UniCredit Shares Fall After 3Q Miss on Turkish Business Hit -- Update

08 Noviembre 2018 - 5:53AM

Noticias Dow Jones

Adds share price, expectations, CEO comment, revised and

confirmed targets, analysts' comments.

By Pietro Lombardi

Shares in UniCredit SpA (UCG.MI) trade lower Thursday after the

bank's third-quarter net profit missed expectations as it reported

an impairment related to its stake in Turkish bank Yapi Kredi and

increased provisions ahead of "the upcoming settlement of alleged

U.S. sanctions violations."

Net profit for the period was 29 million euros ($33.2 million),

down from EUR2.82 billion a year earlier, when the bank reported a

EUR2.1 billion capital gain on the sale of its asset-management

unit Pioneer Investments.

The bank reported an EUR846 million impairment in the quarter

related to its stake in Yapi Kredi.

Analysts had expected the bank to report a net profit of EUR921

million on revenue of EUR4.78 billion, according to a consensus

provided by the company.

On an adjusted basis, which excludes one-offs like the unit sale

or the Yapi impairment, net profit for the period rose to EUR875

million, compared with EUR835 million a year ago, the bank

said.

At 1120 GMT shares in UniCredit traded 4.5% lower.

The bank's performance showed "mixed numbers" for the third

quarter, UBS analysts said. Underlying earnings were strong but

"capital depletion will take the market by surprise," they

added.

The bank delivered strong third-quarter underlying results "in

an increasingly challenging macroeconomic environment," Chief

Executive Jean Pierre Mustier said in a statement.

Total revenue increased 2% on year, supported by growing net

interest income and fees and commissions, while operating costs

fell 7.7%.

"During the quarter we took decisive actions related to

nonrecurring events," the CEO said, mentioning the "additional

provisions relating to the upcoming settlement of alleged U.S.

sanctions violations."

"We are also implementing a number of measures to protect our

capital position, including specific asset disposals such as real

estate, and around 35% reduction in the sensitivity of our CET1

ratio to BTP spreads," he said.

The Italian bank confirmed its 2019 targets for net profit and

Return on Tangible Equity, seen at EUR4.7 billion and above 9%

respectively. It also confirmed its 2019 outlook for net interest

income and fees. However, it cut the revenue outlook, and now

expects 2019 revenue of EUR19.8 billion, from a previous

expectations of EUR20.6 billion.

UniCredit is improving its cost-reduction targets for 2018 and

2019, seeing 2019 costs below EUR10.6 billion, from a previous

target of EUR10.6 billion.

It also said it expects its 2019 core tier 1 ratio at between

12% and 12.5%, from a previous expectations of above 12.5%.

UniCredit's fully loaded common equity Tier 1 ratio, a key

measure of capital strength, fell to 12.11% in September, down from

12.51% in June.

"We are being very conservative on the Turkish side and the

trading side," the CEO said in a call with journalists, stressing

that the bank confirmed its profitability targets and will

compensate with lower costs.

Write to Pietro Lombardi at pietro.lombardi@dowjones.com

(END) Dow Jones Newswires

November 08, 2018 06:38 ET (11:38 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

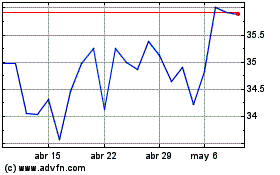

Unicredit (BIT:UCG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Unicredit (BIT:UCG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024