited Unaudited Audited

Derivative Financial

Liability

Interest rate

swap 35,000 5.060% 20.19 (20,997) (21,881) (22,831)

Interest rate

swap 25,000 4.630% 3.42 (2,970) (3,915) (3,569)

Interest rate

swap* 25,000 2.141% 13.42 (1,174) - -

------------

(25,141) (25,796) (26,400)

--------- ------------ ------------

Movement in derivative financial liabilities 1,259 2,454 1,850

========= ============ ============

*This swap commences on 1 December 2021 when the GBP25,000,000

4.63% swap ceases, as it is at a lower rate it will result in an

annual interest saving of circa GBP625,000 per annum.

Interest rate derivatives are shown at fair value in the

statement of financial position, with charges in fair value taken

to the income statement. Interest rate swaps are classified as

level 2 in the fair value hierarchy specified in IFRS 13.

The vast majority of the derivative financial liabilities are

due in over one year and therefore they have been disclosed as all

due in over one year.

The above fair values are based on quotations from the Group's

banks and Directors' valuation.

Treasury management

The long-term funding of the Group is maintained by three main

methods, all with their own benefits. The Group has equity finance,

has surplus profits and cash flow which can be utilised, and also

has loan facilities with financial institutions. The various

available sources provide the Group with more flexibility in

matching the suitable type of financing to the business activity

and ensure long-term capital requirements are satisfied.

8. Net asset value per share

30 June 30 June 31 December

2018 2017 2017

GBP'000 GBP'000 GBP'000

Unaudited Unaudited Audited

Basic and diluted 552p 433p 516p

========== ========== ============

9. Copies of this report are to be sent to all shareholders and

are available from the Company's registered office at Unicorn

House, Station Close, Potters Bar, EN6 1TL and will also be

available for download from our website www.pantherplc.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR LLFLSAEIEFIT

(END) Dow Jones Newswires

September 26, 2018 02:00 ET (06:00 GMT)

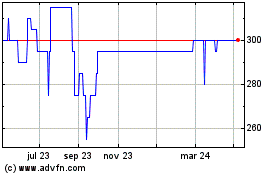

Panther Securities (LSE:PNS)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Panther Securities (LSE:PNS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024