Primorus Investments PLC Engage Technology Investor Update (5934G)

07 Noviembre 2018 - 1:00AM

UK Regulatory

TIDMPRIM

RNS Number : 5934G

Primorus Investments PLC

07 November 2018

Primorus Investments plc

("Primorus" or the "Company")

Engage Technology Investor Update Received

Primorus Investments plc (AIM: PRIM, NEX: PRIM) is pleased to

provide shareholders with an update on its investment in the SaaS

("Software as a Service") end-to-end workforce software vendor

Engage Technology Partners ("`Engage") by way of an update received

by Primorus from Engage. Primorus has invested a total of

GBPGBP1.4m in Engage made up of GBPGBP400,000 at GBP15 per share

and GBPGBP1.0m at GBP22 per share.

This update follows on from information provided in the Primorus

Q3 Report announced on 24 October 2018 and please note that some

areas of content of the Engage Report is deemed commercial in

confidence however Engage have kindly allowed us to transmit some

of the information for the benefit of Primorus shareholders.

Highlights;

-- Strong construction market penetration via VMS ("Vendor

Management System") sales to Tier 1 construction companies.

Post-period reporting 75 live Corporate Clients with a further 17

contracted pending going live.

-- Significant corporate interest from global software vendors

and aggregators in Engage products and the Engage platform.

Discussions with multi-party potential corporate investors

accelerate.

-- Collaboration with California-based Jumio to incorporate and

integrate their global RTW ("Right To Work") verification solution

into the Engage platform.

-- Completed several keenly awaited critical first version

self-serve product units including OSP ("Outsourced Payroll

Product") and PAYE for Temps allowing the entire platform to attain

a level of self service across the offering.

-- A product scaling refinement has reduced the run-rate average

monthly revenues to below management forecasts. Pleasingly product

engineering has already mitigated this specific issue.

-- Projected platform revenues expected to accelerate into Q1

2019 and point of maximum product development spend reached in

October and cashflows heading back towards breakeven in 2019.

Alastair Clayton, Executive Director, commented:

"We are pleased to report a summary of a very positive Quarterly

Report received from Engage and I am happy to be able to share what

I am allowed to with shareholders. It is clear the Engage team

continue to win business at an impressive rate and what is

noteworthy is the speed with which the Engage VMS product has

penetrated the market. With several key self-service product

deliveries dropping in the Quarter we are closely watching the

platform's ability over the coming few quarters to automate the

on-boarding process and generate globally scalable revenues from

its existing and future customers.

We invested in Engage not because of its immediate revenue

generation, and there was a (now mitigated) revenue miss this

quarter as outlined above, but because we believe the viral nature

of the platform has the potential to totally disrupt the existing

software offerings servicing this huge global sector. What is most

pleasing is that we have begun to see the first signs that the

sales aspect of the Engage platform is both viral from the bottom

of the supply chain upwards but also top down from large corporates

seeking solutions for their UK and overseas operations.

I believe that, should the trajectory of client wins, and

product delivery, continue to grow as they are, we will begin to

see the revenue gain pace and grow exponentially over the coming

quarter or two as all the benefits of taking the time (and money)

to build a truly globally scalable, self-service, pure SaaS

platform begin to pay off. Engage have taken a more difficult path

to deliver a better revenue outcome.

As with many of the private businesses we meet, I see the

biggest risk for Engage as one of executing small short-term

financings in a market dominated by large, Private Equity and

Venture Capital investors. Make no mistake, just because Engage

needs modest amounts of money to execute its plan, it doesn't mean

the resulting company cannot, in my opinion, be a global market

force.

We are aware that whilst this strategy may not fit the standard

large investors "cookie-cutter" investment criteria, it does fit

ours. Judging by the significant corporate interest being shown in

the Engage platform by other specialist investors, global HR

software vendors and aggregators, I am confident that we are not

alone."

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

For further information, please contact:

Primorus Investments plc: +44 (0) 20 7440 0640

Alastair Clayton

Nominated Adviser: +44 (0) 20 7213 0880

Cairn Financial Advisers LLP

James Caithie / Sandy Jamieson

Broker: +44 (0) 20 3621 4120

Turner Pope Investments

Andy Thacker

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDLIFIRLSLDIIT

(END) Dow Jones Newswires

November 07, 2018 02:00 ET (07:00 GMT)

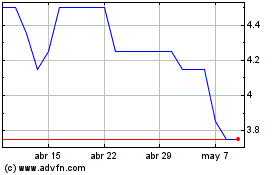

Primorus Investments (LSE:PRIM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Primorus Investments (LSE:PRIM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024