BHP to Return $10.4 Billion to Shareholders

31 Octubre 2018 - 8:02PM

Noticias Dow Jones

By Rhiannon Hoyle

SYDNEY -- BHP Billiton Ltd. said it would hand $10.4 billion to

shareholders via a stock buyback and special dividend, as the miner

continues to face a campaign against its strategy and structure by

activist investor Elliott Management Corp.

The capital return was outlined by BHP, the world's biggest

mining company by market value, within hours of completing the sale

of most of its U.S. onshore shale division to BP PLC. The sale of

the oil and gas fields was among the demands of Elliott, a U.S.

hedge fund founded by Paul Singer, and ends a costly saga that left

the company roughly $20 billion worse off.

BHP's Australia-listed shares surged on news of the buyback and

dividend, rising around 5% after touching a near six-month low in

late October as the mining sector felt the heat from the global

equities selloff. Analysts said the stock gains reflected an

earlier payout to shareholders than many in the market had

expected.

Like many of its competitors in the global resources industry,

BHP had used cash generated during earlier booms in commodity

prices to buy assets or invest in expanding its mining operations

from Australia to North America. It paid a combined $20 billion to

acquire U.S. shale assets in 2011, and then spent billions more to

explore and develop them.

But a collapse in energy prices resulted in massive impairment

charges, including a more than $7 billion pretax charge in 2016

that is its largest-ever single write-down. Miners including BHP

and Rio Tinto PLC have adopted a conservative strategy since then,

even as commodity prices recover.

Frictions between BHP's management and Elliott look likely to

continue as several other key demands by the activist investor

remain unmet. Elliott, which disclosed a sizable stake in the

company in April 2017 and immediately sought sweeping changes,

wants BHP to collapse a structure that sees its shares trade in

London and Sydney in favor of a single Australia-incorporated

company.

Elliott says its plan would create some $22 billion in value for

shareholders. BHP disagrees with that assessment, and has so far

rejected the move as too costly without bringing enough

benefit.

"I acknowledge there are some ways in which you can do the

numbers where the upside prize looks quite large," but other

scenarios suggest it would be a very risky move, Chief Executive

Andrew Mackenzie said earlier this year.

Elliott, which controls about 5% of BHP's London stock, wasn't

immediately available to comment on the capital-return plan, which

will only include a $5.2 billion buyback of Australian stock

only.

Under Australian tax laws, BHP can purchase shares off-market at

a discount of up to 14%, which increases its appeal when London

shares are trading at a discount of lesser value. London listed

shares were on Wednesday worth about 12% less than Australia-listed

ones.

"We believe that the off-market buyback and special dividend

program announced today will return significant value to all our

shareholders, allowing the entire BHP global shareholder base to

participate, both directly and indirectly, in the shareholder

return program," BHP Chairman Ken MacKenzie said.

The buyback will start immediately and be completed before the

end of the year. BHP said it will also pay a special dividend to

shareholders totaling $5.2 billion, adding that it would bring the

total cash handed back to shareholders over the past two years to

$21 billion.

Still, some investors question whether mining companies are

retaining enough cash for future growth, for fear they may be too

late to take advantage of the next big upswing in prices. The

world's top diversified miners are now spending less than half what

they spent on projects six years ago.

BHP said it retains enough cash to keep investing, with $8

billion set aside for projects annually. In recent months the

company bought a roughly 11% stake in copper explorer SolGold PLC,

which is developing the Cascabel copper and gold project in

Ecuador.

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

October 31, 2018 21:47 ET (01:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

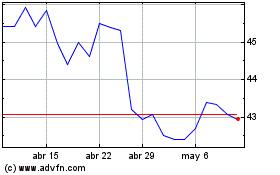

BHP (ASX:BHP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

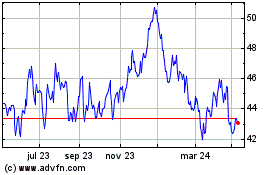

BHP (ASX:BHP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024